oregon motor carrier registration & tax manual - Oregon Department ...

oregon motor carrier registration & tax manual - Oregon Department ...

oregon motor carrier registration & tax manual - Oregon Department ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Oregon</strong> Motor Carrier Registration & Tax Manual<br />

<br />

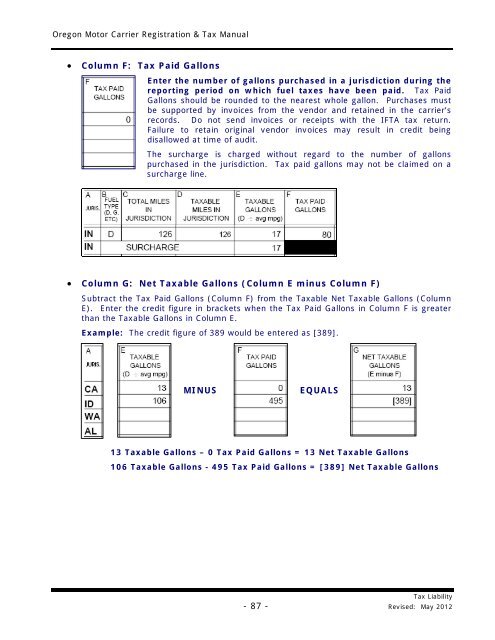

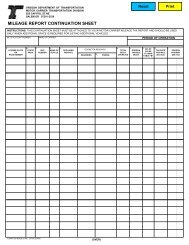

Column F: Tax Paid Gallons<br />

Enter the number of gallons purchased in a jurisdiction during the<br />

reporting period on which fuel <strong>tax</strong>es have been paid. Tax Paid<br />

Gallons should be rounded to the nearest whole gallon. Purchases must<br />

be supported by invoices from the vendor and retained in the <strong>carrier</strong>’s<br />

records. Do not send invoices or receipts with the IFTA <strong>tax</strong> return.<br />

Failure to retain original vendor invoices may result in credit being<br />

disallowed at time of audit.<br />

The surcharge is charged without regard to the number of gallons<br />

purchased in the jurisdiction. Tax paid gallons may not be claimed on a<br />

surcharge line.<br />

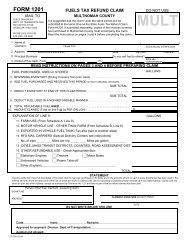

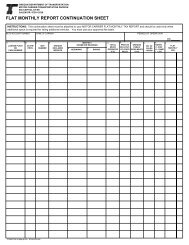

Column G: Net Taxable Gallons (Column E minus Column F)<br />

Subtract the Tax Paid Gallons (Column F) from the Taxable Net Taxable Gallons (Column<br />

E). Enter the credit figure in brackets when the Tax Paid Gallons in Column F is greater<br />

than the Taxable Gallons in Column E.<br />

Example: The credit figure of 389 would be entered as [389].<br />

MINUS<br />

EQUALS<br />

13 Taxable Gallons – 0 Tax Paid Gallons = 13 Net Taxable Gallons<br />

106 Taxable Gallons - 495 Tax Paid Gallons = [389] Net Taxable Gallons<br />

Tax Liability<br />

- 87 - Revised: May 2012