Insurance facts and figures 2007 - PwC

Insurance facts and figures 2007 - PwC

Insurance facts and figures 2007 - PwC

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Financial reporting<br />

4<br />

4.4 Annual accounts<br />

In general, a public company must file its annual shareholder accounts with ASIC within<br />

four months of year-end. Small proprietary companies are generally not required to<br />

lodge the shareholder accounts with ASIC. The shareholders’ accounts prepared under<br />

the Corporations Act must be independently audited by an Australian registered auditor.<br />

GENERAL INSURANCE<br />

The Financial Sector (Collection of Data) Act 2001 made APRA the single government<br />

collection agency for financial sector data. Therefore, all of APRA’s industry supervision<br />

acts, including the <strong>Insurance</strong> Act, were amended to remove their data collection<br />

provisions. The yearly statutory accounts, which must be audited, are required to be<br />

prepared on a different basis than the financial statements which must comply with the<br />

Corporations Act <strong>and</strong> Australian accounting st<strong>and</strong>ards. The key differences are outlined<br />

in the following table:<br />

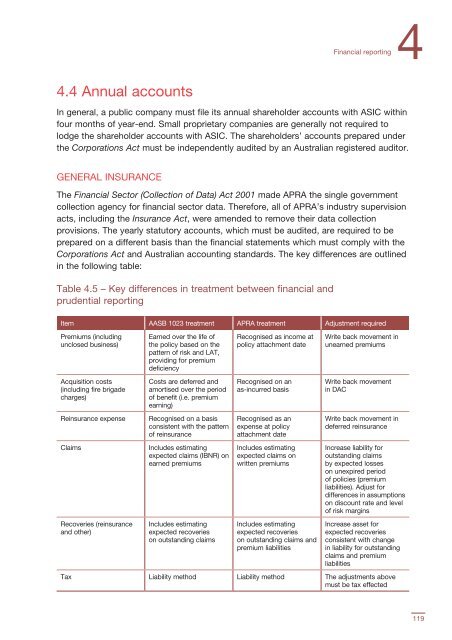

Table 4.5 – Key differences in treatment between financial <strong>and</strong><br />

prudential reporting<br />

Item AASB 1023 treatment APRA treatment Adjustment required<br />

Premiums (including<br />

unclosed business)<br />

Acquisition costs<br />

(including fire brigade<br />

charges)<br />

Reinsurance expense<br />

Claims<br />

Recoveries (reinsurance<br />

<strong>and</strong> other)<br />

Earned over the life of<br />

the policy based on the<br />

pattern of risk <strong>and</strong> LAT,<br />

providing for premium<br />

deficiency<br />

Costs are deferred <strong>and</strong><br />

amortised over the period<br />

of benefit (i.e. premium<br />

earning)<br />

Recognised on a basis<br />

consistent with the pattern<br />

of reinsurance<br />

Includes estimating<br />

expected claims (IBNR) on<br />

earned premiums<br />

Includes estimating<br />

expected recoveries<br />

on outst<strong>and</strong>ing claims<br />

Recognised as income at<br />

policy attachment date<br />

Recognised on an<br />

as-incurred basis<br />

Recognised as an<br />

expense at policy<br />

attachment date<br />

Includes estimating<br />

expected claims on<br />

written premiums<br />

Includes estimating<br />

expected recoveries<br />

on outst<strong>and</strong>ing claims <strong>and</strong><br />

premium liabilities<br />

Write back movement in<br />

unearned premiums<br />

Write back movement<br />

in DAC<br />

Write back movement in<br />

deferred reinsurance<br />

Increase liability for<br />

outst<strong>and</strong>ing claims<br />

by expected losses<br />

on unexpired period<br />

of policies (premium<br />

liabilities). Adjust for<br />

differences in assumptions<br />

on discount rate <strong>and</strong> level<br />

of risk margins<br />

Increase asset for<br />

expected recoveries<br />

consistent with change<br />

in liability for outst<strong>and</strong>ing<br />

claims <strong>and</strong> premium<br />

liabilities<br />

Tax Liability method Liability method The adjustments above<br />

must be tax effected<br />

119