planning department - Town of Scarborough

planning department - Town of Scarborough

planning department - Town of Scarborough

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

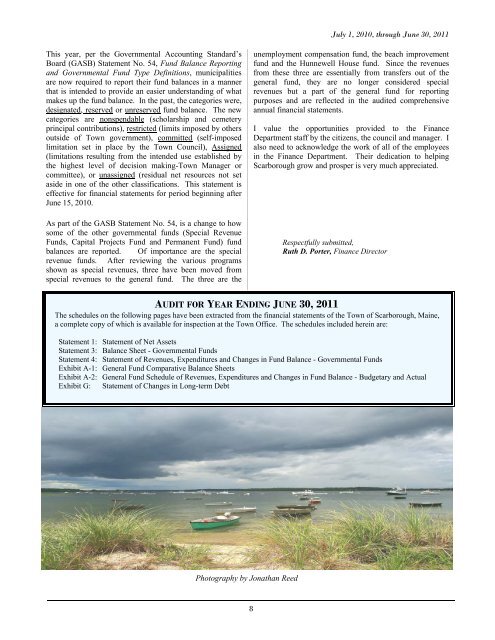

July 1, 2010, through June 30, 2011<br />

This year, per the Governmental Accounting Standard’s<br />

Board (GASB) Statement No. 54, Fund Balance Reporting<br />

and Governmental Fund Type Definitions, municipalities<br />

are now required to report their fund balances in a manner<br />

that is intended to provide an easier understanding <strong>of</strong> what<br />

makes up the fund balance. In the past, the categories were,<br />

designated, reserved or unreserved fund balance. The new<br />

categories are nonspendable (scholarship and cemetery<br />

principal contributions), restricted (limits imposed by others<br />

outside <strong>of</strong> <strong>Town</strong> government), committed (self-imposed<br />

limitation set in place by the <strong>Town</strong> Council), Assigned<br />

(limitations resulting from the intended use established by<br />

the highest level <strong>of</strong> decision making-<strong>Town</strong> Manager or<br />

committee), or unassigned (residual net resources not set<br />

aside in one <strong>of</strong> the other classifications. This statement is<br />

effective for financial statements for period beginning after<br />

June 15, 2010.<br />

As part <strong>of</strong> the GASB Statement No. 54, is a change to how<br />

some <strong>of</strong> the other governmental funds (Special Revenue<br />

Funds, Capital Projects Fund and Permanent Fund) fund<br />

balances are reported. Of importance are the special<br />

revenue funds. After reviewing the various programs<br />

shown as special revenues, three have been moved from<br />

special revenues to the general fund. The three are the<br />

unemployment compensation fund, the beach improvement<br />

fund and the Hunnewell House fund. Since the revenues<br />

from these three are essentially from transfers out <strong>of</strong> the<br />

general fund, they are no longer considered special<br />

revenues but a part <strong>of</strong> the general fund for reporting<br />

purposes and are reflected in the audited comprehensive<br />

annual financial statements.<br />

I value the opportunities provided to the Finance<br />

Department staff by the citizens, the council and manager. I<br />

also need to acknowledge the work <strong>of</strong> all <strong>of</strong> the employees<br />

in the Finance Department. Their dedication to helping<br />

<strong>Scarborough</strong> grow and prosper is very much appreciated.<br />

Respectfully submitted,<br />

Ruth D. Porter, Finance Director<br />

AUDIT FOR YEAR ENDING JUNE 30, 2011<br />

The schedules on the following pages have been extracted from the financial statements <strong>of</strong> the <strong>Town</strong> <strong>of</strong> <strong>Scarborough</strong>, Maine,<br />

a complete copy <strong>of</strong> which is available for inspection at the <strong>Town</strong> Office. The schedules included herein are:<br />

Statement 1: Statement <strong>of</strong> Net Assets<br />

Statement 3: Balance Sheet - Governmental Funds<br />

Statement 4: Statement <strong>of</strong> Revenues, Expenditures and Changes in Fund Balance - Governmental Funds<br />

Exhibit A-1: General Fund Comparative Balance Sheets<br />

Exhibit A-2: General Fund Schedule <strong>of</strong> Revenues, Expenditures and Changes in Fund Balance - Budgetary and Actual<br />

Exhibit G: Statement <strong>of</strong> Changes in Long-term Debt<br />

Photography by Jonathan Reed<br />

8