Here - RTÃ

Here - RTÃ

Here - RTÃ

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

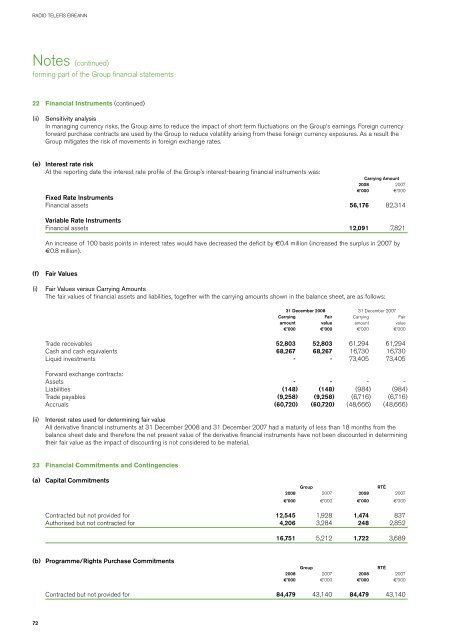

RADIO TELEFÍS ÉIREANN<br />

Notes (continued)<br />

forming part of the Group financial statements<br />

22 Financial Instruments (continued)<br />

(ii) Sensitivity analysis<br />

In managing currency risks, the Group aims to reduce the impact of short term fluctuations on the Group’s earnings. Foreign currency<br />

forward purchase contracts are used by the Group to reduce volatility arising from these foreign currency exposures. As a result the<br />

Group mitigates the risk of movements in foreign exchange rates.<br />

(e) Interest rate risk<br />

At the reporting date the interest rate profile of the Group’s interest-bearing financial instruments was:<br />

Carrying Amount<br />

2008 2007<br />

€’000 €’000<br />

Fixed Rate Instruments<br />

Financial assets 56,176 82,314<br />

Variable Rate Instruments<br />

Financial assets 12,091 7,821<br />

An increase of 100 basis points in interest rates would have decreased the deficit by €0.4 million (increased the surplus in 2007 by<br />

€0.8 million).<br />

(f) Fair Values<br />

(i)<br />

Fair Values versus Carrying Amounts<br />

The fair values of financial assets and liabilities, together with the carrying amounts shown in the balance sheet, are as follows:<br />

31 December 2008 31 December 2007<br />

Carrying Fair Carrying Fair<br />

amount value amount value<br />

€’000 €’000 €’000 €’000<br />

Trade receivables 52,803 52,803 61,294 61,294<br />

Cash and cash equivalents 68,267 68,267 16,730 16,730<br />

Liquid investments - - 73,405 73,405<br />

Forward exchange contracts:<br />

Assets - - - -<br />

Liabilities (148) (148) (984) (984)<br />

Trade payables (9,258) (9,258) (6,716) (6,716)<br />

Accruals (60,720) (60,720) (48,666) (48,666)<br />

(ii) Interest rates used for determining fair value<br />

All derivative financial instruments at 31 December 2008 and 31 December 2007 had a maturity of less than 18 months from the<br />

balance sheet date and therefore the net present value of the derivative financial instruments have not been discounted in determining<br />

their fair value as the impact of discounting is not considered to be material.<br />

23 Financial Commitments and Contingencies<br />

(a) Capital Commitments<br />

Group<br />

RTÉ<br />

2008 2007 2008 2007<br />

€’000 €’000 €’000 €’000<br />

Contracted but not provided for 12,545 1,928 1,474 837<br />

Authorised but not contracted for 4,206 3,284 248 2,852<br />

16,751 5,212 1,722 3,689<br />

(b) Programme/Rights Purchase Commitments<br />

Group<br />

RTÉ<br />

2008 2007 2008 2007<br />

€’000 €’000 €’000 €’000<br />

Contracted but not provided for 84,479 43,140 84,479 43,140<br />

72