Annual Report 2001-2002 - Tourism Western Australia - The ...

Annual Report 2001-2002 - Tourism Western Australia - The ...

Annual Report 2001-2002 - Tourism Western Australia - The ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

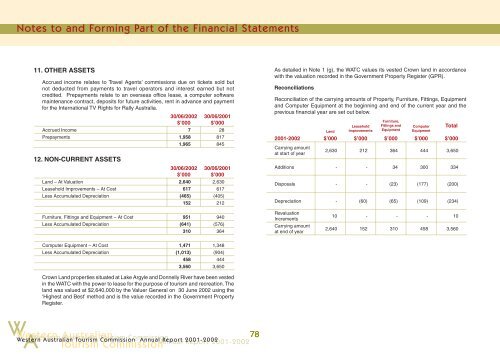

Notes to and Forming Part of the Financial Statements<br />

11. OTHER ASSETS<br />

Accrued income relates to Travel Agents’ commissions due on tickets sold but<br />

not deducted from payments to travel operators and interest earned but not<br />

credited. Prepayments relate to an overseas office lease, a computer software<br />

maintenance contract, deposits for future activities, rent in advance and payment<br />

for the International TV Rights for Rally <strong>Australia</strong>.<br />

30/06/<strong>2002</strong> 30/06/<strong>2001</strong><br />

$’000 $’000<br />

Accrued Income 7 28<br />

Prepayments 1,958 817<br />

12. NON-CURRENT ASSETS<br />

1,965 845<br />

30/06/<strong>2002</strong> 30/06/<strong>2001</strong><br />

$’000 $’000<br />

Land – At Valuation 2,640 2,630<br />

Leasehold Improvements – At Cost 617 617<br />

Less Accumulated Depreciation (465) (405)<br />

152 212<br />

As detailed in Note 1 (g), the WATC values its vested Crown land in accordance<br />

with the valuation recorded in the Government Property Register (GPR).<br />

Reconciliations<br />

Reconciliation of the carrying amounts of Property, Furniture, Fittings, Equipment<br />

and Computer Equipment at the beginning and end of the current year and the<br />

previous financial year are set out below.<br />

Land<br />

Leasehold<br />

Improvements<br />

Furniture,<br />

Fittings and<br />

Equipment<br />

Computer<br />

Equipment<br />

Total<br />

<strong>2001</strong>-<strong>2002</strong> $’000 $’000 $’000 $’000 $’000<br />

Carrying amount<br />

at start of year<br />

2,630 212 364 444 3,650<br />

Additions - - 34 300 334<br />

Disposals - - (23) (177) (200)<br />

Depreciation - (60) (65) (109) (234)<br />

Furniture, Fittings and Equipment – At Cost 951 940<br />

Less Accumulated Depreciation (641) (576)<br />

310 364<br />

Revaluation<br />

Increments<br />

Carrying amount<br />

at end of year<br />

10 - - - 10<br />

2,640 152 310 458 3,560<br />

Computer Equipment – At Cost 1,471 1,348<br />

Less Accumulated Depreciation (1,013) (904)<br />

458 444<br />

3,560 3,650<br />

Crown Land properties situated at Lake Argyle and Donnelly River have been vested<br />

in the WATC with the power to lease for the purpose of tourism and recreation. <strong>The</strong><br />

land was valued at $2,640,000 by the Valuer General on 30 June <strong>2002</strong> using the<br />

‘Highest and Best’ method and is the value recorded in the Government Property<br />

Register.<br />

W A<br />

<strong>Western</strong> <strong>Australia</strong>n<br />

<strong>Tourism</strong> Commission<br />

<strong>Western</strong> <strong>Australia</strong>n <strong>Tourism</strong> Commission<br />

78<br />

<strong>Annual</strong> <strong>Report</strong> <strong>2001</strong>-<strong>2002</strong>02<br />

Wester n <strong>Australia</strong>n <strong>Tourism</strong> Commission <strong>Annual</strong> <strong>Report</strong> <strong>2001</strong>-<strong>2002</strong>

![Annual Report 2002 - 2003 [pdf ] - Tourism Western Australia](https://img.yumpu.com/27124309/1/186x260/annual-report-2002-2003-pdf-tourism-western-australia.jpg?quality=85)

![Our Direction in China 2012 - 2015 [pdf ] - Tourism Western Australia](https://img.yumpu.com/27124271/1/184x260/our-direction-in-china-2012-2015-pdf-tourism-western-australia.jpg?quality=85)

![Naturebank Program 2011 [pdf ] - Tourism Western Australia](https://img.yumpu.com/27124244/1/184x260/naturebank-program-2011-pdf-tourism-western-australia.jpg?quality=85)