Tally.ERP 9 Series A Release 3.4 Stat.900 Version 169 Release Notes

Tally.ERP 9 Series A Release 3.4 Stat.900 Version 169 Release Notes

Tally.ERP 9 Series A Release 3.4 Stat.900 Version 169 Release Notes

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

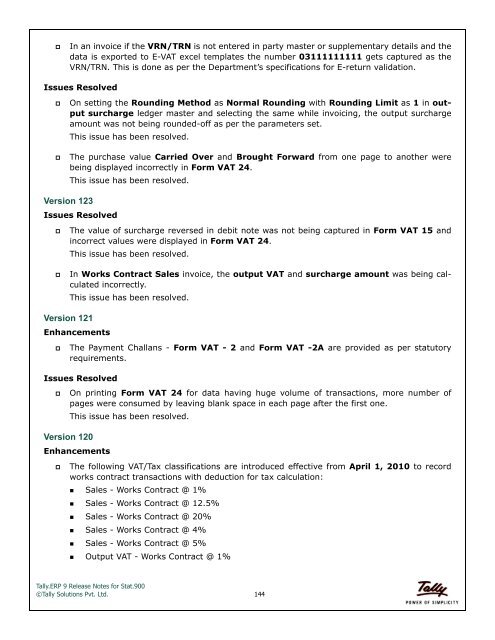

In an invoice if the VRN/TRN is not entered in party master or supplementary details and the<br />

data is exported to E-VAT excel templates the number 03111111111 gets captured as the<br />

VRN/TRN. This is done as per the Department’s specifications for E-return validation.<br />

Issues Resolved<br />

<br />

<br />

On setting the Rounding Method as Normal Rounding with Rounding Limit as 1 in output<br />

surcharge ledger master and selecting the same while invoicing, the output surcharge<br />

amount was not being rounded-off as per the parameters set.<br />

This issue has been resolved.<br />

The purchase value Carried Over and Brought Forward from one page to another were<br />

being displayed incorrectly in Form VAT 24.<br />

This issue has been resolved.<br />

<strong>Version</strong> 123<br />

Issues Resolved<br />

<br />

The value of surcharge reversed in debit note was not being captured in Form VAT 15 and<br />

incorrect values were displayed in Form VAT 24.<br />

This issue has been resolved.<br />

<br />

In Works Contract Sales invoice, the output VAT and surcharge amount was being calculated<br />

incorrectly.<br />

This issue has been resolved.<br />

<strong>Version</strong> 121<br />

Enhancements<br />

<br />

The Payment Challans - Form VAT - 2 and Form VAT -2A are provided as per statutory<br />

requirements.<br />

Issues Resolved<br />

On printing Form VAT 24 for data having huge volume of transactions, more number of<br />

pages were consumed by leaving blank space in each page after the first one.<br />

This issue has been resolved.<br />

<strong>Version</strong> 120<br />

Enhancements<br />

<br />

The following VAT/Tax classifications are introduced effective from April 1, 2010 to record<br />

works contract transactions with deduction for tax calculation:<br />

•Sales - Works Contract @ 1%<br />

•Sales - Works Contract @ 12.5%<br />

•Sales - Works Contract @ 20%<br />

•Sales - Works Contract @ 4%<br />

•Sales - Works Contract @ 5%<br />

•Output VAT - Works Contract @ 1%<br />

<strong>Tally</strong>.<strong>ERP</strong> 9 <strong>Release</strong> <strong>Notes</strong> for <strong>Stat.900</strong><br />

©<strong>Tally</strong> Solutions Pvt. Ltd. 144