How do we rebuild shareholder trust on executive pay

How do we rebuild shareholder trust on executive pay

How do we rebuild shareholder trust on executive pay

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

A look in the rear-visi<strong>on</strong> mirror:<br />

ASX 100 remunerati<strong>on</strong> in 2009<br />

Deferred short-term incentive plans<br />

Approximately 32% of ASX 100 companies now<br />

operate a deferred STI plan with compulsary<br />

deferral. We expect the percentage of companies<br />

with compulsory deferral plans to increase,<br />

particularly given APRA requirements within the<br />

regulated financial services sector.<br />

It is likely that voluntary deferral plans will largely<br />

become redundant as a result of the Federal<br />

Government’s tax rule changes.<br />

Approximately two-thirds of companies operating<br />

deferred STI plans use shares as the instrument of<br />

deferral, with the remainder simply deferring cash.<br />

Levels of compulsory deferral range bet<str<strong>on</strong>g>we</str<strong>on</strong>g>en<br />

33% and 50% of the actual STI <strong>pay</strong>ment. Of the<br />

companies where deferral is compulsory, the time<br />

period for deferral typically ranges from <strong>on</strong>e to<br />

three years.<br />

L<strong>on</strong>g-term incentives<br />

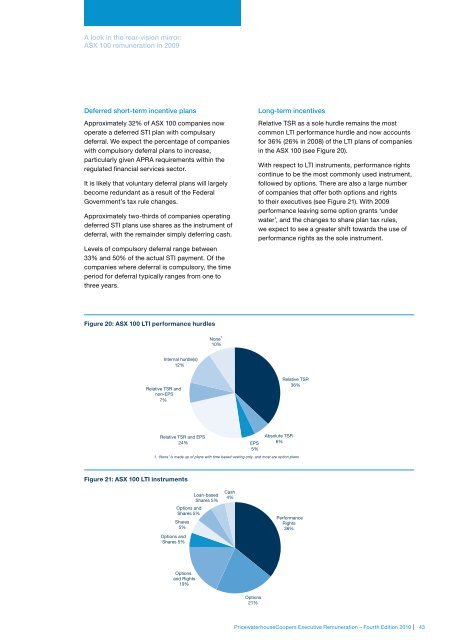

Relative TSR as a sole hurdle remains the most<br />

comm<strong>on</strong> LTI performance hurdle and now accounts<br />

for 36% (26% in 2008) of the LTI plans of companies<br />

in the ASX 100 (see Figure 20).<br />

With respect to LTI instruments, performance rights<br />

c<strong>on</strong>tinue to be the most comm<strong>on</strong>ly used instrument,<br />

follo<str<strong>on</strong>g>we</str<strong>on</strong>g>d by opti<strong>on</strong>s. There are also a large number<br />

of companies that offer both opti<strong>on</strong>s and rights<br />

to their <strong>executive</strong>s (see Figure 21). With 2009<br />

performance leaving some opti<strong>on</strong> grants ‘under<br />

water’, and the changes to share plan tax rules,<br />

<str<strong>on</strong>g>we</str<strong>on</strong>g> expect to see a greater shift towards the use of<br />

performance rights as the sole instrument.<br />

Figure 20: ASX 100 LTI performance hurdles<br />

N<strong>on</strong>e 1<br />

10%<br />

Internal hurdle(s)<br />

12%<br />

Relative TSR and<br />

n<strong>on</strong>-EPS<br />

7%<br />

Relative TSR<br />

36%<br />

Relative TSR and EPS<br />

24%<br />

EPS<br />

5%<br />

Absolute TSR<br />

6%<br />

1. ‘N<strong>on</strong>e’ is made up of plans with time based vesting <strong>on</strong>ly, and most are opti<strong>on</strong> plans<br />

Figure 21: ASX 100 LTI instruments<br />

Loan-based<br />

Shares 5%<br />

Opti<strong>on</strong>s and<br />

Shares 5%<br />

Shares<br />

5%<br />

Opti<strong>on</strong>s and<br />

Shares 5%<br />

Cash<br />

4%<br />

Performance<br />

Rights<br />

36%<br />

Opti<strong>on</strong>s<br />

and Rights<br />

19%<br />

Opti<strong>on</strong>s<br />

21%<br />

PricewaterhouseCoopers Executive Remunerati<strong>on</strong> – Fourth Editi<strong>on</strong> 2010 | 43