Chevron 2006 Annual Report

Chevron 2006 Annual Report

Chevron 2006 Annual Report

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF<br />

FINANCIAL CONDITION AND RESULTS OF OPERATIONS<br />

Pension Obligations In <strong>2006</strong>, the company’s pension<br />

plan contributions totaled approximately $450 million.<br />

Approximately $225 million of the total was contributed to<br />

U.S. plans. In 2007, the company estimates total contributions<br />

will be $500 million. Actual amounts are dependent<br />

upon plan-investment results, changes in pension obligations,<br />

regulatory requirements and other economic factors.<br />

Additional funding may be required if investment returns are<br />

insufficient to offset increases in plan obligations. Refer also<br />

to the discussion of pension accounting in “Critical Accounting<br />

Estimates and Assumptions,” beginning on page 44.<br />

FINANCIAL RATIOS<br />

Financial Ratios<br />

At December 31<br />

<strong>2006</strong> 2005 2004<br />

Current Ratio 1.3 1.4 1.5<br />

Interest Coverage Ratio 53.5 47.5 47.6<br />

Total Debt/Total Debt-Plus-Equity 12.5% 17.0% 19.9%<br />

Current Ratio – current assets divided by current liabilities.<br />

The current ratio in all periods was adversely affected by<br />

the fact that <strong>Chevron</strong>’s inventories are valued on a Last-In-<br />

First-Out basis. At year-end <strong>2006</strong>, the book value of inventory<br />

was lower than replacement costs, based on average acquisition<br />

costs during the year, by approximately $6 billion.<br />

Interest Coverage Ratio – income before income tax<br />

expense, plus interest and debt expense and amortization of<br />

capitalized interest, divided by before-tax interest costs. The<br />

interest coverage ratio was higher in <strong>2006</strong> compared with<br />

2005, primarily due to higher before-tax income and lower<br />

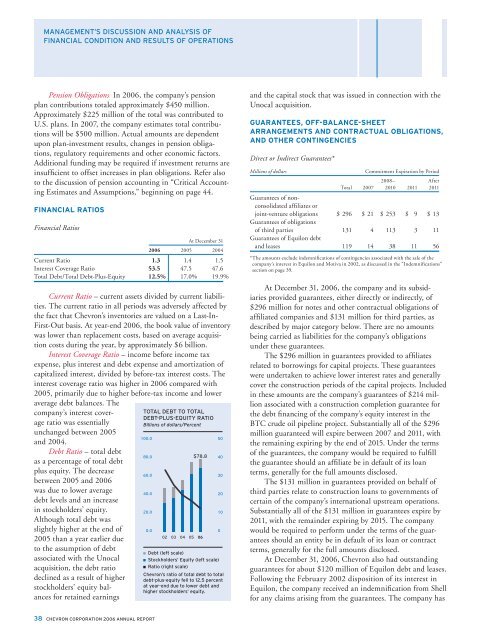

average debt balances. The<br />

company’s interest coverage<br />

ratio was essentially<br />

unchanged between 2005<br />

and 2004.<br />

Debt Ratio – total debt<br />

as a percentage of total debt<br />

plus equity. The decrease<br />

between 2005 and <strong>2006</strong><br />

was due to lower average<br />

debt levels and an increase<br />

in stockholders’ equity.<br />

Although total debt was<br />

slightly higher at the end of<br />

2005 than a year earlier due<br />

to the assumption of debt<br />

associated with the Unocal<br />

acquisition, the debt ratio<br />

declined as a result of higher<br />

stockholders’ equity balances<br />

for retained earnings<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

and the capital stock that was issued in connection with the<br />

Unocal acquisition.<br />

GUARANTEES, OFF-BALANCE-SHEET<br />

ARRANGEMENTS AND CONTRACTUAL OBLIGATIONS,<br />

AND OTHER CONTINGENCIES<br />

Direct or Indirect Guarantees*<br />

Millions of dollars<br />

Commitment Expiration by Period<br />

2008– After<br />

Total 2007 2010 2011 2011<br />

Guarantees of nonconsolidated<br />

affi liates or<br />

joint-venture obligations $ 296 $ 21 $ 253 $ 9 $ 13<br />

Guarantees of obligations<br />

of third parties 131 4 113 3 11<br />

Guarantees of Equilon debt<br />

and leases 119 14 38 11 56<br />

* The amounts exclude indemnifications of contingencies associated with the sale of the<br />

company’s interest in Equilon and Motiva in 2002, as discussed in the “Indemnifications”<br />

section on page 39.<br />

At December 31, <strong>2006</strong>, the company and its subsidiaries<br />

provided guarantees, either directly or indirectly, of<br />

$296 million for notes and other contractual obligations of<br />

affi liated companies and $131 million for third parties, as<br />

described by major category below. There are no amounts<br />

being carried as liabilities for the company’s obligations<br />

under these guarantees.<br />

The $296 million in guarantees provided to affiliates<br />

related to borrowings for capital projects. These guarantees<br />

were undertaken to achieve lower interest rates and generally<br />

cover the construction periods of the capital projects. Included<br />

in these amounts are the company’s guarantees of $214 million<br />

associated with a construction completion guarantee for<br />

the debt financing of the company’s equity interest in the<br />

BTC crude oil pipeline project. Substantially all of the $296<br />

million guaranteed will expire between 2007 and 2011, with<br />

the remaining expiring by the end of 2015. Under the terms<br />

of the guarantees, the company would be required to fulfill<br />

the guarantee should an affiliate be in default of its loan<br />

terms, generally for the full amounts disclosed.<br />

The $131 million in guarantees provided on behalf of<br />

third parties relate to construction loans to governments of<br />

certain of the company’s international upstream operations.<br />

Substantially all of the $131 million in guarantees expire by<br />

2011, with the remainder expiring by 2015. The company<br />

would be required to perform under the terms of the guarantees<br />

should an entity be in default of its loan or contract<br />

terms, generally for the full amounts disclosed.<br />

At December 31, <strong>2006</strong>, <strong>Chevron</strong> also had outstanding<br />

guarantees for about $120 million of Equilon debt and leases.<br />

Following the February 2002 disposition of its interest in<br />

Equilon, the company received an indemnification from Shell<br />

for any claims arising from the guarantees. The company has<br />

38 CHEVRON CORPORATION <strong>2006</strong> ANNUAL REPORT