Dataline A look at current financial reporting issues - PwC

Dataline A look at current financial reporting issues - PwC

Dataline A look at current financial reporting issues - PwC

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

.9 In early 2011, the boards began redeliber<strong>at</strong>ions to address these concerns, the five<br />

key areas discussed in paragraph 13 below, and other <strong>issues</strong>. In discussions over the past<br />

18 months, the boards identified altern<strong>at</strong>ive approaches to reduce complexity and<br />

address certain applic<strong>at</strong>ion <strong>issues</strong>. They also conducted extensive outreach with users<br />

and preparers to understand the oper<strong>at</strong>ionality and usefulness of their altern<strong>at</strong>ive<br />

approaches.<br />

.10 At their July 17, 2012 joint meeting, the boards substantially completed their<br />

redeliber<strong>at</strong>ions and instructed their staffs to begin drafting a revised ED. The boards plan<br />

to issue the revised ED by the end of November 2012 with a 120-day comment period.<br />

However, the issuance may slip into early 2013.<br />

.11 The difficulties encountered during the 18-month-long redeliber<strong>at</strong>ion process were<br />

highlighted when the board members were asked whether they planned to present an<br />

altern<strong>at</strong>ive view in the revised ED. Three of the seven FASB members and <strong>at</strong> least two of<br />

the IASB members st<strong>at</strong>ed they may present altern<strong>at</strong>ive views. However, the st<strong>at</strong>ed<br />

r<strong>at</strong>ionales for their altern<strong>at</strong>ive views are very different. The FASB members expressed<br />

significant concerns about whether some of the core objectives of the project are met in<br />

the revised ED. They question the overall cost/benefit proposition and whether the<br />

revised proposals will provide <strong>financial</strong> st<strong>at</strong>ement users with useful inform<strong>at</strong>ion. Other<br />

specific concerns include the accounting for variable lease payments, the effectiveness of<br />

the proposed disclosures, and the interaction of lessor accounting with the proposed<br />

revenue recognition model.<br />

.12 In contrast, IASB members contempl<strong>at</strong>ing presenting an altern<strong>at</strong>ive view primarily<br />

expressed concern about the conceptual merits of a dual, r<strong>at</strong>her than single, lease<br />

accounting approach being applied by both lessees and lessors.<br />

The main details of the redeliber<strong>at</strong>ions<br />

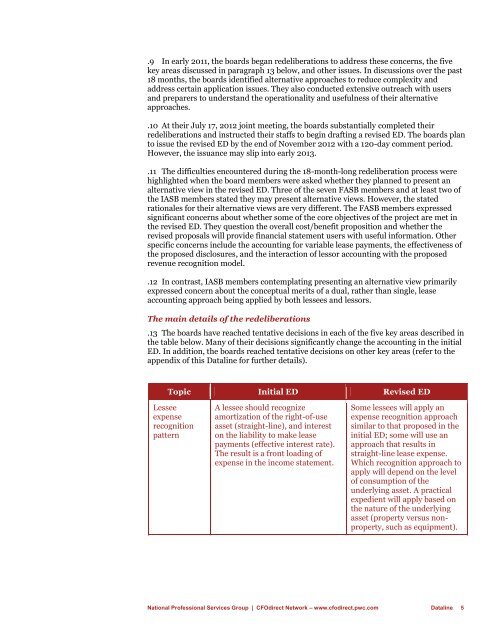

.13 The boards have reached tent<strong>at</strong>ive decisions in each of the five key areas described in<br />

the table below. Many of their decisions significantly change the accounting in the initial<br />

ED. In addition, the boards reached tent<strong>at</strong>ive decisions on other key areas (refer to the<br />

appendix of this <strong>D<strong>at</strong>aline</strong> for further details).<br />

Topic Initial ED Revised ED<br />

Lessee<br />

expense<br />

recognition<br />

p<strong>at</strong>tern<br />

A lessee should recognize<br />

amortiz<strong>at</strong>ion of the right-of-use<br />

asset (straight-line), and interest<br />

on the liability to make lease<br />

payments (effective interest r<strong>at</strong>e).<br />

The result is a front loading of<br />

expense in the income st<strong>at</strong>ement.<br />

Some lessees will apply an<br />

expense recognition approach<br />

similar to th<strong>at</strong> proposed in the<br />

initial ED; some will use an<br />

approach th<strong>at</strong> results in<br />

straight-line lease expense.<br />

Which recognition approach to<br />

apply will depend on the level<br />

of consumption of the<br />

underlying asset. A practical<br />

expedient will apply based on<br />

the n<strong>at</strong>ure of the underlying<br />

asset (property versus nonproperty,<br />

such as equipment).<br />

N<strong>at</strong>ional Professional Services Group | CFOdirect Network – www.cfodirect.pwc.com <strong>D<strong>at</strong>aline</strong> 5