planning department - Town of Scarborough

planning department - Town of Scarborough

planning department - Town of Scarborough

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

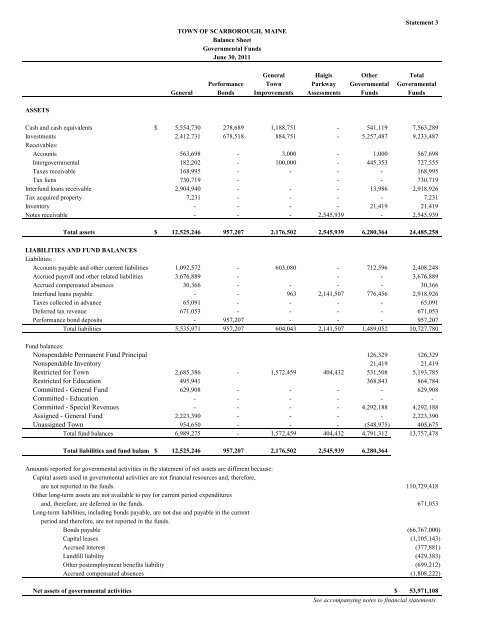

TOWN OF SCARBOROUGH, MAINE<br />

Balance Sheet<br />

Governmental Funds<br />

June 30, 2011<br />

Statement 3<br />

General Haigis Other Total<br />

Performance <strong>Town</strong> Parkway Governmental Governmental<br />

General Bonds Improvements Assessments Funds Funds<br />

ASSETS<br />

Cash and cash equivalents $ 5,554,730 278,689 1,188,751 - 541,119 7,563,289<br />

Investments 2,412,731 678,518 884,751 - 5,257,487 9,233,487<br />

Receivables:<br />

Accounts 563,698 - 3,000 - 1,000 567,698<br />

Intergovernmental 182,202 - 100,000 - 445,353 727,555<br />

Taxes receivable 168,995 - - - - 168,995<br />

Tax liens 730,719 - - - 730,719<br />

Interfund loans receivable 2,904,940 - - - 13,986 2,918,926<br />

Tax acquired property 7,231 - - - - 7,231<br />

Inventory - - - - 21,419 21,419<br />

Notes receivable - - - 2,545,939 - 2,545,939<br />

Total assets $ 12,525,246 957,207 2,176,502 2,545,939 6,280,364 24,485,258<br />

LIABILITIES AND FUND BALANCES<br />

Liabilities:<br />

Accounts payable and other current liabilities 1,092,572 - 603,080 - 712,596 2,408,248<br />

Accrued payroll and other related liabilities 3,676,889 - - - 3,676,889<br />

Accrued compensated absences 30,366 - - - - 30,366<br />

Interfund loans payable - - 963 2,141,507 776,456 2,918,926<br />

Taxes collected in advance 65,091 - - - - 65,091<br />

Deferred tax revenue 671,053 - - - - 671,053<br />

Performance bond deposits - 957,207 - - - 957,207<br />

Total liabilities 5,535,971 957,207 604,043 2,141,507 1,489,052 10,727,780<br />

Fund balances:<br />

Nonspendable Permanent Fund Principal 126,329 126,329<br />

Nonspendable Inventory 21,419 21,419<br />

Restricted for <strong>Town</strong> 2,685,386 - 1,572,459 404,432 531,508 5,193,785<br />

Restricted for Education 495,941 368,843 864,784<br />

Committed - General Fund 629,908 - - - - 629,908<br />

Committed - Education - - - - - -<br />

Committed - Special Revenues - - - - 4,292,188 4,292,188<br />

Assigned - General Fund 2,223,390 - - - - 2,223,390<br />

Unassigned <strong>Town</strong> 954,650 - - - (548,975) 405,675<br />

Total fund balances 6,989,275 - 1,572,459 404,432 4,791,312 13,757,478<br />

Total liabilities and fund balanc $ 12,525,246 957,207 2,176,502 2,545,939 6,280,364<br />

Amounts reported for governmental activities in the statement <strong>of</strong> net assets are different because:<br />

Capital assets used in governmental activities are not financial resources and, therefore,<br />

are not reported in the funds. 110,729,418<br />

Other long-term assets are not available to pay for current period expenditures<br />

and, therefore, are deferred in the funds. 671,053<br />

Long-term liabilities, including bonds payable, are not due and payable in the current<br />

period and therefore, are not reported in the funds.<br />

Bonds payable (66,767,000)<br />

Capital leases (1,105,143)<br />

Accrued interest (377,881)<br />

Landfill liability (429,383)<br />

Other postemployment benefits liability (699,212)<br />

Accrued compensated absences (1,808,222)<br />

Net assets <strong>of</strong> governmental activities 53,971,108<br />

$<br />

See accompanying notes to financial statements.