QBE European Operations plc

QBE European Operations plc

QBE European Operations plc

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>QBE</strong> <strong>European</strong> <strong>Operations</strong> <strong>plc</strong> Annual report 2011 32<br />

Financial management<br />

continued<br />

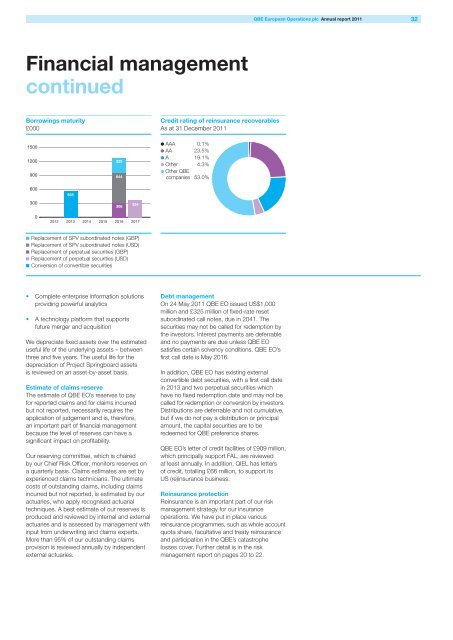

Borrowings maturity<br />

£000<br />

1500<br />

1200<br />

900<br />

325<br />

644<br />

Credit rating of reinsurance recoverables<br />

As at 31 December 2011<br />

● AAA 0.1%<br />

● AA 23.5%<br />

● A 19.1%<br />

● Other 4.3%<br />

● Other <strong>QBE</strong><br />

companies 53.0%<br />

600<br />

300<br />

565<br />

308<br />

354<br />

0<br />

2012 2013<br />

2014 2015 2016 2017<br />

■ Replacement of SPV subordinated notes (GBP)<br />

■ Replacement of SPV subordinated notes (USD)<br />

■ Replacement of perpetual securities (GBP)<br />

■ Replacement of perpetual securities (USD)<br />

■ Conversion of convertible securities<br />

• Complete enterprise information solutions<br />

providing powerful analytics<br />

• A technology platform that supports<br />

future merger and acquisition<br />

We depreciate fixed assets over the estimated<br />

useful life of the underlying assets – between<br />

three and five years. The useful life for the<br />

depreciation of Project Springboard assets<br />

is reviewed on an asset-by-asset basis.<br />

Estimate of claims reserve<br />

The estimate of <strong>QBE</strong> EO’s reserves to pay<br />

for reported claims and for claims incurred<br />

but not reported, necessarily requires the<br />

application of judgement and is, therefore,<br />

an important part of financial management<br />

because the level of reserves can have a<br />

significant impact on profitability.<br />

Our reserving committee, which is chaired<br />

by our Chief Risk Officer, monitors reserves on<br />

a quarterly basis. Claims estimates are set by<br />

experienced claims technicians. The ultimate<br />

costs of outstanding claims, including claims<br />

incurred but not reported, is estimated by our<br />

actuaries, who apply recognised actuarial<br />

techniques. A best estimate of our reserves is<br />

produced and reviewed by internal and external<br />

actuaries and is assessed by management with<br />

input from underwriting and claims experts.<br />

More than 95% of our outstanding claims<br />

provision is reviewed annually by independent<br />

external actuaries.<br />

Debt management<br />

On 24 May 2011 <strong>QBE</strong> EO issued US$1,000<br />

million and £325 million of fixed-rate reset<br />

subordinated call notes, due in 2041. The<br />

securities may not be called for redemption by<br />

the investors. Interest payments are deferrable<br />

and no payments are due unless <strong>QBE</strong> EO<br />

satisfies certain solvency conditions. <strong>QBE</strong> EO’s<br />

first call date is May 2016.<br />

In addition, <strong>QBE</strong> EO has existing external<br />

convertible debt securities, with a first call date<br />

in 2013 and two perpetual securities which<br />

have no fixed redemption date and may not be<br />

called for redemption or conversion by investors.<br />

Distributions are deferrable and not cumulative,<br />

but if we do not pay a distribution or principal<br />

amount, the capital securities are to be<br />

redeemed for <strong>QBE</strong> preference shares.<br />

<strong>QBE</strong> EO’s letter of credit facilities of £909 million,<br />

which principally support FAL, are reviewed<br />

at least annually. In addition, QIEL has letters<br />

of credit, totalling £66 million, to support its<br />

US (re)insurance business.<br />

Reinsurance protection<br />

Reinsurance is an important part of our risk<br />

management strategy for our insurance<br />

operations. We have put in place various<br />

reinsurance programmes, such as whole account<br />

quota share, facultative and treaty reinsurance<br />

and participation in the <strong>QBE</strong>’s catastrophe<br />

losses cover. Further detail is in the risk<br />

management report on pages 20 to 22.