Chevron 2006 Annual Report

Chevron 2006 Annual Report

Chevron 2006 Annual Report

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

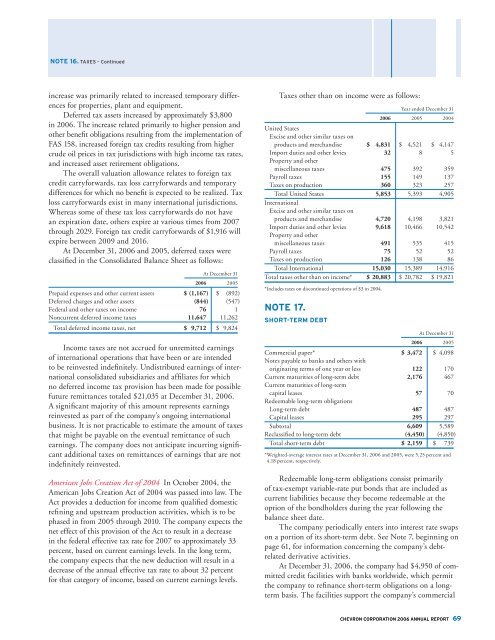

NOTE 16. TAXES – Continued<br />

increase was primarily related to increased temporary differences<br />

for properties, plant and equipment.<br />

Deferred tax assets increased by approximately $3,800<br />

in <strong>2006</strong>. The increase related primarily to higher pension and<br />

other benefit obligations resulting from the implementation of<br />

FAS 158, increased foreign tax credits resulting from higher<br />

crude oil prices in tax jurisdictions with high income tax rates,<br />

and increased asset retirement obligations.<br />

The overall valuation allowance relates to foreign tax<br />

credit carry forwards, tax loss carryforwards and temporary<br />

differences for which no benefit is expected to be realized. Tax<br />

loss carry forwards exist in many international jurisdictions.<br />

Whereas some of these tax loss carry forwards do not have<br />

an expiration date, others expire at various times from 2007<br />

through 2029. Foreign tax credit carryforwards of $1,916 will<br />

expire between 2009 and 2016.<br />

At December 31, <strong>2006</strong> and 2005, deferred taxes were<br />

classified in the Consolidated Balance Sheet as follows:<br />

At December 31<br />

<strong>2006</strong> 2005<br />

Prepaid expenses and other current assets $ (1,167) $ (892)<br />

Deferred charges and other assets (844) (547)<br />

Federal and other taxes on income 76 1<br />

Noncurrent deferred income taxes 11,647 11,262<br />

Total deferred income taxes, net $ 9,712 $ 9,824<br />

Income taxes are not accrued for unremitted earnings<br />

of international operations that have been or are intended<br />

to be reinvested indefinitely. Undistributed earnings of international<br />

consolidated subsidiaries and affiliates for which<br />

no deferred income tax provision has been made for possible<br />

future remittances totaled $21,035 at December 31, <strong>2006</strong>.<br />

A significant majority of this amount represents earnings<br />

reinvested as part of the company’s ongoing international<br />

business. It is not practicable to estimate the amount of taxes<br />

that might be payable on the eventual remittance of such<br />

earnings. The company does not anticipate incurring significant<br />

additional taxes on remittances of earnings that are not<br />

indefinitely reinvested.<br />

American Jobs Creation Act of 2004 In October 2004, the<br />

Amer ican Jobs Creation Act of 2004 was passed into law. The<br />

Act provides a deduction for income from qualified domestic<br />

refining and upstream production activities, which is to be<br />

phased in from 2005 through 2010. The company expects the<br />

net effect of this provision of the Act to result in a decrease<br />

in the federal effective tax rate for 2007 to approximately 33<br />

percent, based on current earnings levels. In the long term,<br />

the company expects that the new deduction will result in a<br />

decrease of the annual effective tax rate to about 32 percent<br />

for that category of income, based on current earnings levels.<br />

Taxes other than on income were as follows:<br />

Year ended December 31<br />

<strong>2006</strong> 2005 2004<br />

United States<br />

Excise and other similar taxes on<br />

products and merchandise $ 4,831 $ 4,521 $ 4,147<br />

Import duties and other levies 32 8 5<br />

Property and other<br />

miscellaneous taxes 475 392 359<br />

Payroll taxes 155 149 137<br />

Taxes on production 360 323 257<br />

Total United States 5,853 5,393 4,905<br />

International<br />

Excise and other similar taxes on<br />

products and merchandise 4,720 4,198 3,821<br />

Import duties and other levies 9,618 10,466 10,542<br />

Property and other<br />

miscellaneous taxes 491 535 415<br />

Payroll taxes 75 52 52<br />

Taxes on production 126 138 86<br />

Total International 15,030 15,389 14,916<br />

Total taxes other than on income* $ 20,883 $ 20,782 $ 19,821<br />

* Includes taxes on discontinued operations of $3 in 2004.<br />

NOTE 17.<br />

SHORT-TERM DEBT<br />

At December 31<br />

<strong>2006</strong> 2005<br />

Commercial paper* $ 3,472 $ 4,098<br />

Notes payable to banks and others with<br />

originating terms of one year or less 122 170<br />

Current maturities of long-term debt 2,176 467<br />

Current maturities of long-term<br />

capital leases 57 70<br />

Redeemable long-term obligations<br />

Long-term debt 487 487<br />

Capital leases 295 297<br />

Subtotal 6,609 5,589<br />

Reclassified to long-term debt (4,450) (4,850)<br />

Total short-term debt $ 2,159 $ 739<br />

* Weighted-average interest rates at December 31, <strong>2006</strong> and 2005, were 5.25 percent and<br />

4.18 percent, respectively.<br />

Redeemable long-term obligations consist primarily<br />

of tax-exempt variable-rate put bonds that are included as<br />

current liabilities because they become redeemable at the<br />

option of the bondholders during the year following the<br />

balance sheet date.<br />

The company periodically enters into interest rate swaps<br />

on a portion of its short-term debt. See Note 7, beginning on<br />

page 61, for information concerning the company’s debtrelated<br />

derivative activities.<br />

At December 31, <strong>2006</strong>, the company had $4,950 of committed<br />

credit facilities with banks worldwide, which permit<br />

the company to refinance short-term obligations on a longterm<br />

basis. The facilities support the company’s commercial<br />

CHEVRON CORPORATION <strong>2006</strong> ANNUAL REPORT 69