Helping people find their lives again - RNIB

Helping people find their lives again - RNIB

Helping people find their lives again - RNIB

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

19. Pension costs<br />

The <strong>RNIB</strong> Pension Scheme is partly defined benefit and partly defined contribution, members<br />

joining before 1 April 2005 being wholly defined benefit, with members joining after having a<br />

hybrid of defined benefit and defined contribution. The assets of the Scheme are held in a<br />

separate fund, under control of its trustees, to which <strong>RNIB</strong> has no access.<br />

An actuarial valuation was carried out at 1 April 2006 by consulting Actuaries, “Hewitt Associates<br />

Limited”, using the projected unit method. That valuation disclosed that the market value of the<br />

Scheme’s assets (excluding Voluntary Contributions) at that date was £105million, and that there<br />

was a surplus (calculated as the excess of the market value of the Scheme’s assets to the value of<br />

its past service ongoing liabilities, with allowance for future pay increases) of £8.4million.<br />

Following the valuation it has been agreed by the Pension Scheme Trustees and <strong>RNIB</strong> that<br />

contributions from <strong>RNIB</strong> will be 16 per cent and 17 per cent of pensionable salaries for the years<br />

ending 31 March 2009 and 2010 respectively.<br />

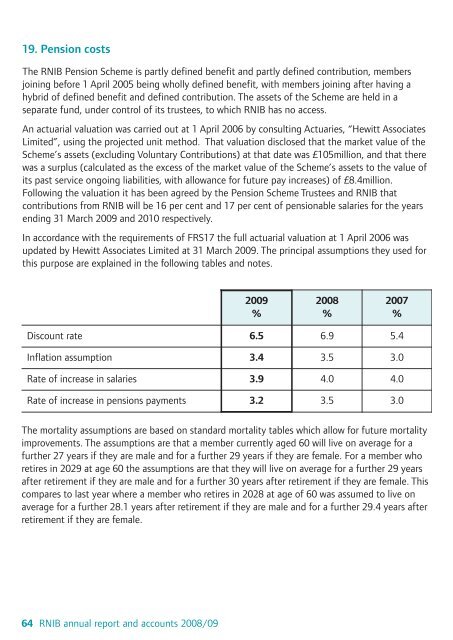

In accordance with the requirements of FRS17 the full actuarial valuation at 1 April 2006 was<br />

updated by Hewitt Associates Limited at 31 March 2009. The principal assumptions they used for<br />

this purpose are explained in the following tables and notes.<br />

2009<br />

%<br />

2008<br />

%<br />

2007<br />

%<br />

Discount rate 6.5 6.9 5.4<br />

Inflation assumption 3.4 3.5 3.0<br />

Rate of increase in salaries 3.9 4.0 4.0<br />

Rate of increase in pensions payments 3.2 3.5 3.0<br />

The mortality assumptions are based on standard mortality tables which allow for future mortality<br />

improvements. The assumptions are that a member currently aged 60 will live on average for a<br />

further 27 years if they are male and for a further 29 years if they are female. For a member who<br />

retires in 2029 at age 60 the assumptions are that they will live on average for a further 29 years<br />

after retirement if they are male and for a further 30 years after retirement if they are female. This<br />

compares to last year where a member who retires in 2028 at age of 60 was assumed to live on<br />

average for a further 28.1 years after retirement if they are male and for a further 29.4 years after<br />

retirement if they are female.<br />

64 <strong>RNIB</strong> annual report and accounts 2008/09