Sales breakdown 2004 - Solvay

Sales breakdown 2004 - Solvay

Sales breakdown 2004 - Solvay

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Global Annual Report <strong>Solvay</strong> <strong>2004</strong><br />

70<br />

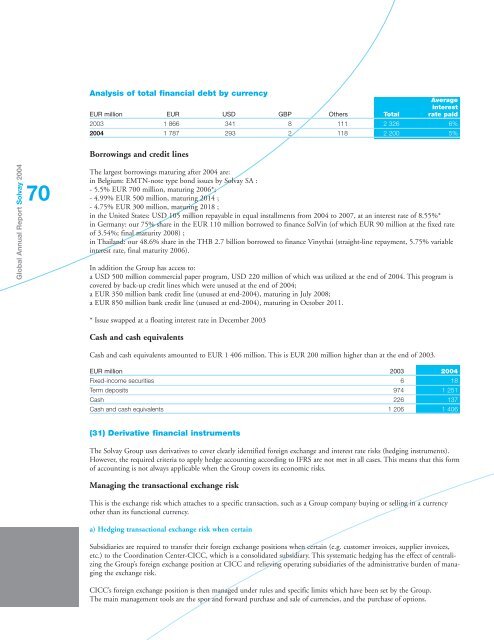

Analysis of total financial debt by currency<br />

Average<br />

interest<br />

EUR million EUR USD GBP Others Total rate paid<br />

2003 1 866 341 8 111 2 326 6%<br />

<strong>2004</strong> 1 787 293 2 118 2 200 5%<br />

Borrowings and credit lines<br />

The largest borrowings maturing after <strong>2004</strong> are:<br />

in Belgium: EMTN-note type bond issues by <strong>Solvay</strong> SA :<br />

- 5.5% EUR 700 million, maturing 2006*;<br />

- 4.99% EUR 500 million, maturing 2014 ;<br />

- 4.75% EUR 300 million, maturing 2018 ;<br />

in the United States: USD 105 million repayable in equal installments from <strong>2004</strong> to 2007, at an interest rate of 8.55%*<br />

in Germany: our 75% share in the EUR 110 million borrowed to finance SolVin (of which EUR 90 million at the fixed rate<br />

of 3.54%; final maturity 2008) ;<br />

in Thailand: our 48.6% share in the THB 2.7 billion borrowed to finance Vinythai (straight-line repayment, 5.75% variable<br />

interest rate, final maturity 2006).<br />

In addition the Group has access to:<br />

a USD 500 million commercial paper program, USD 220 million of which was utilized at the end of <strong>2004</strong>. This program is<br />

covered by back-up credit lines which were unused at the end of <strong>2004</strong>;<br />

a EUR 350 million bank credit line (unused at end-<strong>2004</strong>), maturing in July 2008;<br />

a EUR 850 million bank credit line (unused at end-<strong>2004</strong>), maturing in October 2011.<br />

* Issue swapped at a floating interest rate in December 2003<br />

Cash and cash equivalents<br />

Cash and cash equivalents amounted to EUR 1 406 million. This is EUR 200 million higher than at the end of 2003.<br />

EUR million 2003 <strong>2004</strong><br />

Fixed-income securities 6 18<br />

Term deposits 974 1 251<br />

Cash 226 137<br />

Cash and cash equivalents 1 206 1 406<br />

(31) Derivative financial instruments<br />

The <strong>Solvay</strong> Group uses derivatives to cover clearly identified foreign exchange and interest rate risks (hedging instruments).<br />

However, the required criteria to apply hedge accounting according to IFRS are not met in all cases. This means that this form<br />

of accounting is not always applicable when the Group covers its economic risks.<br />

Managing the transactional exchange risk<br />

This is the exchange risk which attaches to a specific transaction, such as a Group company buying or selling in a currency<br />

other than its functional currency.<br />

a) Hedging transactional exchange risk when certain<br />

Subsidiaries are required to transfer their foreign exchange positions when certain (e.g. customer invoices, supplier invoices,<br />

etc.) to the Coordination Center-CICC, which is a consolidated subsidiary. This systematic hedging has the effect of centralizing<br />

the Group’s foreign exchange position at CICC and relieving operating subsidiaries of the administrative burden of managing<br />

the exchange risk.<br />

CICC’s foreign exchange position is then managed under rules and specific limits which have been set by the Group.<br />

The main management tools are the spot and forward purchase and sale of currencies, and the purchase of options.