What forms of the bancassurance alliance model is ... - Emerald

What forms of the bancassurance alliance model is ... - Emerald

What forms of the bancassurance alliance model is ... - Emerald

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

The current <strong>is</strong>sue and full text archive <strong>of</strong> th<strong>is</strong> journal <strong>is</strong> available at<br />

www.emeraldinsight.com/1746-5664.htm<br />

<strong>What</strong> <strong>forms</strong> <strong>of</strong> <strong>the</strong> <strong>bancassurance</strong><br />

<strong>alliance</strong> <strong>model</strong> <strong>is</strong> customers’<br />

preference?<br />

Cheng-Ru Wu, Chin-Tsai Lin and Yu-Fan Lin<br />

Yuanpei University, Hsinchu, Taiwan, Republic <strong>of</strong> China<br />

Bancassurance<br />

<strong>alliance</strong> <strong>model</strong><br />

207<br />

Abstract<br />

Purpose – The purpose <strong>of</strong> th<strong>is</strong> paper <strong>is</strong> to identify and evaluate <strong>the</strong> relationships among <strong>the</strong><br />

flexibility enablers and to prepare a hierarchy <strong>of</strong> <strong>the</strong>se enablers to know <strong>the</strong>ir influences over each<br />

o<strong>the</strong>r in global supply chain. The framework suggests that <strong>the</strong> priority <strong>of</strong> enablers in supply chain<br />

should be determined on <strong>the</strong> bas<strong>is</strong> <strong>of</strong> <strong>the</strong>ir driving power and dependency.<br />

Design/methodology/approach – Various enablers used by researchers and practitioners for<br />

flexibility management <strong>of</strong> global supply chain have been identified. These enablers have been<br />

classified as strategic, operational and performance-based enablers. Interpretive structural <strong>model</strong>ing<br />

(ISM) <strong>is</strong> used to establ<strong>is</strong>h mutual relationships among <strong>the</strong> flexibility enablers and to prepare a<br />

hierarchy-based <strong>model</strong>.<br />

Findings – It has been observed that some enablers having high-driving power and low dependency<br />

are <strong>of</strong> strategic importance. These enablers require more attention while o<strong>the</strong>r enablers based on<br />

operations and performances are dependents <strong>of</strong> strategic enablers.<br />

Practical implications – The index <strong>of</strong> enablers based on driving power and dependency provide an<br />

insight for supply chain managers to make <strong>the</strong> entire supply chain highly flexible, that would help<br />

<strong>the</strong>m to respond to global uncertainties.<br />

Originality/value – Presentation <strong>of</strong> enablers in <strong>the</strong> form <strong>of</strong> hierarchy using ISM and ranking <strong>the</strong>m<br />

into various driving power and dependent categories <strong>is</strong> a good effort to make flexible global supply<br />

chain.<br />

Keywords Banks, Insurance companies, Strategic <strong>alliance</strong>s, Dec<strong>is</strong>ion making,<br />

Supply chain management, Taiwan<br />

Paper type Research paper<br />

1. Introduction<br />

Bancassurance has enjoyed considerable success in Europe, but th<strong>is</strong> concept <strong>is</strong><br />

relatively new for Asian countries, having emerged only in 2002. Fur<strong>the</strong>rmore, <strong>the</strong><br />

formation <strong>of</strong> strategic <strong>alliance</strong>s has been a growing trend in <strong>the</strong> financial industry.<br />

Never<strong>the</strong>less, Taiwan financial institutions are participating in <strong>the</strong> business activities<br />

<strong>of</strong> o<strong>the</strong>r financial institutions since <strong>the</strong> Taiwan’s government deregulated its financial<br />

restrictions. Especially, after enactment <strong>of</strong> <strong>the</strong> Financial Holding Company Law, <strong>the</strong><br />

<strong>bancassurance</strong> has escalated rapidly. Such an arrangement may benefit consumers<br />

with a “one-stop shopping” option as well as create a business synergy through<br />

cross-selling between banks and insurance companies.<br />

In <strong>the</strong> present day, <strong>the</strong> literature regarding <strong>the</strong> financial <strong>alliance</strong>s between banks<br />

and insurance companies <strong>is</strong> limited. Wever (2000) refers to <strong>bancassurance</strong> as <strong>the</strong><br />

d<strong>is</strong>tribution <strong>of</strong> insurance products through banking networks; in o<strong>the</strong>r words, as <strong>the</strong><br />

collaboration between banks and insurers to d<strong>is</strong>tribute insurance products to bank<br />

customers. Staikouras (2006) and Staikouras and Nurullah (2008) find that banking and<br />

Journal <strong>of</strong> Modelling in Management<br />

Vol. 3 No. 3, 2008<br />

pp. 207-219<br />

q <strong>Emerald</strong> Group Publ<strong>is</strong>hing Limited<br />

1746-5664<br />

DOI 10.1108/17465660810920564

JM2<br />

3,3<br />

208<br />

insurance entities have more similarities than differences, character<strong>is</strong>tics that may<br />

favor joint production and business synergies. Through diversification, <strong>the</strong><br />

<strong>bancassurance</strong> approach reduces <strong>the</strong> resources required to manage r<strong>is</strong>k, which in<br />

turn results in lower costs (Hughes et al., 1999). Korhonen and Voutilainen (2006) and<br />

Korhonen et al. (2006, 2005) applied <strong>the</strong> expert panels and <strong>the</strong> analytical hierarchy<br />

process (AHP) to explore <strong>the</strong> most prefer alternative <strong>alliance</strong>s between banks and<br />

insurance companies from executive management perspectives, superv<strong>is</strong>ory<br />

authorities, and customers, respectively. Wu et al. (2008) adopt <strong>the</strong> modified Delphi<br />

method to construct <strong>the</strong> framework <strong>of</strong> mutual fund performance and <strong>the</strong> AHP <strong>model</strong> to<br />

design an assessment method for mutual fund performance.<br />

According to <strong>the</strong> context <strong>of</strong> Taiwan’s current conditions with regard to finance and<br />

financial systems, <strong>the</strong> aim <strong>of</strong> th<strong>is</strong> paper <strong>is</strong> to searching for <strong>the</strong> preferable <strong>bancassurance</strong><br />

<strong>alliance</strong> <strong>model</strong> to customers. Both <strong>the</strong> banks and insurance companies involved in a<br />

strategic <strong>alliance</strong> can be domestic or foreign with operations in <strong>the</strong> Taiwan area, and<br />

insurers can be life or non-life companies with operations in <strong>the</strong> Taiwan area.<br />

The selection <strong>of</strong> an alternative <strong>is</strong> a multi-criteria dec<strong>is</strong>ion-making (MCDM) problem.<br />

First, we defined three criteria and nine sub-criteria for use in evaluating six alternative<br />

<strong>model</strong>s <strong>of</strong> financial <strong>alliance</strong>. The criteria and sub-criteria were introduced at <strong>the</strong><br />

suggestion <strong>of</strong> <strong>the</strong> industry experts and <strong>the</strong> advanced or well-informed customers, and<br />

o<strong>the</strong>r elements were based on <strong>the</strong> methodology <strong>of</strong> previous studies. Each expert was<br />

interviewed individually. Then, <strong>the</strong> same experts were assembled as a panel to find <strong>the</strong><br />

preferable <strong>bancassurance</strong> <strong>alliance</strong> <strong>model</strong> to customers. As a dec<strong>is</strong>ion support system,<br />

we used <strong>the</strong> AHP developed by Saaty (1980).<br />

Th<strong>is</strong> paper <strong>is</strong> organized as follows: Section 2 briefly describes <strong>the</strong> AHP<br />

methodology. Sections 3 applying <strong>the</strong> AHP and <strong>the</strong> sensitivity analytic develop an<br />

evaluation method. Finally, we conclude <strong>the</strong> paper with general remarks and<br />

suggestions for fur<strong>the</strong>r research.<br />

2. Analytic hierarchy process methodology<br />

As a dec<strong>is</strong>ion method that decomposes a complex MCDM problem into a hierarchy<br />

(Saaty, 2000), AHP <strong>is</strong> also a measurement <strong>the</strong>ory that prioritizes <strong>the</strong> hierarchy and<br />

cons<strong>is</strong>tency <strong>of</strong> judgmental data provided by a group <strong>of</strong> dec<strong>is</strong>ion makers. AHP<br />

incorporates <strong>the</strong> evaluations <strong>of</strong> all dec<strong>is</strong>ion makers into a final dec<strong>is</strong>ion, without<br />

having to elicit <strong>the</strong>ir utility functions on subjective and objective criteria, by pair-w<strong>is</strong>e<br />

compar<strong>is</strong>ons <strong>of</strong> <strong>the</strong> alternatives (Saaty, 1990), with <strong>the</strong> calculation procedure as<br />

follows.<br />

2.1 Establ<strong>is</strong>h <strong>the</strong> hierarchy structure<br />

When deals <strong>the</strong> complex <strong>is</strong>sue, we can be performed decompose <strong>the</strong> hierarchy<br />

structure. Based on <strong>the</strong> human cannot compar<strong>is</strong>on above <strong>the</strong> seven kinds things at<br />

<strong>the</strong> same time, so we must assume each elements <strong>of</strong> <strong>the</strong> hierarchy not suitably<br />

surpasses seven elements. Under th<strong>is</strong> limited condition, it may carry on <strong>the</strong> reasonable<br />

compar<strong>is</strong>on and easier ensure <strong>the</strong> cons<strong>is</strong>tency (Saaty, 1980). The first hierarchy <strong>of</strong> <strong>the</strong><br />

structure that <strong>is</strong> we want to achieve goal. Under <strong>the</strong> end hierarchy <strong>is</strong> <strong>the</strong> choice projects<br />

or replacement alternatives, as well as <strong>the</strong> each middle hierarchies are <strong>the</strong> appra<strong>is</strong>al<br />

factor or criteria.

2.2 Various hierarchies’ elements weight computation<br />

2.2.1 Establ<strong>is</strong>hment <strong>of</strong> pair-w<strong>is</strong>e compar<strong>is</strong>on matrix A. Based on an element <strong>of</strong> <strong>the</strong><br />

upper hierarchy <strong>is</strong> an evaluating standard, going on <strong>the</strong> pair-w<strong>is</strong>e compar<strong>is</strong>on to<br />

each elements. If has <strong>the</strong> n elements must make nðn 2 1Þ=2 elements <strong>of</strong> <strong>the</strong><br />

pair-w<strong>is</strong>e compar<strong>is</strong>on. Let C 1 ; C 2 ; ...; C n denote <strong>the</strong> set <strong>of</strong> elements, while a ij<br />

represents a quantified judgment on a pair <strong>of</strong> elements C i , C j . In <strong>the</strong> AHP, paired<br />

compar<strong>is</strong>on judgments from a fundamental scale <strong>of</strong> absolute numbers are entered in<br />

a reciprocal matrix. Their numerical values and corresponding intensities are: 1 –<br />

equal, 3 – moderately dominant, 5 – strongly dominant, 7 – very strongly<br />

dominant and 9 – extremely dominant, along with intermediate values for<br />

comprom<strong>is</strong>e and reciprocals for inverse judgments and even using decimals to<br />

compare homogeneous elements whose compar<strong>is</strong>on falls within one unit. Th<strong>is</strong> yields<br />

an n £ n matrix A as follows:<br />

Bancassurance<br />

<strong>alliance</strong> <strong>model</strong><br />

209<br />

A ¼½a ij Š¼<br />

C 1 C 2 ··· C n<br />

0<br />

1<br />

C 1 1 a 12 ··· a 1n<br />

C 2<br />

1=a 12 1 ··· a 2n<br />

; ð1Þ<br />

.<br />

. . .<br />

. . .<br />

.<br />

B<br />

. . C<br />

@<br />

A<br />

C n 1=a 1n 1=a 2n ··· 1<br />

where a ij ¼ 1 and a ij ¼ 1=a ji ; i; j ¼ 1; 2; ...; n. In matrix A, <strong>the</strong> problem becomes<br />

one <strong>of</strong> assigning to <strong>the</strong> n elements C 1 ; C 2 ; ...; C n a set <strong>of</strong> numerical weights<br />

W 1 ; W 2 ; ...; W n that reflects <strong>the</strong> recorded judgments. If A <strong>is</strong> a cons<strong>is</strong>tency matrix, <strong>the</strong><br />

relations between weights W i and judgments a ij are simply given by W i =W j ¼ a ij<br />

ðfor i; j ¼ 1; 2; ...; nÞ and matrix A as follows:<br />

A ¼<br />

C 1 C 2 ··· C n<br />

2<br />

3<br />

C 1 w 1 =w 1 w 1 =w 2 ··· w 1 =w n<br />

C 2<br />

w 2 =w 1 w 2 =w 2 ··· w 2 =w n<br />

. .<br />

.<br />

. . . . . ; ð2Þ<br />

6<br />

7<br />

4<br />

5<br />

C n w n =w 1 w n =w 2 ··· w n =w n<br />

2.2.2 Eigenvalue and eigenvector calculation. Matrix A multiply <strong>the</strong> elements weight<br />

vector (x) equal to nx, that <strong>is</strong> ðA 2 nIÞx ¼ 0, <strong>the</strong> x <strong>is</strong> <strong>the</strong> eigenvalue (n) <strong>of</strong> eigenvector.<br />

Owing to a ij be makers’ subjective judgment give compar<strong>is</strong>on and appra<strong>is</strong>al, with <strong>the</strong><br />

truly value ðW i =W j Þ have <strong>the</strong> some level degree difference, so that Ax ¼ n · x cannot<br />

to be set up. Saaty (1990) suggested that <strong>the</strong> largest eigenvalue l max be:<br />

l max ¼ Xn<br />

j¼1<br />

a ij<br />

W j<br />

W i<br />

:<br />

ð3Þ

JM2<br />

3,3<br />

If A <strong>is</strong> a cons<strong>is</strong>tency matrix, eigenvector X can be calculated by:<br />

ðA 2 l max IÞX ¼ 0:<br />

ð4Þ<br />

210<br />

2.2.3 Cons<strong>is</strong>tency test. Saaty (1990) proposed utilizing cons<strong>is</strong>tency index (CI) and<br />

cons<strong>is</strong>tency ratio (CR) to verify <strong>the</strong> cons<strong>is</strong>tency <strong>of</strong> <strong>the</strong> compar<strong>is</strong>on matrix. CI and RI are<br />

defined as follows:<br />

CI ¼ l max 2 n<br />

n 2 1 ; ð5Þ<br />

CR ¼ CI<br />

RI ;<br />

ð6Þ<br />

where RI represents <strong>the</strong> average CI over numerous random entries <strong>of</strong> same order<br />

reciprocal matrices. If CR # 0:1, <strong>the</strong> estimate <strong>is</strong> accepted: o<strong>the</strong>rw<strong>is</strong>e, a new compar<strong>is</strong>on<br />

matrix <strong>is</strong> solicited until CR # 0:1.<br />

2.3 Overall hierarchy weight computation<br />

After weight computation for <strong>the</strong> various hierarchies and elements, <strong>the</strong>n compiles <strong>the</strong><br />

overall hierarchy weight computation, and finally to decide our goal <strong>of</strong> <strong>the</strong> most<br />

suitable plan.<br />

3. Evaluation process for <strong>the</strong> preferable <strong>bancassurance</strong> <strong>alliance</strong> <strong>model</strong><br />

In th<strong>is</strong> paper, <strong>bancassurance</strong> <strong>alliance</strong> <strong>model</strong>s are classified into six categories stand on<br />

<strong>the</strong> bank whe<strong>the</strong>r direct cross-operation insurance business activities by <strong>the</strong> current<br />

status and business <strong>model</strong> <strong>of</strong> <strong>bancassurance</strong> in Taiwan. We introduce <strong>the</strong> following<br />

<strong>alliance</strong> <strong>model</strong>s.<br />

3.1 Direct cross-operation<br />

.<br />

Financial holding company (FHC). An FHC <strong>is</strong> a financial conglomerate that<br />

engages in at least two different financial industries as a single entity, including<br />

<strong>the</strong> banking, security, and insurance industries (Li, 2006). For <strong>the</strong> purposes <strong>of</strong><br />

th<strong>is</strong> study, FHC means a company that <strong>is</strong> establ<strong>is</strong>hed in accordance with<br />

Taiwan’s “Financial Holding Company Act” and has a controlling interest in a<br />

bank or an insurance company.<br />

.<br />

Holding shareholding (HS). The bank makes equity investment in insurance<br />

companies. It becomes an insurance companies’ limited liability shareholder.<br />

.<br />

Establ<strong>is</strong>hing a new joint venture (JV). A bank and an insurance company jointly<br />

establ<strong>is</strong>h ano<strong>the</strong>r, new insurance company.<br />

3.2 Indirect involvement<br />

.<br />

Precompetitive <strong>alliance</strong>s (PA). For purposes <strong>of</strong> th<strong>is</strong> study, indirect involvement<br />

means that <strong>the</strong> agreement or <strong>the</strong> cooperative relationship <strong>is</strong> usually establ<strong>is</strong>hed<br />

according to <strong>the</strong> terms <strong>of</strong> a written contract. Moreover, it has a specified duration<br />

and does not establ<strong>is</strong>h ano<strong>the</strong>r, new company.

.<br />

Establ<strong>is</strong>hing insurance intermediaries. A bank invests to establ<strong>is</strong>h an insurance<br />

“agency” or “brokerage” (IA or IB) company and <strong>the</strong>n an agent or a broker<br />

contract with <strong>the</strong> insurance companies. At <strong>the</strong> same time, <strong>the</strong> bank sells products<br />

<strong>of</strong> <strong>the</strong>se insurance companies and gains comm<strong>is</strong>sions. The difference between<br />

insurance agents and insurance brokers <strong>is</strong> that agents can be a substitute for<br />

insurance companies to <strong>is</strong>sue policies, insurance brokers cannot.<br />

The proposed evaluation <strong>model</strong> aimed at determining <strong>the</strong> preferable <strong>bancassurance</strong><br />

<strong>alliance</strong> <strong>model</strong> for Taiwan’s customers through <strong>the</strong> following steps.<br />

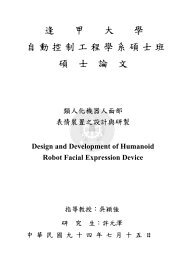

3.2.1 Step 1: define <strong>the</strong> evaluative criteria and sub-criteria for determining <strong>the</strong><br />

preferable <strong>bancassurance</strong> <strong>alliance</strong> <strong>model</strong> e and establ<strong>is</strong>h a hierarchical framework. Here,<br />

<strong>the</strong> modified Delphi method (Murry and Hammons, 1995) <strong>is</strong> applied to define <strong>the</strong><br />

evaluation criteria and sub-criteria. About 12 experts contain two financiers, two<br />

academicians, and eight <strong>the</strong> advanced or well-informed customers are <strong>the</strong>n <strong>is</strong>sued a<br />

preliminary questionnaire in which three evaluation criteria and nine evaluation<br />

sub-criteria are incorporated and are described in <strong>the</strong> definition <strong>of</strong> operation type for<br />

each criterion. Finally, based on <strong>the</strong> modified Delphi method, <strong>the</strong>re was a general<br />

consensus among experts that a hierarchical structure should be establ<strong>is</strong>hed. The<br />

preferable choices for a <strong>bancassurance</strong> <strong>alliance</strong> <strong>model</strong> can be selected and assessed<br />

based on three evaluation criterion, nine evaluation sub-criterion and, finally, <strong>the</strong><br />

alternatives (Figure 1).<br />

Bancassurance<br />

<strong>alliance</strong> <strong>model</strong><br />

211<br />

3.3 Executive aspect (C 1 )<br />

Customers will consider <strong>the</strong> financial institution’s operating conditions, financial<br />

products and sales channels before <strong>the</strong>y purchase insurance products. And <strong>the</strong>n select<br />

a sound and stable <strong>bancassurance</strong> <strong>alliance</strong> to be traded:<br />

.<br />

Product development (SC 1 ). Financial institutions should grasp <strong>the</strong> different<br />

needs <strong>of</strong> <strong>the</strong> customers to develop new financial products for <strong>the</strong>m, such as<br />

endowment insurance, credit insurance and investment-linked product.<br />

.<br />

Economies <strong>of</strong> scale (SC 2 ). Here <strong>is</strong> to mean <strong>the</strong> service network rationalization. In<br />

o<strong>the</strong>r words, <strong>the</strong> service networks <strong>of</strong> a financial institution should be average<br />

d<strong>is</strong>tribution in <strong>the</strong> Taiwan area for customers’ convenience.<br />

.<br />

Stability <strong>of</strong> <strong>the</strong> operation (SC 3 ). For customers, it <strong>is</strong> very important that financial<br />

institutions whe<strong>the</strong>r have sufficiency <strong>of</strong> capital, solvency and solidity. Because <strong>of</strong><br />

th<strong>is</strong> may affect customers’ rights and interests.<br />

3.4 Superv<strong>is</strong>or aspect (C 2 )<br />

The customers will evaluate that <strong>the</strong> superv<strong>is</strong>ory authorities whe<strong>the</strong>r effectively<br />

superv<strong>is</strong>e <strong>the</strong> financial <strong>alliance</strong> before <strong>the</strong>y purchase financial products. If superv<strong>is</strong>ory<br />

authorities cannot superv<strong>is</strong>e effectively, <strong>the</strong> customer may choose in <strong>the</strong> traditional<br />

sector to transact:<br />

.<br />

System r<strong>is</strong>k control (SC 4 ). Systemic r<strong>is</strong>k <strong>is</strong> usually caused by environmental<br />

factors, such as <strong>the</strong> overall political, economic, and social conditions. The<br />

character<strong>is</strong>tic <strong>of</strong> <strong>the</strong> system r<strong>is</strong>ks <strong>is</strong> that if one business operator fails, so happens<br />

to a second and a third one, etc. It was stated that efficient superv<strong>is</strong>ion <strong>is</strong> <strong>the</strong> way<br />

to prevent <strong>the</strong> realization <strong>of</strong> system r<strong>is</strong>ks (Korhonen et al., 2005).

JM2<br />

3,3<br />

212<br />

Figure 1.<br />

Hierarchical structure to<br />

select and evaluate <strong>the</strong><br />

preferable <strong>bancassurance</strong><br />

<strong>alliance</strong> <strong>model</strong> for<br />

customers’ perspectives<br />

Level 1: Ultimate goal Level 2: Criteria Level 3: Sub-criteria Level 4: Alternatives<br />

Product development<br />

Financial holding<br />

company<br />

Economies <strong>of</strong> scale<br />

Execituve aspect<br />

Holding shareholding<br />

Stability <strong>of</strong> <strong>the</strong> operation<br />

Establ<strong>is</strong>hing a new joint<br />

venture<br />

System r<strong>is</strong>k control<br />

Superv<strong>is</strong>ory authorities has better resources<br />

Superv<strong>is</strong>or aspect<br />

Precompetitive <strong>alliance</strong>s<br />

Choosing a preferable<br />

<strong>bancassurance</strong> <strong>alliance</strong><br />

<strong>model</strong> alternatives<br />

Div<strong>is</strong>ion <strong>of</strong> r<strong>is</strong>ks and benefits between<br />

<strong>alliance</strong> members<br />

Establ<strong>is</strong>hing insurance<br />

agent company<br />

Service convenience<br />

Establ<strong>is</strong>hing insurance<br />

broker company<br />

Sufficiency <strong>of</strong> product information<br />

Customer aspect<br />

Equal treatment <strong>of</strong> customers

.<br />

Superv<strong>is</strong>ory authorities has better resources (SC 5 ). Superv<strong>is</strong>ory authorities for<br />

<strong>the</strong> financial institutions’ mutual cooperation should have proper superv<strong>is</strong>ion<br />

policies to prevent <strong>the</strong> r<strong>is</strong>ks and conflicts <strong>of</strong> <strong>the</strong> financial <strong>alliance</strong>, for example,<br />

improper insider trading may affect <strong>the</strong> interests <strong>of</strong> consumers.<br />

.<br />

Div<strong>is</strong>ion <strong>of</strong> r<strong>is</strong>ks and benefits between <strong>alliance</strong> members (SC 6 ). Financial<br />

institutions cross-operating with o<strong>the</strong>r financial enterpr<strong>is</strong>es may m<strong>is</strong>manage<br />

financial products and thus affect <strong>the</strong>ir original banking or insurance business.<br />

Accordingly, <strong>the</strong> r<strong>is</strong>ks and benefits should be clearly divided and avoid mutual<br />

circulation among <strong>the</strong> members <strong>of</strong> <strong>alliance</strong>.<br />

Bancassurance<br />

<strong>alliance</strong> <strong>model</strong><br />

213<br />

3.5 Customer aspect (C 3 )<br />

Customers receive <strong>the</strong> benefits and rights among a <strong>bancassurance</strong> <strong>alliance</strong>:<br />

.<br />

Service convenience (SC 7 ). It means that a customer <strong>is</strong> <strong>of</strong>fered as many bank and<br />

insurance products as possible at one place during one customer service event.<br />

The objective <strong>is</strong> full customer service at one stop, keeping customers and<br />

deepening consumer loyalty (Voutilainen, 2005).<br />

.<br />

Sufficiency <strong>of</strong> product information (SC 8 ). Customers will base on <strong>the</strong><br />

transparency <strong>of</strong> product information as a purchase reference. Therefore,<br />

<strong>the</strong> higher <strong>the</strong> transparency <strong>of</strong> product information, <strong>the</strong> more easily obtain <strong>the</strong><br />

consumers’ trust.<br />

.<br />

Equal treatment <strong>of</strong> customers (SC 9 ). For example, <strong>the</strong> customers in an insurance<br />

company gain treatment in claims handling whe<strong>the</strong>r better than <strong>the</strong> customers<br />

who to a bank purchase insurance products.<br />

3.5.1 Step 2: establ<strong>is</strong>hment each factors <strong>of</strong> <strong>the</strong> pair-w<strong>is</strong>e compar<strong>is</strong>on matrix. Th<strong>is</strong><br />

purposive sampling study <strong>is</strong> applied to twelve experts representing financiers,<br />

academicians and <strong>the</strong> advanced or well-informed customers. The weights <strong>of</strong> level 2<br />

criteria and level 3 sub-criteria are <strong>the</strong>n determined for a sample group <strong>of</strong> twelve<br />

individuals matching <strong>the</strong> above character<strong>is</strong>tics, with each expert making a<br />

pair-w<strong>is</strong>e compar<strong>is</strong>on <strong>of</strong> <strong>the</strong> dec<strong>is</strong>ion elements and assigning <strong>the</strong>m relative scores.<br />

At <strong>the</strong> same time, each expert also makes a pair-w<strong>is</strong>e compar<strong>is</strong>on <strong>of</strong> <strong>the</strong> selection <strong>of</strong> six<br />

<strong>alliance</strong> structure <strong>model</strong>s under nine subjective sub-criteria and, <strong>the</strong>n, assigns those<br />

relative scores. The relative scores provided by <strong>the</strong> 12 experts are aggregated using<br />

<strong>the</strong> geometric mean method. We used <strong>the</strong> equations (1) and (2) to calculate <strong>the</strong><br />

aggregate pair-w<strong>is</strong>e compar<strong>is</strong>on matrix. The pair-w<strong>is</strong>e compar<strong>is</strong>ons matrix <strong>of</strong><br />

<strong>the</strong> criteria and sub-criteria and <strong>the</strong> corresponding value scores for <strong>the</strong> various <strong>alliance</strong><br />

<strong>model</strong>s are presented in Tables I-III, respectively.<br />

3.5.2 Step 3: determine <strong>the</strong> eigenvalue and eigenvector. The compar<strong>is</strong>on matrices in<br />

Tables I-III are used to calculate <strong>the</strong> eigenvectors using equation (3) and (4). Table IV<br />

summarizes <strong>the</strong> results <strong>of</strong> eigenvectors for <strong>the</strong> criteria, sub-criteria, and six <strong>alliance</strong><br />

structure <strong>model</strong>s.<br />

3.5.3 Step 4: cons<strong>is</strong>tency ratio. According to equations (5) and (6), each hierarchy’s<br />

criteria compar<strong>is</strong>on matrix <strong>of</strong> CR <strong>is</strong> calculated, as shown in Tables I-III. Th<strong>is</strong> result<br />

shows that <strong>the</strong> CR <strong>of</strong> <strong>the</strong> each hierarchy’s criteria compar<strong>is</strong>on matrix <strong>is</strong> below 0.1,<br />

indicating “cons<strong>is</strong>tency.”

JM2<br />

3,3<br />

214<br />

3.5.4 Step 5: computation <strong>of</strong> each levels relative weight <strong>of</strong> <strong>the</strong> elements. The<br />

aggregate-related scores provided by all dec<strong>is</strong>ion makers using simple additive<br />

weighting and <strong>the</strong> results for each level’s relative weight <strong>of</strong> <strong>the</strong> elements are shown in<br />

Table IV.<br />

3.5.5 Step 6: overall level hierarchy weight calculation for selecting <strong>the</strong> preferable<br />

<strong>bancassurance</strong> <strong>alliance</strong> <strong>model</strong>. The composite value scale for <strong>the</strong> <strong>alliance</strong> structure<br />

alternatives was found by computing <strong>the</strong> weighted sums for each alternative. The<br />

separate value scores were multiplied by <strong>the</strong> scaled scores <strong>of</strong> <strong>the</strong> criteria. Table V<br />

shows <strong>the</strong> priorities <strong>of</strong> <strong>the</strong> six <strong>alliance</strong> <strong>model</strong>s:<br />

FHCð0:325Þ . JVð0:183Þ . PAð0:175Þ . IAð0:121Þ . IBð0:117Þ . HSð0:079Þ:<br />

Th<strong>is</strong> result shows that FHC <strong>is</strong> preferable to customers and compares to obtain <strong>the</strong><br />

customers’ trust.<br />

3.5.6 Step 7: sensitivity analys<strong>is</strong> <strong>of</strong> six <strong>alliance</strong> structure <strong>model</strong>s under three criteria.<br />

The final prioritization <strong>of</strong> <strong>the</strong> alternatives <strong>is</strong> heavily dependent on <strong>the</strong> weights attached<br />

to <strong>the</strong> criteria. Sensitivity analys<strong>is</strong> thus can be performed using scenarios that reflect<br />

various future developments or different views regarding <strong>the</strong> relative importance <strong>of</strong> <strong>the</strong><br />

criteria. Increasing or decreasing <strong>the</strong> weightings <strong>of</strong> individual criterion can illustrate<br />

<strong>the</strong> resulting changes in <strong>the</strong> priorities and <strong>the</strong> ranking <strong>of</strong> <strong>the</strong> alternatives. It turns out<br />

that one can give (separately) each criterion whatever value from <strong>the</strong> interval [0, 1], and<br />

FHC still remains <strong>the</strong> most preferable <strong>alliance</strong> <strong>model</strong> to customers.<br />

Goal C 1 C 2 C 3<br />

Table I.<br />

The pair-w<strong>is</strong>e<br />

compar<strong>is</strong>on matrix <strong>of</strong> <strong>the</strong><br />

criteria<br />

C 1 1 3.130 0.485<br />

C 2 0.319 1 0.325<br />

C 3 2.061 3.077 1<br />

l max ¼ 3.11; CR ¼ 0.095<br />

Table II.<br />

Criteria for <strong>the</strong> pair-w<strong>is</strong>e<br />

compar<strong>is</strong>on matrix <strong>of</strong> <strong>the</strong><br />

sub-criteria<br />

C 1 SC 1 SC 2 SC 3<br />

SC 1 1 0.452 0.207<br />

SC 2 2.214 1 0.266<br />

SC 3 4.819 3.761 1<br />

l max ¼ 3.060; CR ¼ 0.052<br />

C 2 SC 4 SC 5 SC 6<br />

SC 4 1 2.449 4.141<br />

SC 5 0.408 1 1.682<br />

SC 6 0.241 0.595 1<br />

l max ¼ 3.00; CR ¼ 0.00<br />

C 3 SC 7 SC 8 SC 9<br />

SC 7 1 1.377 1.681<br />

SC 8 0.726 1 2.213<br />

SC 9 0.595 0.452 1<br />

l max ¼ 3.080; CR ¼ 0.069

FHC HS JV PA IA IB<br />

SC 1<br />

FHC 1 3.364 2.711 2.000 4.606 4.356<br />

HS 0.297 1 0.452 0.302 0.658 0.760<br />

JV 0.369 2.214 1 1.519 2.943 2.783<br />

PA 0.500 3.311 0.658 1 2.632 2.632<br />

IA 0.217 1.520 0.340 0.380 1 0.841<br />

IB 0.230 1.316 0.359 0.380 1.189 1<br />

l max ¼ 6.10; CR ¼ 0.016<br />

SC 2<br />

FHC 1 3.130 2.449 2.546 4.054 3.984<br />

HS 0.319 1 0.500 0.452 0.707 0.783<br />

JV 0.408 2.000 1 1.682 2.590 2.913<br />

PA 0.393 2.214 0.595 1 1.682 2.060<br />

IA 0.247 1.414 0.386 0.595 1 1.414<br />

IB 0.251 1.278 0.343 0.485 0.707 1<br />

l max ¼ 6.10; CR ¼ 0.016<br />

SC 3<br />

FHC 1 3.310 2.913 1.968 2.449 3.027<br />

HS 0.302 1 0.537 0.562 0.707 0.748<br />

JV 0.343 1.862 1 1.565 2.449 2.590<br />

PA 0.508 1.779 0.639 1 2.913 3.310<br />

IA 0.408 1.414 0.408 0.343 1 1.565<br />

IB 0.330 1.337 0.386 0.302 0.639 1<br />

l max ¼ 6.20; CR ¼ 0.032<br />

SC 4<br />

FHC 1 3.500 3.130 1.968 2.913 3.027<br />

HS 0.286 1 0.537 0.523 0.632 0.707<br />

JV 0.319 1.862 1 1.565 2.783 3.130<br />

PA 0.508 1.911 0.639 1 2.378 2.783<br />

IA 0.343 1.581 0.359 0.420 1 1.565<br />

IB 0.330 1.414 0.319 0.359 0.639 1<br />

l max ¼ 6.20; CR ¼ 0.032<br />

SC 5<br />

FHC 1 3.310 3.000 2.632 3.663 4.120<br />

HS 0.302 1 0.686 0.553 0.669 0.748<br />

JV 0.333 1.457 1 2.060 2.632 2.991<br />

PA 0.380 1.807 0.485 1 2.590 2.711<br />

IA 0.273 1.495 0.380 0.386 1 1.565<br />

IB 0.243 1.337 0.334 0.369 0.639 1<br />

l max ¼ 6.20; CR ¼ 0.032<br />

SC 6<br />

FHC 1 3.224 2.632 2.515 4.356 4.527<br />

HS 0.310 1 0.707 0.903 0.970 0.955<br />

JV 0.380 1.414 1 2.449 2.913 3.310<br />

PA 0.398 1.107 0.408 1 2.515 2.913<br />

IA 0.230 1.030 0.343 0.398 1 1.565<br />

IB 0.221 1.047 0.302 0.343 0.639 1<br />

l max ¼ 6.150; CR ¼ 0.024<br />

(continued)<br />

Bancassurance<br />

<strong>alliance</strong> <strong>model</strong><br />

215<br />

Table III.<br />

Sub-criteria (SC 1 -SC 9 ) for<br />

<strong>the</strong> pair-w<strong>is</strong>e compar<strong>is</strong>on<br />

matrix <strong>of</strong> <strong>the</strong> alternatives

JM2<br />

3,3<br />

216<br />

Table III.<br />

FHC HS JV PA IA IB<br />

SC 7<br />

FHC 1 2.340 1.861 1.316 1.862 1.667<br />

HS 0.427 1 0.420 0.325 0.319 0.266<br />

JV 0.537 2.378 1 0.903 1.565 1.377<br />

PA 0.760 3.082 1.107 1 1.245 1.075<br />

IA 0.537 3.131 0.639 0.803 1 0.903<br />

IB 0.600 3.761 0.726 0.930 1.107 1<br />

l max ¼ 6.10; CR ¼ 0.016<br />

SC 8<br />

FHC 1 3.464 3.834 2.783 1.456 1.524<br />

HS 0.289 1 0.707 0.473 0.334 0.330<br />

JV 0.261 1.415 1 1.000 1.107 1.145<br />

PA 0.359 2.115 1.000 1 1.190 1.230<br />

IA 0.687 2.991 0.903 0.840 1 0.903<br />

IB 0.656 3.027 0.874 0.813 1.107 1<br />

l max ¼ 6.150; CR ¼ 0.024<br />

SC 9<br />

FHC 1 3.310 3.000 2.632 3.663 3.834<br />

HS 0.302 1 0.760 0.707 0.760 0.748<br />

JV 0.333 1.316 1 2.060 2.280 2.632<br />

PA 0.380 1.415 0.485 1 2.783 2.632<br />

IA 0.273 1.316 0.439 0.359 1 1.316<br />

IB 0.261 1.337 0.380 0.380 0.760 1<br />

l max ¼ 6.20; CR ¼ 0.032<br />

4. Conclusions<br />

AHP applies widely in MCDM problems. One <strong>of</strong> <strong>the</strong> main advantages <strong>of</strong> th<strong>is</strong> method <strong>is</strong><br />

that it can effectively manage tangible and intangible or qualitative and quantitative<br />

factors. Th<strong>is</strong> study attempts to find <strong>the</strong> most preferable <strong>bancassurance</strong> <strong>alliance</strong> <strong>model</strong><br />

for customers’ perspective, which <strong>is</strong> a problem that involves complex MCDM.<br />

Therefore, using <strong>the</strong> AHP method seems to be a successful approach in finding a<br />

solution to <strong>the</strong> finance <strong>alliance</strong> problem.<br />

The composite priority <strong>of</strong> <strong>the</strong> six <strong>alliance</strong> structure <strong>model</strong>s beneath <strong>the</strong> three criteria<br />

<strong>is</strong>: executive aspect (0.331); superv<strong>is</strong>or aspect (0.135) and customer aspect (0.533).<br />

Customer aspect ranked highest in <strong>the</strong> hierarchy. From th<strong>is</strong> result knows that<br />

customers will first consider <strong>the</strong>mselves benefits while <strong>the</strong>y purchase financial<br />

products. Moreover, we d<strong>is</strong>covered at customers care about not only <strong>the</strong>mselves<br />

benefits (SC 7 ,SC 8 and SC 9 ) but also system r<strong>is</strong>k control (SC 4 ) and stability <strong>of</strong> financial<br />

institutions operation (SC 3 ) (Table VI). Summarizing <strong>the</strong> results, <strong>the</strong> FHC received<br />

higher overall value scores largely because it had highest scores according to criteria<br />

executive aspect, superv<strong>is</strong>or aspect and customer aspect.<br />

Through consultation with financiers, academicians, and <strong>the</strong> advanced or well<br />

informed customers, we learned that Taiwan’s consumers in <strong>the</strong> purchase <strong>of</strong> financial<br />

products will consider many factors regarding <strong>the</strong> executive, superv<strong>is</strong>or and customer<br />

aspects, including company’s scale and operation condition, customer’s benefits, r<strong>is</strong>k<br />

and so forth. But <strong>the</strong> most important factors are convenience, customer’s benefits and

Criteria C 1 C 2 C 3<br />

Weights <strong>of</strong> criteria 0.331 0.135 0.533<br />

Sub-criteria SC 1 SC 2 SC 3 Global priority SC 4 SC 5 SC 6 Global priority SC 7 SC 8 SC 9 Global priority<br />

Weights <strong>of</strong> Sub-criteria 0.116 0.214 0.670 0.606 0.247 0.147 0.421 0.373 0.206<br />

FHC 0.371 0.372 0.335 0.347 0.350 0.378 0.377 0.361 0.252 0.321 0.376 0.303<br />

HS 0.073 0.084 0.086 0.084 0.082 0.088 0.106 0.087 0.065 0.071 0.096 0.074<br />

JV 0.204 0.210 0.200 0.202 0.207 0.202 0.217 0.207 0.180 0.135 0.193 0.166<br />

PA 0.192 0.155 0.195 0.186 0.179 0.162 0.148 0.170 0.187 0.152 0.161 0.169<br />

IA 0.078 0.098 0.102 0.099 0.101 0.094 0.084 0.097 0.148 0.160 0.092 0.141<br />

IB 0.082 0.082 0.082 0.082 0.082 0.076 0.070 0.078 0.169 0.162 0.082 0.149<br />

Bancassurance<br />

<strong>alliance</strong> <strong>model</strong><br />

217<br />

Table IV.<br />

Eigenvectors and weights<br />

<strong>of</strong> six <strong>alliance</strong> structure<br />

<strong>model</strong>s under nine<br />

sub-criteria

JM2<br />

3,3<br />

218<br />

Table V.<br />

C 1 C 2 C 3 Aggregate score Rank<br />

0.331 0.135 0.533<br />

FHC 0.347 0.361 0.303 0.325 1<br />

HS 0.084 0.087 0.074 0.079 6<br />

JV 0.202 0.207 0.166 0.183 2<br />

PA 0.186 0.170 0.169 0.175 3<br />

IA 0.099 0.097 0.141 0.121 4<br />

IB 0.082 0.078 0.149 0.117 5<br />

Note: The composite priority vector for application AHP dec<strong>is</strong>ion <strong>model</strong> to select <strong>the</strong> <strong>alliance</strong><br />

structure <strong>model</strong>s result<br />

Criteria Sub-criteria Global priority Rank<br />

Table VI.<br />

Global priority <strong>of</strong> six<br />

<strong>alliance</strong> structure <strong>model</strong>s<br />

under nine sub-criteria<br />

C 1 SC 1 0.038 7<br />

SC 2 0.071 6<br />

SC 3 0.222 2<br />

C 2 SC 4 0.082 5<br />

SC 5 0.033 8<br />

SC 6 0.020 9<br />

C 3 SC 7 0.225 1<br />

SC 8 0.199 3<br />

SC 9 0.110 4<br />

r<strong>is</strong>k control. Therefore, <strong>the</strong> results <strong>of</strong> th<strong>is</strong> study correspond with <strong>the</strong> realities <strong>of</strong><br />

Taiwan’s current situation.<br />

Th<strong>is</strong> study provides an evaluation criterion for determining <strong>the</strong> optimal <strong>alliance</strong><br />

structure for Taiwan’s emerging <strong>bancassurance</strong> sector, and <strong>the</strong> proposal evaluation<br />

criteria provides high-level management <strong>of</strong> financial institutions and academicians<br />

with recommendations for future development.<br />

References<br />

Hughes, J.P., Lang, W.W., Mester, L.J. and Moon, C.G. (1999), “The dollars and sense <strong>of</strong> bank<br />

consolidation”, Journal <strong>of</strong> Banking & Finance, Vol. 23, pp. 291-324.<br />

Korhonen, P. and Voutilainen, R. (2006), “Finding <strong>the</strong> most preferred <strong>alliance</strong> structure between<br />

banks and insurance companies”, European Journal <strong>of</strong> Operational Research, Vol. 175,<br />

pp. 1285-99.<br />

Korhonen, P., Koskinen, L. and Voutilainen, R. (2005), “Customer view on <strong>the</strong> most preferred<br />

<strong>alliance</strong> structure between banks and insurance companies”, working papers, Helsinki<br />

School <strong>of</strong> Economics, Helsinki, forthcoming in Zeitschrift fur Betriebswirtschaft.<br />

Korhonen, P., Koskinen, L. and Voutilainen, R. (2006), “A financial <strong>alliance</strong> comprom<strong>is</strong>e between<br />

executives and superv<strong>is</strong>ory authorities”, European Journal <strong>of</strong> Operational Research,<br />

Vol. 175, pp. 1300-10.<br />

Li, J. (2006), “Financial holding company: organizational choice for China’s financial sector<br />

reform”, European Business Law Review, Vol. 17, pp. 1265-9.

Murry, J.W. and Hammons, J.O. (1995), “Delphi: a versatile methodology for conducting<br />

qualitative research”, Review <strong>of</strong> Higher Education, Vol. 18 No. 4, pp. 423-36.<br />

Saaty, T.L. (1980), The Analytic Hierarchy Process, McGraw-Hill, New York, NY.<br />

Saaty, T.L. (1990), “How to mark a dec<strong>is</strong>ion: <strong>the</strong> analytic hierarchy process”, European Journal <strong>of</strong><br />

Operational Research, Vol. 48, pp. 9-26.<br />

Saaty, T.L. (2000), Fundamentals <strong>of</strong> Dec<strong>is</strong>ion Making and Priority Theory with <strong>the</strong> Analytic<br />

Hierarchy Process, RWS Publications, Pittsburgh, PA.<br />

Staikouras, S.K. (2006), “Business opportunities and market realities in financial conglomerates”,<br />

The Geneva Papers on R<strong>is</strong>k and Insurance, Vol. 31 No. 1, pp. 124-48.<br />

Staikouras, S.K. and Nurullah, M. (2008), “The separation <strong>of</strong> banking from insurance: evidence<br />

from Europe”, Multinational Finance Journal, Vol. 12, pp. 157-84.<br />

Voutilainen, R. (2005), “Comparing alternative structures <strong>of</strong> financial <strong>alliance</strong>s”, The Geneva<br />

Papers on R<strong>is</strong>k and Insurance, Vol. 30 No. 2, pp. 327-42.<br />

Wever, E.M. (2000), “Latin America <strong>bancassurance</strong>”, International Section News, September, p. 9.<br />

Wu, C.R., Chang, H.Y. and Wu, L.S. (2008), “A framework <strong>of</strong> assessable mutual fund<br />

performance”, Journal <strong>of</strong> Modelling in Management, Vol. 3 No. 2, pp. 125-39.<br />

Bancassurance<br />

<strong>alliance</strong> <strong>model</strong><br />

219<br />

About <strong>the</strong> authors<br />

Cheng-Ru Wu <strong>is</strong> Head <strong>of</strong> <strong>the</strong> Graduate Institute <strong>of</strong> Business and Management at Yuanpei<br />

University. He holds PhD from Ming Chuan University. He <strong>is</strong> <strong>the</strong> member <strong>of</strong> <strong>the</strong> Operations<br />

Research Society <strong>of</strong> Taiwan. H<strong>is</strong> major interest <strong>is</strong> in dec<strong>is</strong>ion science, real options, ma<strong>the</strong>matical<br />

finance and ma<strong>the</strong>matical economics. H<strong>is</strong> papers appeared in Applied Stochastic Models in<br />

Business and Industry, Asia-Pacific Journal <strong>of</strong> Operational Research, Building and Environment,<br />

International Journal <strong>of</strong> Technology Management, Quality and Quantity, Computers & Industrial<br />

Engineering, International Journal <strong>of</strong> Advanced Manufacturing Technology, S<strong>of</strong>tware Quality<br />

Journal, Production Planning and Control, Expert Systems with Applications, Information<br />

Sciences, Waste Management and o<strong>the</strong>rs. Cheng-Ru Wu <strong>is</strong> <strong>the</strong> corresponding author and can be<br />

contacted at: alexru00@ms41.hinet.net<br />

Chin-Tsai Lin <strong>is</strong> in <strong>the</strong> Graduate Institute <strong>of</strong> Business and Management and <strong>is</strong> head <strong>of</strong><br />

Yuanpei University. He holds PhD in <strong>the</strong> Institute <strong>of</strong> Management Science, National Chiao-Tung<br />

University. He <strong>is</strong> <strong>the</strong> member <strong>of</strong> <strong>the</strong> Operations Research Society <strong>of</strong> Taiwan. H<strong>is</strong> current research<br />

interests are in <strong>the</strong> area <strong>of</strong> dec<strong>is</strong>ion science, grey system, and optimization <strong>the</strong>ory and<br />

applications. He has publ<strong>is</strong>hed more than 190 research papers in International journals. H<strong>is</strong><br />

papers appeared in Journal <strong>of</strong> <strong>the</strong> Operational Research Society, Asia-Pacific Journal <strong>of</strong><br />

Operational Research, Journal <strong>of</strong> Grey System, Information Sciences, International Journal <strong>of</strong><br />

Advanced Manufacturing Technology, Frontiers in Bioscience, Stat<strong>is</strong>tics and Computing and<br />

o<strong>the</strong>rs.<br />

Yu-Fan Lin <strong>is</strong> a Master in <strong>the</strong> Graduate Institute <strong>of</strong> Business and Management at Yuanpei<br />

University. Her major interest <strong>is</strong> in dec<strong>is</strong>ion science, <strong>bancassurance</strong>, performance evaluation and<br />

ma<strong>the</strong>matical finance.<br />

To purchase reprints <strong>of</strong> th<strong>is</strong> article please e-mail: reprints@emeraldinsight.com<br />

Or v<strong>is</strong>it our web site for fur<strong>the</strong>r details: www.emeraldinsight.com/reprints