Tally.ERP 9 Series A Release 3.4 Stat.900 Version 169 Release Notes

Tally.ERP 9 Series A Release 3.4 Stat.900 Version 169 Release Notes

Tally.ERP 9 Series A Release 3.4 Stat.900 Version 169 Release Notes

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

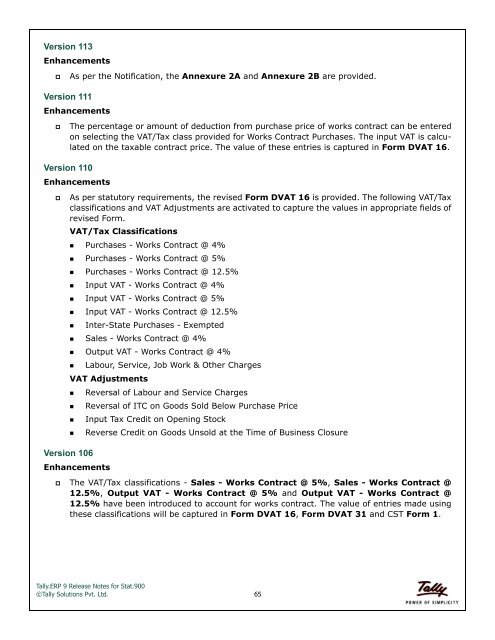

<strong>Version</strong> 113<br />

Enhancements<br />

<br />

<strong>Version</strong> 111<br />

As per the Notification, the Annexure 2A and Annexure 2B are provided.<br />

Enhancements<br />

<br />

The percentage or amount of deduction from purchase price of works contract can be entered<br />

on selecting the VAT/Tax class provided for Works Contract Purchases. The input VAT is calculated<br />

on the taxable contract price. The value of these entries is captured in Form DVAT 16.<br />

<strong>Version</strong> 110<br />

Enhancements<br />

<br />

As per statutory requirements, the revised Form DVAT 16 is provided. The following VAT/Tax<br />

classifications and VAT Adjustments are activated to capture the values in appropriate fields of<br />

revised Form.<br />

VAT/Tax Classifications<br />

•Purchases - Works Contract @ 4%<br />

•Purchases - Works Contract @ 5%<br />

•Purchases - Works Contract @ 12.5%<br />

•Input VAT - Works Contract @ 4%<br />

•Input VAT - Works Contract @ 5%<br />

•Input VAT - Works Contract @ 12.5%<br />

•Inter-State Purchases - Exempted<br />

•Sales - Works Contract @ 4%<br />

•Output VAT - Works Contract @ 4%<br />

•Labour, Service, Job Work & Other Charges<br />

VAT Adjustments<br />

•Reversal of Labour and Service Charges<br />

•Reversal of ITC on Goods Sold Below Purchase Price<br />

•Input Tax Credit on Opening Stock<br />

<strong>Version</strong> 106<br />

•Reverse Credit on Goods Unsold at the Time of Business Closure<br />

Enhancements<br />

<br />

The VAT/Tax classifications - Sales - Works Contract @ 5%, Sales - Works Contract @<br />

12.5%, Output VAT - Works Contract @ 5% and Output VAT - Works Contract @<br />

12.5% have been introduced to account for works contract. The value of entries made using<br />

these classifications will be captured in Form DVAT 16, Form DVAT 31 and CST Form 1.<br />

<strong>Tally</strong>.<strong>ERP</strong> 9 <strong>Release</strong> <strong>Notes</strong> for <strong>Stat.900</strong><br />

©<strong>Tally</strong> Solutions Pvt. Ltd. 65