Dataline A look at current financial reporting issues - PwC

Dataline A look at current financial reporting issues - PwC

Dataline A look at current financial reporting issues - PwC

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

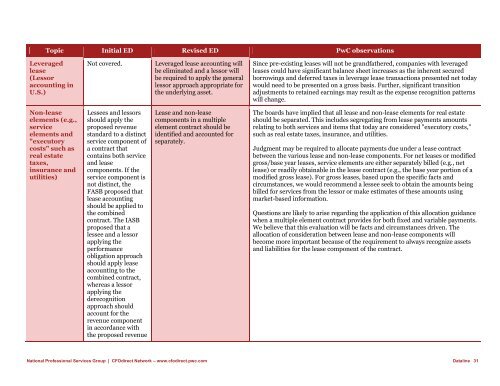

Topic Initial ED Revised ED <strong>PwC</strong> observ<strong>at</strong>ions<br />

Leveraged<br />

lease<br />

(Lessor<br />

accounting in<br />

U.S.)<br />

Not covered.<br />

Leveraged lease accounting will<br />

be elimin<strong>at</strong>ed and a lessor will<br />

be required to apply the general<br />

lessor approach appropri<strong>at</strong>e for<br />

the underlying asset.<br />

Since pre-existing leases will not be grandf<strong>at</strong>hered, companies with leveraged<br />

leases could have significant balance sheet increases as the inherent secured<br />

borrowings and deferred taxes in leverage lease transactions presented net today<br />

would need to be presented on a gross basis. Further, significant transition<br />

adjustments to retained earnings may result as the expense recognition p<strong>at</strong>terns<br />

will change.<br />

Non-lease<br />

elements (e.g.,<br />

service<br />

elements and<br />

"executory<br />

costs" such as<br />

real est<strong>at</strong>e<br />

taxes,<br />

insurance and<br />

utilities)<br />

Lessees and lessors<br />

should apply the<br />

proposed revenue<br />

standard to a distinct<br />

service component of<br />

a contract th<strong>at</strong><br />

contains both service<br />

and lease<br />

components. If the<br />

service component is<br />

not distinct, the<br />

FASB proposed th<strong>at</strong><br />

lease accounting<br />

should be applied to<br />

the combined<br />

contract. The IASB<br />

proposed th<strong>at</strong> a<br />

lessee and a lessor<br />

applying the<br />

performance<br />

oblig<strong>at</strong>ion approach<br />

should apply lease<br />

accounting to the<br />

combined contract,<br />

whereas a lessor<br />

applying the<br />

derecognition<br />

approach should<br />

account for the<br />

revenue component<br />

in accordance with<br />

the proposed revenue<br />

Lease and non-lease<br />

components in a multiple<br />

element contract should be<br />

identified and accounted for<br />

separ<strong>at</strong>ely.<br />

The boards have implied th<strong>at</strong> all lease and non-lease elements for real est<strong>at</strong>e<br />

should be separ<strong>at</strong>ed. This includes segreg<strong>at</strong>ing from lease payments amounts<br />

rel<strong>at</strong>ing to both services and items th<strong>at</strong> today are considered "executory costs,"<br />

such as real est<strong>at</strong>e taxes, insurance, and utilities.<br />

Judgment may be required to alloc<strong>at</strong>e payments due under a lease contract<br />

between the various lease and non-lease components. For net leases or modified<br />

gross/base year leases, service elements are either separ<strong>at</strong>ely billed (e.g., net<br />

lease) or readily obtainable in the lease contract (e.g., the base year portion of a<br />

modified gross lease). For gross leases, based upon the specific facts and<br />

circumstances, we would recommend a lessee seek to obtain the amounts being<br />

billed for services from the lessor or make estim<strong>at</strong>es of these amounts using<br />

market-based inform<strong>at</strong>ion.<br />

Questions are likely to arise regarding the applic<strong>at</strong>ion of this alloc<strong>at</strong>ion guidance<br />

when a multiple element contract provides for both fixed and variable payments.<br />

We believe th<strong>at</strong> this evalu<strong>at</strong>ion will be facts and circumstances driven. The<br />

alloc<strong>at</strong>ion of consider<strong>at</strong>ion between lease and non-lease components will<br />

become more important because of the requirement to always recognize assets<br />

and liabilities for the lease component of the contract.<br />

N<strong>at</strong>ional Professional Services Group | CFOdirect Network – www.cfodirect.pwc.com <strong>D<strong>at</strong>aline</strong> 31