2010 FERC Form 1 - Pacific Gas and Electric Company

2010 FERC Form 1 - Pacific Gas and Electric Company

2010 FERC Form 1 - Pacific Gas and Electric Company

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Name of Respondent<br />

PACIFIC GAS AND ELECTRIC COMPANY<br />

This Report is:<br />

(1) X An Original<br />

(2) A Resubmission<br />

Date of Report<br />

(Mo, Da, Yr)<br />

04/08/2011<br />

Year/Period of Report<br />

<strong>2010</strong>/Q4<br />

NOTES TO FINANCIAL STATEMENTS (Continued)<br />

the amount of dividend equivalents associated with the vested RSUs that have accrued since the date of grant.<br />

The weighted average grant-date fair value per RSU granted during <strong>2010</strong> <strong>and</strong> 2009 was $42.97 <strong>and</strong> $35.53, respectively. The<br />

total fair value of RSUs that vested during <strong>2010</strong> <strong>and</strong> 2009 was $5 million <strong>and</strong> less than $1 million, respectively. As of December 31,<br />

<strong>2010</strong>, $21 million of total unrecognized compensation costs related to nonvested RSUs are expected to be recognized over the<br />

remaining weighted average period of 2.70 years.<br />

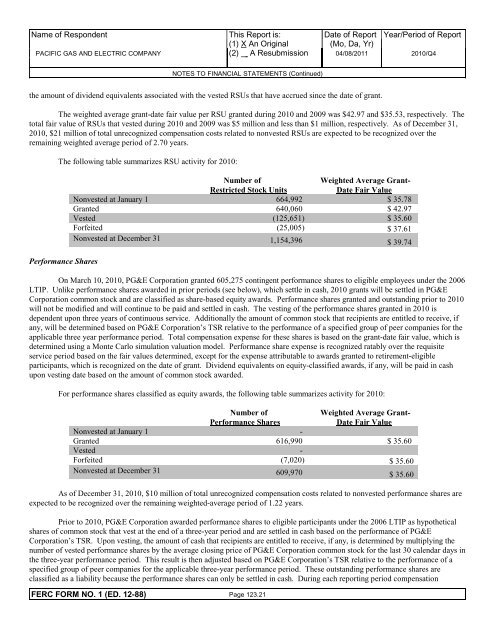

The following table summarizes RSU activity for <strong>2010</strong>:<br />

Number of<br />

Weighted Average Grant-<br />

Restricted Stock Units<br />

Date Fair Value<br />

Nonvested at January 1 664,992 $ 35.78<br />

Granted 640,060 $ 42.97<br />

Vested (125,651) $ 35.60<br />

Forfeited (25,005) $ 37.61<br />

Nonvested at December 31 1,154,396 $ 39.74<br />

Performance Shares<br />

On March 10, <strong>2010</strong>, PG&E Corporation granted 605,275 contingent performance shares to eligible employees under the 2006<br />

LTIP. Unlike performance shares awarded in prior periods (see below), which settle in cash, <strong>2010</strong> grants will be settled in PG&E<br />

Corporation common stock <strong>and</strong> are classified as share-based equity awards. Performance shares granted <strong>and</strong> outst<strong>and</strong>ing prior to <strong>2010</strong><br />

will not be modified <strong>and</strong> will continue to be paid <strong>and</strong> settled in cash. The vesting of the performance shares granted in <strong>2010</strong> is<br />

dependent upon three years of continuous service. Additionally the amount of common stock that recipients are entitled to receive, if<br />

any, will be determined based on PG&E Corporation’s TSR relative to the performance of a specified group of peer companies for the<br />

applicable three year performance period. Total compensation expense for these shares is based on the grant-date fair value, which is<br />

determined using a Monte Carlo simulation valuation model. Performance share expense is recognized ratably over the requisite<br />

service period based on the fair values determined, except for the expense attributable to awards granted to retirement-eligible<br />

participants, which is recognized on the date of grant. Dividend equivalents on equity-classified awards, if any, will be paid in cash<br />

upon vesting date based on the amount of common stock awarded.<br />

For performance shares classified as equity awards, the following table summarizes activity for <strong>2010</strong>:<br />

Number of<br />

Weighted Average Grant-<br />

Performance Shares<br />

Date Fair Value<br />

Nonvested at January 1 -<br />

Granted 616,990 $ 35.60<br />

Vested -<br />

Forfeited (7,020) $ 35.60<br />

Nonvested at December 31 609,970 $ 35.60<br />

As of December 31, <strong>2010</strong>, $10 million of total unrecognized compensation costs related to nonvested performance shares are<br />

expected to be recognized over the remaining weighted-average period of 1.22 years.<br />

Prior to <strong>2010</strong>, PG&E Corporation awarded performance shares to eligible participants under the 2006 LTIP as hypothetical<br />

shares of common stock that vest at the end of a three-year period <strong>and</strong> are settled in cash based on the performance of PG&E<br />

Corporation’s TSR. Upon vesting, the amount of cash that recipients are entitled to receive, if any, is determined by multiplying the<br />

number of vested performance shares by the average closing price of PG&E Corporation common stock for the last 30 calendar days in<br />

the three-year performance period. This result is then adjusted based on PG&E Corporation’s TSR relative to the performance of a<br />

specified group of peer companies for the applicable three-year performance period. These outst<strong>and</strong>ing performance shares are<br />

classified as a liability because the performance shares can only be settled in cash. During each reporting period compensation<br />

<strong>FERC</strong> FORM NO. 1 (ED. 12-88) Page 123.21