Tally.ERP 9 Series A Release 3.4 Stat.900 Version 169 Release Notes

Tally.ERP 9 Series A Release 3.4 Stat.900 Version 169 Release Notes

Tally.ERP 9 Series A Release 3.4 Stat.900 Version 169 Release Notes

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

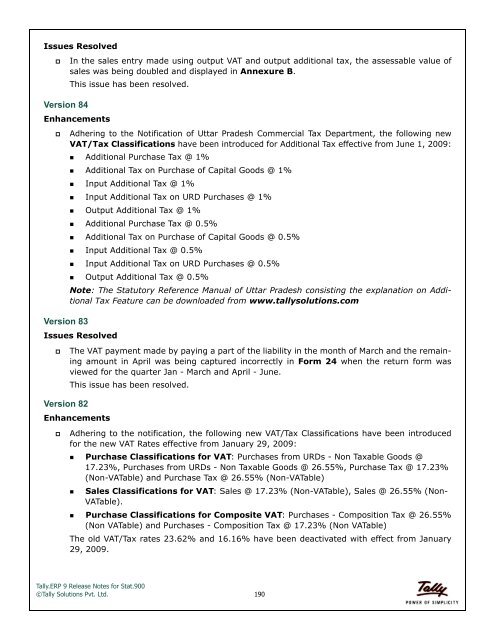

Issues Resolved<br />

<br />

In the sales entry made using output VAT and output additional tax, the assessable value of<br />

sales was being doubled and displayed in Annexure B.<br />

This issue has been resolved.<br />

<strong>Version</strong> 84<br />

Enhancements<br />

<br />

<strong>Version</strong> 83<br />

Adhering to the Notification of Uttar Pradesh Commercial Tax Department, the following new<br />

VAT/Tax Classifications have been introduced for Additional Tax effective from June 1, 2009:<br />

•Additional Purchase Tax @ 1%<br />

•Additional Tax on Purchase of Capital Goods @ 1%<br />

•Input Additional Tax @ 1%<br />

•Input Additional Tax on URD Purchases @ 1%<br />

•Output Additional Tax @ 1%<br />

•Additional Purchase Tax @ 0.5%<br />

•Additional Tax on Purchase of Capital Goods @ 0.5%<br />

•Input Additional Tax @ 0.5%<br />

•Input Additional Tax on URD Purchases @ 0.5%<br />

•Output Additional Tax @ 0.5%<br />

Note: The Statutory Reference Manual of Uttar Pradesh consisting the explanation on Additional<br />

Tax Feature can be downloaded from www.tallysolutions.com<br />

Issues Resolved<br />

<br />

The VAT payment made by paying a part of the liability in the month of March and the remaining<br />

amount in April was being captured incorrectly in Form 24 when the return form was<br />

viewed for the quarter Jan - March and April - June.<br />

This issue has been resolved.<br />

<strong>Version</strong> 82<br />

Enhancements<br />

<br />

Adhering to the notification, the following new VAT/Tax Classifications have been introduced<br />

for the new VAT Rates effective from January 29, 2009:<br />

•Purchase Classifications for VAT: Purchases from URDs - Non Taxable Goods @<br />

17.23%, Purchases from URDs - Non Taxable Goods @ 26.55%, Purchase Tax @ 17.23%<br />

(Non-VATable) and Purchase Tax @ 26.55% (Non-VATable)<br />

•Sales Classifications for VAT: Sales @ 17.23% (Non-VATable), Sales @ 26.55% (Non-<br />

VATable).<br />

•Purchase Classifications for Composite VAT: Purchases - Composition Tax @ 26.55%<br />

(Non VATable) and Purchases - Composition Tax @ 17.23% (Non VATable)<br />

The old VAT/Tax rates 23.62% and 16.16% have been deactivated with effect from January<br />

29, 2009.<br />

<strong>Tally</strong>.<strong>ERP</strong> 9 <strong>Release</strong> <strong>Notes</strong> for <strong>Stat.900</strong><br />

©<strong>Tally</strong> Solutions Pvt. Ltd. 190