2010 FERC Form 1 - Pacific Gas and Electric Company

2010 FERC Form 1 - Pacific Gas and Electric Company

2010 FERC Form 1 - Pacific Gas and Electric Company

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Name of Respondent<br />

PACIFIC GAS AND ELECTRIC COMPANY<br />

This Report is:<br />

(1) X An Original<br />

(2) A Resubmission<br />

Date of Report<br />

(Mo, Da, Yr)<br />

04/08/2011<br />

Year/Period of Report<br />

<strong>2010</strong>/Q4<br />

NOTES TO FINANCIAL STATEMENTS (Continued)<br />

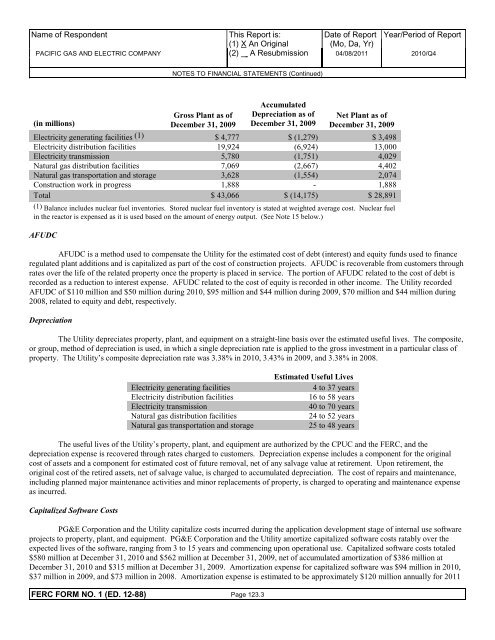

(in millions)<br />

Gross Plant as of<br />

December 31, 2009<br />

Accumulated<br />

Depreciation as of<br />

December 31, 2009<br />

Net Plant as of<br />

December 31, 2009<br />

<strong>Electric</strong>ity generating facilities (1) $ 4,777 $ (1,279) $ 3,498<br />

<strong>Electric</strong>ity distribution facilities 19,924 (6,924) 13,000<br />

<strong>Electric</strong>ity transmission 5,780 (1,751) 4,029<br />

Natural gas distribution facilities 7,069 (2,667) 4,402<br />

Natural gas transportation <strong>and</strong> storage 3,628 (1,554) 2,074<br />

Construction work in progress 1,888 - 1,888<br />

Total $ 43,066 $ (14,175) $ 28,891<br />

(1) Balance includes nuclear fuel inventories. Stored nuclear fuel inventory is stated at weighted average cost. Nuclear fuel<br />

in the reactor is expensed as it is used based on the amount of energy output. (See Note 15 below.)<br />

AFUDC<br />

AFUDC is a method used to compensate the Utility for the estimated cost of debt (interest) <strong>and</strong> equity funds used to finance<br />

regulated plant additions <strong>and</strong> is capitalized as part of the cost of construction projects. AFUDC is recoverable from customers through<br />

rates over the life of the related property once the property is placed in service. The portion of AFUDC related to the cost of debt is<br />

recorded as a reduction to interest expense. AFUDC related to the cost of equity is recorded in other income. The Utility recorded<br />

AFUDC of $110 million <strong>and</strong> $50 million during <strong>2010</strong>, $95 million <strong>and</strong> $44 million during 2009, $70 million <strong>and</strong> $44 million during<br />

2008, related to equity <strong>and</strong> debt, respectively.<br />

Depreciation<br />

The Utility depreciates property, plant, <strong>and</strong> equipment on a straight-line basis over the estimated useful lives. The composite,<br />

or group, method of depreciation is used, in which a single depreciation rate is applied to the gross investment in a particular class of<br />

property. The Utility’s composite depreciation rate was 3.38% in <strong>2010</strong>, 3.43% in 2009, <strong>and</strong> 3.38% in 2008.<br />

<strong>Electric</strong>ity generating facilities<br />

<strong>Electric</strong>ity distribution facilities<br />

<strong>Electric</strong>ity transmission<br />

Natural gas distribution facilities<br />

Natural gas transportation <strong>and</strong> storage<br />

Estimated Useful Lives<br />

4 to 37 years<br />

16 to 58 years<br />

40 to 70 years<br />

24 to 52 years<br />

25 to 48 years<br />

The useful lives of the Utility’s property, plant, <strong>and</strong> equipment are authorized by the CPUC <strong>and</strong> the <strong>FERC</strong>, <strong>and</strong> the<br />

depreciation expense is recovered through rates charged to customers. Depreciation expense includes a component for the original<br />

cost of assets <strong>and</strong> a component for estimated cost of future removal, net of any salvage value at retirement. Upon retirement, the<br />

original cost of the retired assets, net of salvage value, is charged to accumulated depreciation. The cost of repairs <strong>and</strong> maintenance,<br />

including planned major maintenance activities <strong>and</strong> minor replacements of property, is charged to operating <strong>and</strong> maintenance expense<br />

as incurred.<br />

Capitalized Software Costs<br />

PG&E Corporation <strong>and</strong> the Utility capitalize costs incurred during the application development stage of internal use software<br />

projects to property, plant, <strong>and</strong> equipment. PG&E Corporation <strong>and</strong> the Utility amortize capitalized software costs ratably over the<br />

expected lives of the software, ranging from 3 to 15 years <strong>and</strong> commencing upon operational use. Capitalized software costs totaled<br />

$580 million at December 31, <strong>2010</strong> <strong>and</strong> $562 million at December 31, 2009, net of accumulated amortization of $386 million at<br />

December 31, <strong>2010</strong> <strong>and</strong> $315 million at December 31, 2009. Amortization expense for capitalized software was $94 million in <strong>2010</strong>,<br />

$37 million in 2009, <strong>and</strong> $73 million in 2008. Amortization expense is estimated to be approximately $120 million annually for 2011<br />

<strong>FERC</strong> FORM NO. 1 (ED. 12-88) Page 123.3