Helping people find their lives again - RNIB

Helping people find their lives again - RNIB

Helping people find their lives again - RNIB

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

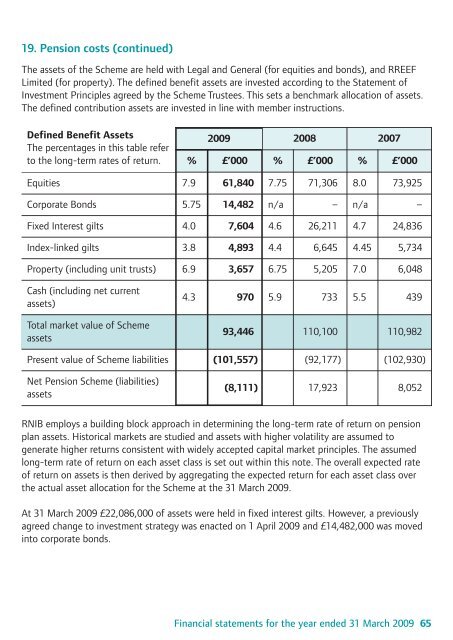

19. Pension costs (continued)<br />

The assets of the Scheme are held with Legal and General (for equities and bonds), and RREEF<br />

Limited (for property). The defined benefit assets are invested according to the Statement of<br />

Investment Principles agreed by the Scheme Trustees. This sets a benchmark allocation of assets.<br />

The defined contribution assets are invested in line with member instructions.<br />

Defined Benefit Assets<br />

The percentages in this table refer<br />

to the long-term rates of return.<br />

2009<br />

2008 2007<br />

% £’000 % £’000 % £’000<br />

Equities 7.9 61,840 7.75 71,306 8.0 73,925<br />

Corporate Bonds 5.75 14,482 n/a – n/a –<br />

Fixed Interest gilts 4.0 7,604 4.6 26,211 4.7 24,836<br />

Index-linked gilts 3.8 4,893 4.4 6,645 4.45 5,734<br />

Property (including unit trusts) 6.9 3,657 6.75 5,205 7.0 6,048<br />

Cash (including net current<br />

assets)<br />

Total market value of Scheme<br />

assets<br />

4.3 970 5.9 733 5.5 439<br />

93,446 110,100 110,982<br />

Present value of Scheme liabilities (101,557) (92,177) (102,930)<br />

Net Pension Scheme (liabilities)<br />

assets<br />

(8,111) 17,923 8,052<br />

<strong>RNIB</strong> employs a building block approach in determining the long-term rate of return on pension<br />

plan assets. Historical markets are studied and assets with higher volatility are assumed to<br />

generate higher returns consistent with widely accepted capital market principles. The assumed<br />

long-term rate of return on each asset class is set out within this note. The overall expected rate<br />

of return on assets is then derived by aggregating the expected return for each asset class over<br />

the actual asset allocation for the Scheme at the 31 March 2009.<br />

At 31 March 2009 £22,086,000 of assets were held in fixed interest gilts. However, a previously<br />

agreed change to investment strategy was enacted on 1 April 2009 and £14,482,000 was moved<br />

into corporate bonds.<br />

Financial statements for the year ended 31 March 2009 65