Annual Report 2001-2002 - Tourism Western Australia - The ...

Annual Report 2001-2002 - Tourism Western Australia - The ...

Annual Report 2001-2002 - Tourism Western Australia - The ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

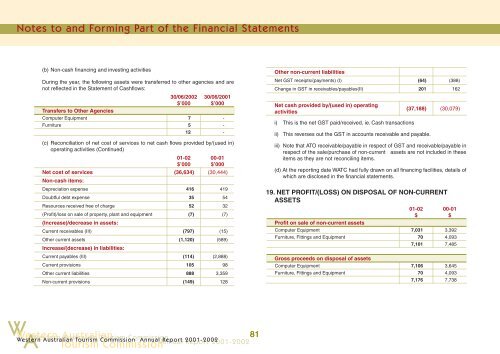

Notes to and Forming Part of the Financial Statements<br />

(b) Non-cash financing and investing activities<br />

During the year, the following assets were transferred to other agencies and are<br />

not reflected in the Statement of Cashflows:<br />

30/06/<strong>2002</strong><br />

$’000<br />

30/06/<strong>2001</strong><br />

$’000<br />

Transfers to Other Agencies<br />

Computer Equipment 7 -<br />

Furniture 5 -<br />

12 -<br />

(c) Reconciliation of net cost of services to net cash flows provided by/(used in)<br />

operating activities (Continued)<br />

01-02<br />

$’000<br />

00-01<br />

$’000<br />

Net cost of services (36,634) (30,444)<br />

Non-cash items:<br />

Depreciation expense 416 419<br />

Doubtful debt expense 35 54<br />

Resources received free of charge 52 32<br />

(Profit)/loss on sale of property, plant and equipment (7) (7)<br />

(Increase)/decrease in assets:<br />

Current receivables (III) (797) (15)<br />

Other current assets (1,120) (589)<br />

Increase/(decrease) in liabilities:<br />

Current payables (III) (114) (2,888)<br />

Current provisions 105 98<br />

Other current liabilities 888 3,359<br />

Non-current provisions (149) 128<br />

Other non-current liabilities<br />

Net GST receipts/(payments) (I) (64) (388)<br />

Change in GST in receivables/payables(II) 201 162<br />

Net cash provided by/(used in) operating<br />

activities<br />

i) This is the net GST paid/received, ie. Cash transactions<br />

ii) This reverses out the GST in accounts receivable and payable.<br />

(37,188) (30,079)<br />

iii) Note that ATO receivable/payable in respect of GST and receivable/payable in<br />

respect of the sale/purchase of non-current assets are not included in these<br />

items as they are not reconciling items.<br />

(d) At the reporting date WATC had fully drawn on all financing facilities, details of<br />

which are disclosed in the financial statements.<br />

19. NET PROFIT/(LOSS) ON DISPOSAL OF NON-CURRENT<br />

ASSETS<br />

01-02<br />

$<br />

00-01<br />

$<br />

Profit on sale of non-current assets<br />

Computer Equipment 7,031 3,392<br />

Furniture, Fittings and Equipment 70 4,093<br />

7,101 7,485<br />

Gross proceeds on disposal of assets<br />

Computer Equipment 7,106 3,645<br />

Furniture, Fittings and Equipment 70 4,093<br />

7,176 7,738<br />

W A<br />

<strong>Western</strong> <strong>Australia</strong>n<br />

<strong>Tourism</strong> Commission<br />

<strong>Western</strong> <strong>Australia</strong>n <strong>Tourism</strong> Commission<br />

81<br />

<strong>Annual</strong> <strong>Report</strong> <strong>2001</strong>-<strong>2002</strong>02<br />

Wester n <strong>Australia</strong>n <strong>Tourism</strong> Commission <strong>Annual</strong> <strong>Report</strong> <strong>2001</strong>-<strong>2002</strong>

![Annual Report 2002 - 2003 [pdf ] - Tourism Western Australia](https://img.yumpu.com/27124309/1/186x260/annual-report-2002-2003-pdf-tourism-western-australia.jpg?quality=85)

![Our Direction in China 2012 - 2015 [pdf ] - Tourism Western Australia](https://img.yumpu.com/27124271/1/184x260/our-direction-in-china-2012-2015-pdf-tourism-western-australia.jpg?quality=85)

![Naturebank Program 2011 [pdf ] - Tourism Western Australia](https://img.yumpu.com/27124244/1/184x260/naturebank-program-2011-pdf-tourism-western-australia.jpg?quality=85)