Insurance facts and figures 2007 - PwC

Insurance facts and figures 2007 - PwC

Insurance facts and figures 2007 - PwC

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Taxation<br />

5<br />

5.7 Key dates<br />

GENERAL INSURANCE<br />

Stamp duty legislation<br />

Lodgement of returns <strong>and</strong> payments<br />

• New South Wales, Victoria, Australian Capital Territory, Tasmania, Western Australia<br />

<strong>and</strong> the Northern Territory<br />

Within 21 days after the end of each month.<br />

• South Australia<br />

Within 15 days after the end of each month. Annual licence to be applied for by<br />

31 January of each year.<br />

• Queensl<strong>and</strong><br />

Within 14 days after the end of each month or such other period as the Commissioner<br />

may determine.<br />

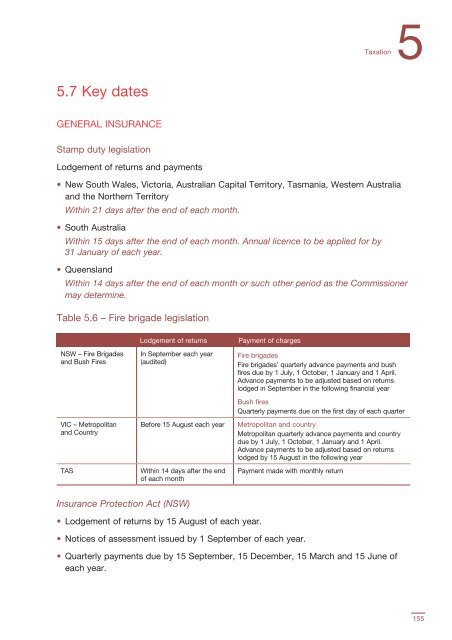

Table 5.6 – Fire brigade legislation<br />

NSW – Fire Brigades<br />

<strong>and</strong> Bush Fires<br />

VIC – Metropolitan<br />

<strong>and</strong> Country<br />

TAS<br />

Lodgement of returns<br />

In September each year<br />

(audited)<br />

Before 15 August each year<br />

Within 14 days after the end<br />

of each month<br />

Payment of charges<br />

Fire brigades<br />

Fire brigades’ quarterly advance payments <strong>and</strong> bush<br />

fires due by 1 July, 1 October, 1 January <strong>and</strong> 1 April.<br />

Advance payments to be adjusted based on returns<br />

lodged in September in the following financial year<br />

Bush fires<br />

Quarterly payments due on the first day of each quarter<br />

Metropolitan <strong>and</strong> country<br />

Metropolitan quarterly advance payments <strong>and</strong> country<br />

due by 1 July, 1 October, 1 January <strong>and</strong> 1 April.<br />

Advance payments to be adjusted based on returns<br />

lodged by 15 August in the following year<br />

Payment made with monthly return<br />

<strong>Insurance</strong> Protection Act (NSW)<br />

• Lodgement of returns by 15 August of each year.<br />

• Notices of assessment issued by 1 September of each year.<br />

• Quarterly payments due by 15 September, 15 December, 15 March <strong>and</strong> 15 June of<br />

each year.<br />

155