Sales breakdown 2004 - Solvay

Sales breakdown 2004 - Solvay

Sales breakdown 2004 - Solvay

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Global Annual Report <strong>Solvay</strong> <strong>2004</strong><br />

68<br />

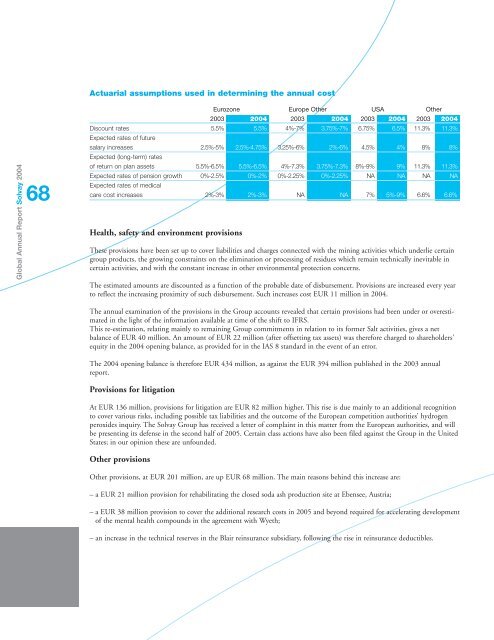

Actuarial assumptions used in determining the annual cost<br />

Eurozone Europe Other USA Other<br />

2003 <strong>2004</strong> 2003 <strong>2004</strong> 2003 <strong>2004</strong> 2003 <strong>2004</strong><br />

Discount rates 5.5% 5.5% 4%-7% 3.75%-7% 6.75% 6.5% 11.3% 11.3%<br />

Expected rates of future<br />

salary increases 2.5%-5% 2.5%-4.75% 3.25%-6% 2%-6% 4.5% 4% 8% 8%<br />

Expected (long-term) rates<br />

of return on plan assets 5.5%-6.5% 5.5%-6.5% 4%-7.3% 3.75%-7.3% 8%-9% 9% 11.3% 11.3%<br />

Expected rates of pension growth 0%-2.5% 0%-2% 0%-2.25% 0%-2.25% NA NA NA NA<br />

Expected rates of medical<br />

care cost increases 2%-3% 2%-3% NA NA 7% 5%-9% 6.6% 6.6%<br />

Health, safety and environment provisions<br />

These provisions have been set up to cover liabilities and charges connected with the mining activities which underlie certain<br />

group products, the growing constraints on the elimination or processing of residues which remain technically inevitable in<br />

certain activities, and with the constant increase in other environmental protection concerns.<br />

The estimated amounts are discounted as a function of the probable date of disbursement. Provisions are increased every year<br />

to reflect the increasing proximity of such disbursement. Such increases cost EUR 11 million in <strong>2004</strong>.<br />

The annual examination of the provisions in the Group accounts revealed that certain provisions had been under or overestimated<br />

in the light of the information available at time of the shift to IFRS.<br />

This re-estimation, relating mainly to remaining Group commitments in relation to its former Salt activities, gives a net<br />

balance of EUR 40 million. An amount of EUR 22 million (after offsetting tax assets) was therefore charged to shareholders'<br />

equity in the <strong>2004</strong> opening balance, as provided for in the IAS 8 standard in the event of an error.<br />

The <strong>2004</strong> opening balance is therefore EUR 434 million, as against the EUR 394 million published in the 2003 annual<br />

report.<br />

Provisions for litigation<br />

At EUR 136 million, provisions for litigation are EUR 82 million higher. This rise is due mainly to an additional recognition<br />

to cover various risks, including possible tax liabilities and the outcome of the European competition authorities’ hydrogen<br />

peroxides inquiry. The <strong>Solvay</strong> Group has received a letter of complaint in this matter from the European authorities, and will<br />

be presenting its defense in the second half of 2005. Certain class actions have also been filed against the Group in the United<br />

States; in our opinion these are unfounded.<br />

Other provisions<br />

Other provisions, at EUR 201 million, are up EUR 68 million. The main reasons behind this increase are:<br />

– a EUR 21 million provision for rehabilitating the closed soda ash production site at Ebensee, Austria;<br />

– a EUR 38 million provision to cover the additional research costs in 2005 and beyond required for accelerating development<br />

of the mental health compounds in the agreement with Wyeth;<br />

– an increase in the technical reserves in the Blair reinsurance subsidiary, following the rise in reinsurance deductibles.