QBE European Operations plc

QBE European Operations plc

QBE European Operations plc

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>QBE</strong> <strong>European</strong> <strong>Operations</strong> <strong>plc</strong> Annual report 2011 21<br />

<strong>QBE</strong>’s risk strategy<br />

management framework<br />

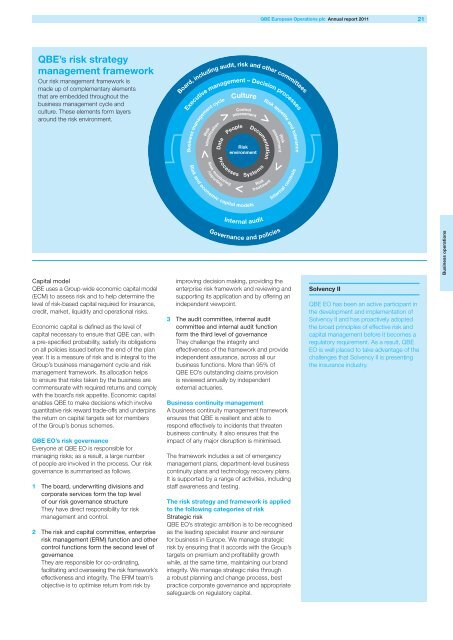

Our risk management framework is<br />

made up of complementary elements<br />

that are embedded throughout the<br />

business management cycle and<br />

culture. These elements form layers<br />

around the risk environment.<br />

Board, including audit, risk and other committees<br />

Business management cycle<br />

Culture<br />

Risk appetite and tolerance<br />

Executive management – Decision processes<br />

><br />

Risk<br />

><br />

Data<br />

identification<br />

People<br />

Control<br />

assessment<br />

Documentation<br />

Risk<br />

environment<br />

><br />

assessment<br />

Risk<br />

Processes<br />

Risk monitoring<br />

Risk and economic capital models<br />

/reporting<br />

><br />

Systems<br />

Risk<br />

treatment<br />

><br />

Internal controls<br />

Internal audit<br />

Governance and policies<br />

Business operations<br />

Capital model<br />

<strong>QBE</strong> uses a Group-wide economic capital model<br />

(ECM) to assess risk and to help determine the<br />

level of risk-based capital required for insurance,<br />

credit, market, liquidity and operational risks.<br />

Economic capital is defined as the level of<br />

capital necessary to ensure that <strong>QBE</strong> can, with<br />

a pre-specified probability, satisfy its obligations<br />

on all policies issued before the end of the plan<br />

year. It is a measure of risk and is integral to the<br />

Group’s business management cycle and risk<br />

management framework. Its allocation helps<br />

to ensure that risks taken by the business are<br />

commensurate with required returns and comply<br />

with the board’s risk appetite. Economic capital<br />

enables <strong>QBE</strong> to make decisions which involve<br />

quantitative risk reward trade-offs and underpins<br />

the return on capital targets set for members<br />

of the Group’s bonus schemes.<br />

<strong>QBE</strong> EO’s risk governance<br />

Everyone at <strong>QBE</strong> EO is responsible for<br />

managing risks; as a result, a large number<br />

of people are involved in the process. Our risk<br />

governance is summarised as follows.<br />

1 The board, underwriting divisions and<br />

corporate services form the top level<br />

of our risk governance structure<br />

They have direct responsibility for risk<br />

management and control.<br />

2 The risk and capital committee, enterprise<br />

risk management (ERM) function and other<br />

control functions form the second level of<br />

governance<br />

They are responsible for co-ordinating,<br />

facilitating and overseeing the risk framework’s<br />

effectiveness and integrity. The ERM team’s<br />

objective is to optimise return from risk by<br />

improving decision making, providing the<br />

enterprise risk framework and reviewing and<br />

supporting its application and by offering an<br />

independent viewpoint.<br />

3 The audit committee, internal audit<br />

committee and internal audit function<br />

form the third level of governance<br />

They challenge the integrity and<br />

effectiveness of the framework and provide<br />

independent assurance, across all our<br />

business functions. More than 95% of<br />

<strong>QBE</strong> EO’s outstanding claims provision<br />

is reviewed annually by independent<br />

external actuaries.<br />

Business continuity management<br />

A business continuity management framework<br />

ensures that <strong>QBE</strong> is resilient and able to<br />

respond effectively to incidents that threaten<br />

business continuity. It also ensures that the<br />

impact of any major disruption is minimised.<br />

The framework includes a set of emergency<br />

management plans, department-level business<br />

continuity plans and technology recovery plans.<br />

It is supported by a range of activities, including<br />

staff awareness and testing.<br />

The risk strategy and framework is applied<br />

to the following categories of risk<br />

Strategic risk<br />

<strong>QBE</strong> EO’s strategic ambition is to be recognised<br />

as the leading specialist insurer and reinsurer<br />

for business in Europe. We manage strategic<br />

risk by ensuring that it accords with the Group’s<br />

targets on premium and profitability growth<br />

while, at the same time, maintaining our brand<br />

integrity. We manage strategic risks through<br />

a robust planning and change process, best<br />

practice corporate governance and appropriate<br />

safeguards on regulatory capital.<br />

Solvency II<br />

<strong>QBE</strong> EO has been an active participant in<br />

the development and implementation of<br />

Solvency II and has proactively adopted<br />

the broad principles of effective risk and<br />

capital management before it becomes a<br />

regulatory requirement. As a result, <strong>QBE</strong><br />

EO is well placed to take advantage of the<br />

challenges that Solvency II is presenting<br />

the insurance industry.