Dataline A look at current financial reporting issues - PwC

Dataline A look at current financial reporting issues - PwC

Dataline A look at current financial reporting issues - PwC

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

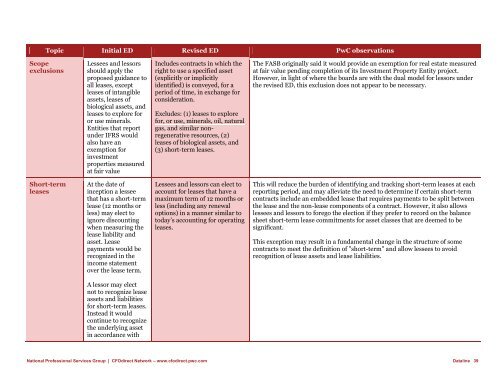

Topic Initial ED Revised ED <strong>PwC</strong> observ<strong>at</strong>ions<br />

Scope<br />

exclusions<br />

Lessees and lessors<br />

should apply the<br />

proposed guidance to<br />

all leases, except<br />

leases of intangible<br />

assets, leases of<br />

biological assets, and<br />

leases to explore for<br />

or use minerals.<br />

Entities th<strong>at</strong> report<br />

under IFRS would<br />

also have an<br />

exemption for<br />

investment<br />

properties measured<br />

<strong>at</strong> fair value<br />

Includes contracts in which the<br />

right to use a specified asset<br />

(explicitly or implicitly<br />

identified) is conveyed, for a<br />

period of time, in exchange for<br />

consider<strong>at</strong>ion.<br />

Excludes: (1) leases to explore<br />

for, or use, minerals, oil, n<strong>at</strong>ural<br />

gas, and similar nonregener<strong>at</strong>ive<br />

resources, (2)<br />

leases of biological assets, and<br />

(3) short-term leases.<br />

The FASB originally said it would provide an exemption for real est<strong>at</strong>e measured<br />

<strong>at</strong> fair value pending completion of its Investment Property Entity project.<br />

However, in light of where the boards are with the dual model for lessors under<br />

the revised ED, this exclusion does not appear to be necessary.<br />

Short-term<br />

leases<br />

At the d<strong>at</strong>e of<br />

inception a lessee<br />

th<strong>at</strong> has a short-term<br />

lease (12 months or<br />

less) may elect to<br />

ignore discounting<br />

when measuring the<br />

lease liability and<br />

asset. Lease<br />

payments would be<br />

recognized in the<br />

income st<strong>at</strong>ement<br />

over the lease term.<br />

Lessees and lessors can elect to<br />

account for leases th<strong>at</strong> have a<br />

maximum term of 12 months or<br />

less (including any renewal<br />

options) in a manner similar to<br />

today’s accounting for oper<strong>at</strong>ing<br />

leases.<br />

This will reduce the burden of identifying and tracking short-term leases <strong>at</strong> each<br />

<strong>reporting</strong> period, and may allevi<strong>at</strong>e the need to determine if certain short-term<br />

contracts include an embedded lease th<strong>at</strong> requires payments to be split between<br />

the lease and the non-lease components of a contract. However, it also allows<br />

lessees and lessors to forego the election if they prefer to record on the balance<br />

sheet short-term lease commitments for asset classes th<strong>at</strong> are deemed to be<br />

significant.<br />

This exception may result in a fundamental change in the structure of some<br />

contracts to meet the definition of "short-term" and allow lessees to avoid<br />

recognition of lease assets and lease liabilities.<br />

A lessor may elect<br />

not to recognize lease<br />

assets and liabilities<br />

for short-term leases.<br />

Instead it would<br />

continue to recognize<br />

the underlying asset<br />

in accordance with<br />

N<strong>at</strong>ional Professional Services Group | CFOdirect Network – www.cfodirect.pwc.com <strong>D<strong>at</strong>aline</strong> 39