What forms of the bancassurance alliance model is ... - Emerald

What forms of the bancassurance alliance model is ... - Emerald

What forms of the bancassurance alliance model is ... - Emerald

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

JM2<br />

3,3<br />

218<br />

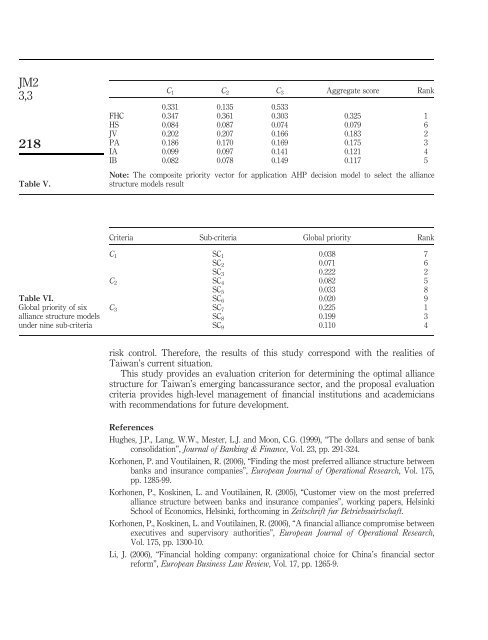

Table V.<br />

C 1 C 2 C 3 Aggregate score Rank<br />

0.331 0.135 0.533<br />

FHC 0.347 0.361 0.303 0.325 1<br />

HS 0.084 0.087 0.074 0.079 6<br />

JV 0.202 0.207 0.166 0.183 2<br />

PA 0.186 0.170 0.169 0.175 3<br />

IA 0.099 0.097 0.141 0.121 4<br />

IB 0.082 0.078 0.149 0.117 5<br />

Note: The composite priority vector for application AHP dec<strong>is</strong>ion <strong>model</strong> to select <strong>the</strong> <strong>alliance</strong><br />

structure <strong>model</strong>s result<br />

Criteria Sub-criteria Global priority Rank<br />

Table VI.<br />

Global priority <strong>of</strong> six<br />

<strong>alliance</strong> structure <strong>model</strong>s<br />

under nine sub-criteria<br />

C 1 SC 1 0.038 7<br />

SC 2 0.071 6<br />

SC 3 0.222 2<br />

C 2 SC 4 0.082 5<br />

SC 5 0.033 8<br />

SC 6 0.020 9<br />

C 3 SC 7 0.225 1<br />

SC 8 0.199 3<br />

SC 9 0.110 4<br />

r<strong>is</strong>k control. Therefore, <strong>the</strong> results <strong>of</strong> th<strong>is</strong> study correspond with <strong>the</strong> realities <strong>of</strong><br />

Taiwan’s current situation.<br />

Th<strong>is</strong> study provides an evaluation criterion for determining <strong>the</strong> optimal <strong>alliance</strong><br />

structure for Taiwan’s emerging <strong>bancassurance</strong> sector, and <strong>the</strong> proposal evaluation<br />

criteria provides high-level management <strong>of</strong> financial institutions and academicians<br />

with recommendations for future development.<br />

References<br />

Hughes, J.P., Lang, W.W., Mester, L.J. and Moon, C.G. (1999), “The dollars and sense <strong>of</strong> bank<br />

consolidation”, Journal <strong>of</strong> Banking & Finance, Vol. 23, pp. 291-324.<br />

Korhonen, P. and Voutilainen, R. (2006), “Finding <strong>the</strong> most preferred <strong>alliance</strong> structure between<br />

banks and insurance companies”, European Journal <strong>of</strong> Operational Research, Vol. 175,<br />

pp. 1285-99.<br />

Korhonen, P., Koskinen, L. and Voutilainen, R. (2005), “Customer view on <strong>the</strong> most preferred<br />

<strong>alliance</strong> structure between banks and insurance companies”, working papers, Helsinki<br />

School <strong>of</strong> Economics, Helsinki, forthcoming in Zeitschrift fur Betriebswirtschaft.<br />

Korhonen, P., Koskinen, L. and Voutilainen, R. (2006), “A financial <strong>alliance</strong> comprom<strong>is</strong>e between<br />

executives and superv<strong>is</strong>ory authorities”, European Journal <strong>of</strong> Operational Research,<br />

Vol. 175, pp. 1300-10.<br />

Li, J. (2006), “Financial holding company: organizational choice for China’s financial sector<br />

reform”, European Business Law Review, Vol. 17, pp. 1265-9.