Dataline A look at current financial reporting issues - PwC

Dataline A look at current financial reporting issues - PwC

Dataline A look at current financial reporting issues - PwC

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

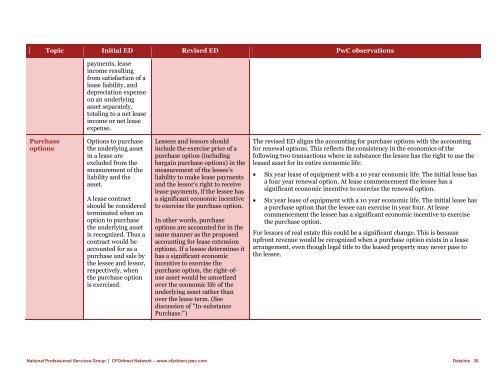

Topic Initial ED Revised ED <strong>PwC</strong> observ<strong>at</strong>ions<br />

payments, lease<br />

income resulting<br />

from s<strong>at</strong>isfaction of a<br />

lease liability, and<br />

depreci<strong>at</strong>ion expense<br />

on an underlying<br />

asset separ<strong>at</strong>ely,<br />

totaling to a net lease<br />

income or net lease<br />

expense.<br />

Purchase<br />

options<br />

Options to purchase<br />

the underlying asset<br />

in a lease are<br />

excluded from the<br />

measurement of the<br />

liability and the<br />

asset.<br />

A lease contract<br />

should be considered<br />

termin<strong>at</strong>ed when an<br />

option to purchase<br />

the underlying asset<br />

is recognized. Thus a<br />

contract would be<br />

accounted for as a<br />

purchase and sale by<br />

the lessee and lessor,<br />

respectively, when<br />

the purchase option<br />

is exercised.<br />

Lessees and lessors should<br />

include the exercise price of a<br />

purchase option (including<br />

bargain purchase options) in the<br />

measurement of the lessee’s<br />

liability to make lease payments<br />

and the lessor’s right to receive<br />

lease payments, if the lessee has<br />

a significant economic incentive<br />

to exercise the purchase option.<br />

In other words, purchase<br />

options are accounted for in the<br />

same manner as the proposed<br />

accounting for lease extension<br />

options. If a lessee determines it<br />

has a significant economic<br />

incentive to exercise the<br />

purchase option, the right-ofuse<br />

asset would be amortized<br />

over the economic life of the<br />

underlying asset r<strong>at</strong>her than<br />

over the lease term. (See<br />

discussion of "In-substance<br />

Purchase.")<br />

The revised ED aligns the accounting for purchase options with the accounting<br />

for renewal options. This reflects the consistency in the economics of the<br />

following two transactions where in substance the lessee has the right to use the<br />

leased asset for its entire economic life:<br />

Six year lease of equipment with a 10 year economic life. The initial lease has<br />

a four year renewal option. At lease commencement the lessee has a<br />

significant economic incentive to exercise the renewal option.<br />

Six year lease of equipment with a 10 year economic life. The initial lease has<br />

a purchase option th<strong>at</strong> the lessee can exercise in year four. At lease<br />

commencement the lessee has a significant economic incentive to exercise<br />

the purchase option.<br />

For lessors of real est<strong>at</strong>e this could be a significant change. This is because<br />

upfront revenue would be recognized when a purchase option exists in a lease<br />

arrangement, even though legal title to the leased property may never pass to<br />

the lessee.<br />

N<strong>at</strong>ional Professional Services Group | CFOdirect Network – www.cfodirect.pwc.com <strong>D<strong>at</strong>aline</strong> 35