How do we rebuild shareholder trust on executive pay

How do we rebuild shareholder trust on executive pay

How do we rebuild shareholder trust on executive pay

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

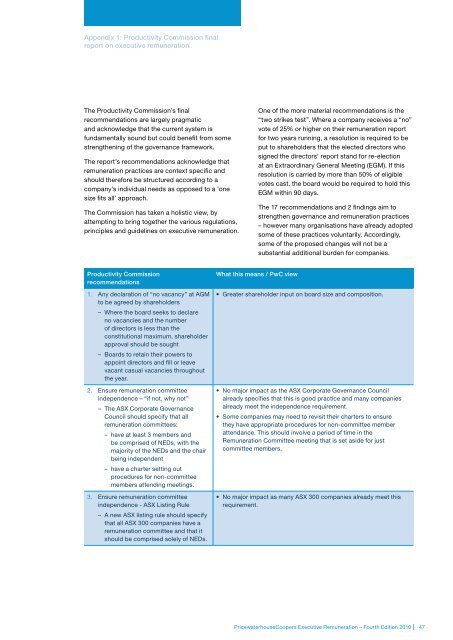

Appendix 1: Productivity Commissi<strong>on</strong> final<br />

report <strong>on</strong> <strong>executive</strong> remunerati<strong>on</strong><br />

The Productivity Commissi<strong>on</strong>’s final<br />

recommendati<strong>on</strong>s are largely pragmatic<br />

and acknowledge that the current system is<br />

fundamentally sound but could benefit from some<br />

strengthening of the governance framework.<br />

The report’s recommendati<strong>on</strong>s acknowledge that<br />

remunerati<strong>on</strong> practices are c<strong>on</strong>text specific and<br />

should therefore be structured according to a<br />

company’s individual needs as opposed to a ‘<strong>on</strong>e<br />

size fits all’ approach.<br />

The Commissi<strong>on</strong> has taken a holistic view, by<br />

attempting to bring together the various regulati<strong>on</strong>s,<br />

principles and guidelines <strong>on</strong> <strong>executive</strong> remunerati<strong>on</strong>.<br />

One of the more material recommendati<strong>on</strong>s is the<br />

“two strikes test”. Where a company receives a “no”<br />

vote of 25% or higher <strong>on</strong> their remunerati<strong>on</strong> report<br />

for two years running, a resoluti<strong>on</strong> is required to be<br />

put to <str<strong>on</strong>g>shareholder</str<strong>on</strong>g>s that the elected directors who<br />

signed the directors’ report stand for re-electi<strong>on</strong><br />

at an Extraordinary General Meeting (EGM). If this<br />

resoluti<strong>on</strong> is carried by more than 50% of eligible<br />

votes cast, the board would be required to hold this<br />

EGM within 90 days.<br />

The 17 recommendati<strong>on</strong>s and 2 findings aim to<br />

strengthen governance and remunerati<strong>on</strong> practices<br />

– ho<str<strong>on</strong>g>we</str<strong>on</strong>g>ver many organisati<strong>on</strong>s have already a<str<strong>on</strong>g>do</str<strong>on</strong>g>pted<br />

some of these practices voluntarily. Accordingly,<br />

some of the proposed changes will not be a<br />

substantial additi<strong>on</strong>al burden for companies.<br />

Productivity Commissi<strong>on</strong><br />

recommendati<strong>on</strong>s<br />

What this means / PwC view<br />

1. Any declarati<strong>on</strong> of “no vacancy” at AGM<br />

to be agreed by <str<strong>on</strong>g>shareholder</str<strong>on</strong>g>s<br />

– Where the board seeks to declare<br />

no vacancies and the number<br />

of directors is less than the<br />

c<strong>on</strong>stituti<strong>on</strong>al maximum, <str<strong>on</strong>g>shareholder</str<strong>on</strong>g><br />

approval should be sought<br />

– Boards to retain their po<str<strong>on</strong>g>we</str<strong>on</strong>g>rs to<br />

appoint directors and fill or leave<br />

vacant casual vacancies throughout<br />

the year.<br />

• Greater <str<strong>on</strong>g>shareholder</str<strong>on</strong>g> input <strong>on</strong> board size and compositi<strong>on</strong>.<br />

2. Ensure remunerati<strong>on</strong> committee<br />

independence – “if not, why not”<br />

– The ASX Corporate Governance<br />

Council should specify that all<br />

remunerati<strong>on</strong> committees:<br />

– have at least 3 members and<br />

be comprised of NEDs, with the<br />

majority of the NEDs and the chair<br />

being independent<br />

– have a charter setting out<br />

procedures for n<strong>on</strong>-committee<br />

members attending meetings.<br />

• No major impact as the ASX Corporate Governance Council<br />

already specifies that this is good practice and many companies<br />

already meet the independence requirement.<br />

• Some companies may need to revisit their charters to ensure<br />

they have appropriate procedures for n<strong>on</strong>-committee member<br />

attendance. This should involve a period of time in the<br />

Remunerati<strong>on</strong> Committee meeting that is set aside for just<br />

committee members.<br />

. Ensure remunerati<strong>on</strong> committee<br />

independence - ASX Listing Rule<br />

– A new ASX listing rule should specify<br />

that all ASX 300 companies have a<br />

remunerati<strong>on</strong> committee and that it<br />

should be comprised solely of NEDs.<br />

• No major impact as many ASX 300 companies already meet this<br />

requirement.<br />

PricewaterhouseCoopers Executive Remunerati<strong>on</strong> – Fourth Editi<strong>on</strong> 2010 | 47