Sales breakdown 2004 - Solvay

Sales breakdown 2004 - Solvay

Sales breakdown 2004 - Solvay

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

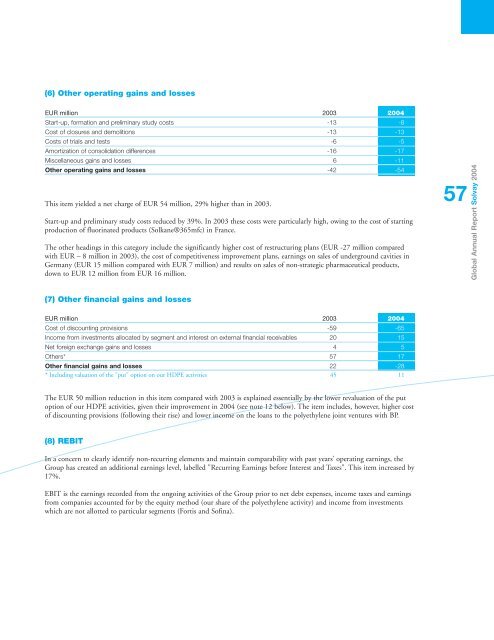

(6) Other operating gains and losses<br />

EUR million 2003 <strong>2004</strong><br />

Start-up, formation and preliminary study costs -13 -8<br />

Cost of closures and demolitions -13 -13<br />

Costs of trials and tests -6 -5<br />

Amortization of consolidation differences -16 -17<br />

Miscellaneous gains and losses 6 -11<br />

Other operating gains and losses -42 -54<br />

This item yielded a net charge of EUR 54 million, 29% higher than in 2003.<br />

Start-up and preliminary study costs reduced by 39%. In 2003 these costs were particularly high, owing to the cost of starting<br />

production of fluorinated products (Solkane®365mfc) in France.<br />

The other headings in this category include the significantly higher cost of restructuring plans (EUR -27 million compared<br />

with EUR – 8 million in 2003), the cost of competitiveness improvement plans, earnings on sales of underground cavities in<br />

Germany (EUR 15 million compared with EUR 7 million) and results on sales of non-strategic pharmaceutical products,<br />

down to EUR 12 million from EUR 16 million.<br />

57<br />

Global Annual Report <strong>Solvay</strong> <strong>2004</strong><br />

(7) Other financial gains and losses<br />

EUR million 2003 <strong>2004</strong><br />

Cost of discounting provisions -59 -65<br />

Income from investments allocated by segment and interest on external financial receivables 20 15<br />

Net foreign exchange gains and losses 4 5<br />

Others* 57 17<br />

Other financial gains and losses 22 -28<br />

* Including valuation of the "put" option on our HDPE activities 45 11<br />

The EUR 50 million reduction in this item compared with 2003 is explained essentially by the lower revaluation of the put<br />

option of our HDPE activities, given their improvement in <strong>2004</strong> (see note 12 below). The item includes, however, higher cost<br />

of discounting provisions (following their rise) and lower income on the loans to the polyethylene joint ventures with BP.<br />

(8) REBIT<br />

In a concern to clearly identify non-recurring elements and maintain comparability with past years’ operating earnings, the<br />

Group has created an additional earnings level, labelled "Recurring Earnings before Interest and Taxes". This item increased by<br />

17%.<br />

EBIT is the earnings recorded from the ongoing activities of the Group prior to net debt expenses, income taxes and earnings<br />

from companies accounted for by the equity method (our share of the polyethylene activity) and income from investments<br />

which are not allotted to particular segments (Fortis and Sofina).