Helping people find their lives again - RNIB

Helping people find their lives again - RNIB

Helping people find their lives again - RNIB

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

The funds in which these investments are made are measured <strong>again</strong>st agreed<br />

benchmark indices for each relevant holding. In relation to the performance of<br />

the UK equities, the majority are invested within the Ethical Fund but with few<br />

such funds existing it is difficult to establish a suitable benchmark.<br />

Investment Committee has reviewed the market performance and is satisfied with<br />

the Investment Manager’s performance and reaffirm that passive management of<br />

<strong>RNIB</strong>’s investments and the current asset allocation strategy are appropriate.<br />

In addition to managed investments, Endowment Funds continue to be invested<br />

with CAF in <strong>their</strong> Balanced Growth and Income Funds, and short term cash<br />

holdings are invested in short term deposit accounts with the Royal Bank of<br />

Scotland.<br />

Reserves policy<br />

<strong>RNIB</strong>’s Reserves policy focuses on the level of “free reserves”. <strong>RNIB</strong>’s free<br />

reserves exclude restricted funds and designated funds, which include the net<br />

book value of land and buildings occupied by <strong>RNIB</strong> services and activities. The<br />

assessment of free reserves excludes any surplus or deficit reported on the<br />

pension scheme.<br />

<strong>RNIB</strong> seeks to maintain free reserves to manage the risks to which the charity is<br />

exposed in the course of its business, including but not limited to safeguarding<br />

<strong>again</strong>st volatile voluntary income.<br />

The Trustees consider that in order to meet these needs, and to operate<br />

effectively, <strong>RNIB</strong> needs reserves equivalent to between 12 and 17 weeks of its<br />

operating costs. This equates to between £20million and £28.5million. <strong>RNIB</strong>’s<br />

free reserves were £21.8million at 31 March 2009 (2008: £22.6million),<br />

representing the balance on general funds of £17.8million (2008: £21million)<br />

and after allowing for fixed assets funded by finance leases of £0.75million<br />

(2008: £1.6million) and a revolving loan of £3.2million regarding the Vision<br />

School and Children’s Home redevelopment project.<br />

The actuarial valuation of <strong>RNIB</strong>’s pension scheme at 31 March 2009 for the<br />

purposes of FRS17 showed a deficit of £8.1million (2007/08 a surplus of<br />

£17.9million), which is set <strong>again</strong>st the level of free reserves. The corresponding<br />

24 <strong>RNIB</strong> annual report and accounts 2008/09<br />

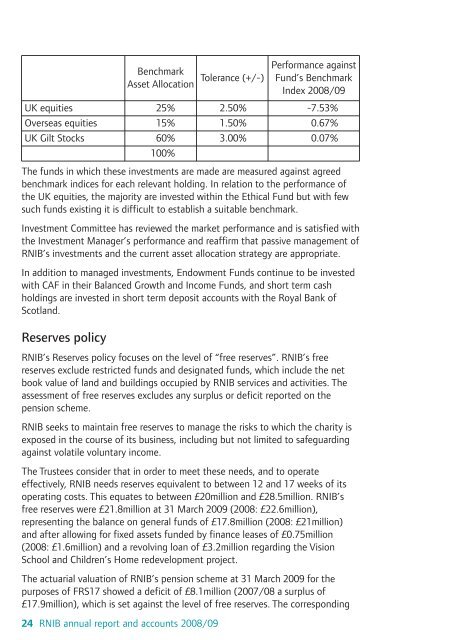

Performance <strong>again</strong>st<br />

Benchmark<br />

Asset Allocation Tolerance (+/-) Fund’s Benchmark<br />

Index 2008/09<br />

UK equities 25% 2.50% -7.53%<br />

Overseas equities 15% 1.50% 0.67%<br />

UK Gilt Stocks 60% 3.00% 0.07%<br />

100%