Dataline A look at current financial reporting issues - PwC

Dataline A look at current financial reporting issues - PwC

Dataline A look at current financial reporting issues - PwC

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

loss and cash flows. After much back and forth, the boards determined they could<br />

support moving away from applying a financing approach to all leases.<br />

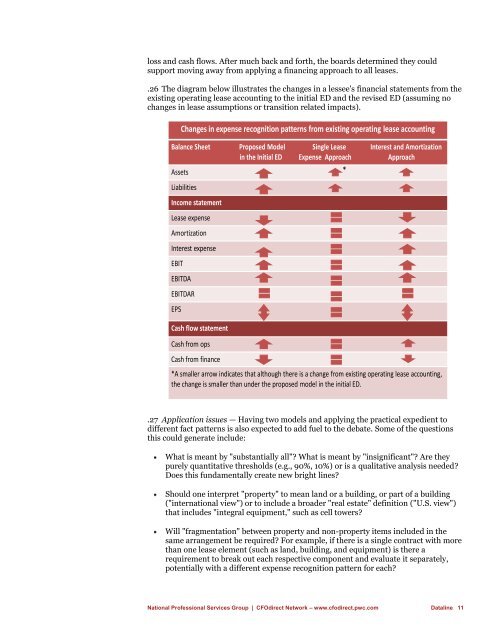

.26 The diagram below illustr<strong>at</strong>es the changes in a lessee's <strong>financial</strong> st<strong>at</strong>ements from the<br />

existing oper<strong>at</strong>ing lease accounting to the initial ED and the revised ED (assuming no<br />

changes in lease assumptions or transition rel<strong>at</strong>ed impacts).<br />

Changes in expense recognition p<strong>at</strong>terns from existing oper<strong>at</strong>ing lease accounting<br />

Balance Sheet Proposed Model Single Lease Interest and Amortiz<strong>at</strong>ion<br />

in the Initial ED Expense Approach Approach<br />

Assets<br />

*<br />

Liabilities<br />

Income st<strong>at</strong>ement<br />

Lease expense<br />

Amortiz<strong>at</strong>ion<br />

Interest expense<br />

EBIT<br />

EBITDA<br />

EBITDAR<br />

EPS<br />

Cash flow st<strong>at</strong>ement<br />

Cash from ops<br />

Cash from finance<br />

*A smaller arrow indic<strong>at</strong>es th<strong>at</strong> although there is a change from existing oper<strong>at</strong>ing lease accounting,<br />

the change is smaller than under the proposed model in the initial ED.<br />

.27 Applic<strong>at</strong>ion <strong>issues</strong> — Having two models and applying the practical expedient to<br />

different fact p<strong>at</strong>terns is also expected to add fuel to the deb<strong>at</strong>e. Some of the questions<br />

this could gener<strong>at</strong>e include:<br />

Wh<strong>at</strong> is meant by "substantially all"? Wh<strong>at</strong> is meant by "insignificant"? Are they<br />

purely quantit<strong>at</strong>ive thresholds (e.g., 90%, 10%) or is a qualit<strong>at</strong>ive analysis needed?<br />

Does this fundamentally cre<strong>at</strong>e new bright lines?<br />

Should one interpret "property" to mean land or a building, or part of a building<br />

("intern<strong>at</strong>ional view") or to include a broader "real est<strong>at</strong>e" definition ("U.S. view")<br />

th<strong>at</strong> includes "integral equipment," such as cell towers?<br />

Will "fragment<strong>at</strong>ion" between property and non-property items included in the<br />

same arrangement be required? For example, if there is a single contract with more<br />

than one lease element (such as land, building, and equipment) is there a<br />

requirement to break out each respective component and evalu<strong>at</strong>e it separ<strong>at</strong>ely,<br />

potentially with a different expense recognition p<strong>at</strong>tern for each?<br />

N<strong>at</strong>ional Professional Services Group | CFOdirect Network – www.cfodirect.pwc.com <strong>D<strong>at</strong>aline</strong> 11