oregon motor carrier registration & tax manual - Oregon Department ...

oregon motor carrier registration & tax manual - Oregon Department ...

oregon motor carrier registration & tax manual - Oregon Department ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Oregon</strong> Motor Carrier Registration & Tax Manual<br />

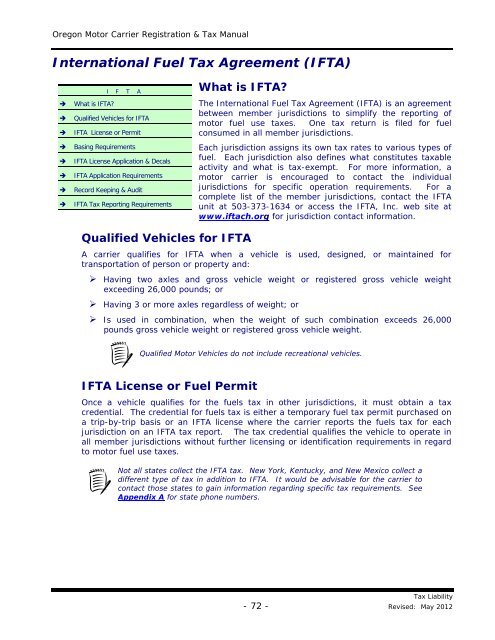

International Fuel Tax Agreement (IFTA)<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

I F T A<br />

What is IFTA?<br />

Qualified Vehicles for IFTA<br />

IFTA License or Permit<br />

Basing Requirements<br />

IFTA License Application & Decals<br />

IFTA Application Requirements<br />

Record Keeping & Audit<br />

IFTA Tax Reporting Requirements<br />

What is IFTA?<br />

The International Fuel Tax Agreement (IFTA) is an agreement<br />

between member jurisdictions to simplify the reporting of<br />

<strong>motor</strong> fuel use <strong>tax</strong>es. One <strong>tax</strong> return is filed for fuel<br />

consumed in all member jurisdictions.<br />

Each jurisdiction assigns its own <strong>tax</strong> rates to various types of<br />

fuel. Each jurisdiction also defines what constitutes <strong>tax</strong>able<br />

activity and what is <strong>tax</strong>-exempt. For more information, a<br />

<strong>motor</strong> <strong>carrier</strong> is encouraged to contact the individual<br />

jurisdictions for specific operation requirements. For a<br />

complete list of the member jurisdictions, contact the IFTA<br />

unit at 503-373-1634 or access the IFTA, Inc. web site at<br />

www.iftach.org for jurisdiction contact information.<br />

Qualified Vehicles for IFTA<br />

A <strong>carrier</strong> qualifies for IFTA when a vehicle is used, designed, or maintained for<br />

transportation of person or property and:<br />

‣ Having two axles and gross vehicle weight or registered gross vehicle weight<br />

exceeding 26,000 pounds; or<br />

‣ Having 3 or more axles regardless of weight; or<br />

‣ Is used in combination, when the weight of such combination exceeds 26,000<br />

pounds gross vehicle weight or registered gross vehicle weight.<br />

Qualified Motor Vehicles do not include recreational vehicles.<br />

IFTA License or Fuel Permit<br />

Once a vehicle qualifies for the fuels <strong>tax</strong> in other jurisdictions, it must obtain a <strong>tax</strong><br />

credential. The credential for fuels <strong>tax</strong> is either a temporary fuel <strong>tax</strong> permit purchased on<br />

a trip-by-trip basis or an IFTA license where the <strong>carrier</strong> reports the fuels <strong>tax</strong> for each<br />

jurisdiction on an IFTA <strong>tax</strong> report. The <strong>tax</strong> credential qualifies the vehicle to operate in<br />

all member jurisdictions without further licensing or identification requirements in regard<br />

to <strong>motor</strong> fuel use <strong>tax</strong>es.<br />

Not all states collect the IFTA <strong>tax</strong>. New York, Kentucky, and New Mexico collect a<br />

different type of <strong>tax</strong> in addition to IFTA. It would be advisable for the <strong>carrier</strong> to<br />

contact those states to gain information regarding specific <strong>tax</strong> requirements. See<br />

Appendix A for state phone numbers.<br />

Tax Liability<br />

- 72 - Revised: May 2012