How do we rebuild shareholder trust on executive pay

How do we rebuild shareholder trust on executive pay

How do we rebuild shareholder trust on executive pay

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Breaking the mould<br />

The increasingly complex nature of variable<br />

remunerati<strong>on</strong> is an area where <str<strong>on</strong>g>we</str<strong>on</strong>g> would like<br />

to see change.<br />

Over the last decade, <strong>executive</strong> remunerati<strong>on</strong> in<br />

Australia has increased significantly. The increase<br />

has mainly been in the form of higher short- and<br />

l<strong>on</strong>g-term incentive awards, which are nearly always<br />

performance-related. This combinati<strong>on</strong> of higher<br />

remunerati<strong>on</strong> outcomes and increased complexity<br />

has left almost every<strong>on</strong>e dissatisfied:<br />

• Generally, management feels that incentives have<br />

become too complex and prescriptive, and are<br />

not aligned to the business strategy or within their<br />

c<strong>on</strong>trol. As a result, they <str<strong>on</strong>g>do</str<strong>on</strong>g> not believe incentives<br />

drive performance or change behaviours, and<br />

many perceive them to be simply a lottery.<br />

• Many instituti<strong>on</strong>al <str<strong>on</strong>g>shareholder</str<strong>on</strong>g>s believe there<br />

is a tenuous link bet<str<strong>on</strong>g>we</str<strong>on</strong>g>en remunerati<strong>on</strong> and<br />

performance. The <str<strong>on</strong>g>shareholder</str<strong>on</strong>g> percepti<strong>on</strong> is<br />

that incentives ratchet up each year in line with<br />

annual benchmarking, while incentive design<br />

and performance measures chop-and-change<br />

depending <strong>on</strong> management’s expectati<strong>on</strong> of them<br />

<strong>pay</strong>ing out (or not). Underlying these percepti<strong>on</strong>s<br />

is a feeling that remunerati<strong>on</strong> committees are not<br />

being tough enough and when they <str<strong>on</strong>g>do</str<strong>on</strong>g> exercise<br />

discreti<strong>on</strong>, it always favours <strong>executive</strong>s.<br />

• Remunerati<strong>on</strong> committees are caught in a<br />

calibrati<strong>on</strong> hell, trying to design incentives that<br />

are durable and balance the expectati<strong>on</strong>s of<br />

<strong>executive</strong>s and <str<strong>on</strong>g>shareholder</str<strong>on</strong>g>s.<br />

• Few really believe that complex l<strong>on</strong>g-term<br />

incentives retain <strong>executive</strong>s; they just make it<br />

more expensive for a new employer to buy out<br />

the <strong>executive</strong> with golden hellos and guarantees.<br />

• The public, particularly since the global financial<br />

crisis, sees <strong>executive</strong> remunerati<strong>on</strong> as nothing<br />

other than a gravy train – <strong>pay</strong> regardless of<br />

performance, rather than <strong>pay</strong> for performance.<br />

The World Ec<strong>on</strong>omic Forum<br />

has c<strong>on</strong>sistently ranked Australia in<br />

the top three countries for corporate<br />

governance since 2002<br />

Source Productivity Commissi<strong>on</strong> Inquiry into<br />

Executive Remunerati<strong>on</strong> 19 December 2009<br />

Generally, Australia is seen to be am<strong>on</strong>g the<br />

global leaders in terms of corporate governance<br />

and remunerati<strong>on</strong> disclosure. We have <strong>on</strong>e of<br />

the highest standards of disclosure, various best<br />

practice guidance, and healthy levels of <str<strong>on</strong>g>shareholder</str<strong>on</strong>g><br />

engagement <strong>on</strong> <strong>executive</strong> remunerati<strong>on</strong> compared<br />

with many other countries. <str<strong>on</strong>g>How</str<strong>on</strong>g>ever, many<br />

stakeholders would argue that this has not led to<br />

a particularly successful outcome; yet the danger is<br />

that any further prescripti<strong>on</strong> will result in more of the<br />

same, with calls for tougher performance c<strong>on</strong>diti<strong>on</strong>s,<br />

tougher l<strong>on</strong>g-term incentives, greater disclosure and<br />

more governance.<br />

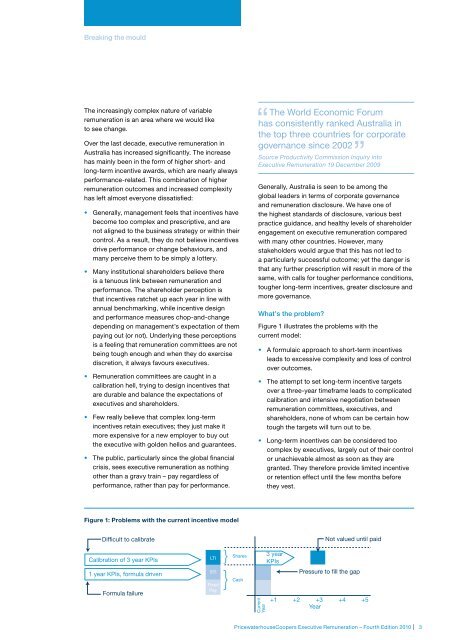

What’s the problem?<br />

Figure 1 illustrates the problems with the<br />

current model:<br />

• A formulaic approach to short-term incentives<br />

leads to excessive complexity and loss of c<strong>on</strong>trol<br />

over outcomes.<br />

• The attempt to set l<strong>on</strong>g-term incentive targets<br />

over a three-year timeframe leads to complicated<br />

calibrati<strong>on</strong> and intensive negotiati<strong>on</strong> bet<str<strong>on</strong>g>we</str<strong>on</strong>g>en<br />

remunerati<strong>on</strong> committees, <strong>executive</strong>s, and<br />

<str<strong>on</strong>g>shareholder</str<strong>on</strong>g>s, n<strong>on</strong>e of whom can be certain how<br />

tough the targets will turn out to be.<br />

• L<strong>on</strong>g-term incentives can be c<strong>on</strong>sidered too<br />

complex by <strong>executive</strong>s, largely out of their c<strong>on</strong>trol<br />

or unachievable almost as so<strong>on</strong> as they are<br />

granted. They therefore provide limited incentive<br />

or retenti<strong>on</strong> effect until the few m<strong>on</strong>ths before<br />

they vest.<br />

Figure 1: Problems with the current incentive model<br />

Difficult to calibrate<br />

Not valued until paid<br />

Calibrati<strong>on</strong> of 3 year KPIs<br />

LTI<br />

Shares<br />

3 year<br />

KPIs<br />

1 year KPIs, formula driven<br />

Formula failure<br />

STI<br />

Fixed<br />

Pay<br />

Cash<br />

Current<br />

Year<br />

Pressure to fill the gap<br />

+1 +2 +3 +4 +5<br />

Year<br />

PricewaterhouseCoopers Executive Remunerati<strong>on</strong> – Fourth Editi<strong>on</strong> 2010 |