Chevron 2006 Annual Report

Chevron 2006 Annual Report

Chevron 2006 Annual Report

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

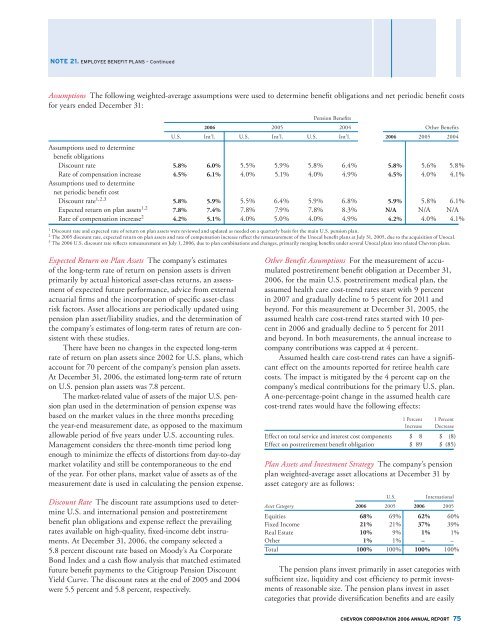

NOTE 21. EMPLOYEE BENEFIT PLANS – Continued<br />

Assumptions The following weighted-average assumptions were used to determine benefit obligations and net periodic benefit costs<br />

for years ended December 31:<br />

Pension Benefits<br />

<strong>2006</strong> 2005 2004 Other Benefits<br />

U.S. Int’l. U.S. Int’l. U.S. Int’l. <strong>2006</strong> 2005 2004<br />

Assumptions used to determine<br />

benefit obligations<br />

Discount rate 5.8% 6.0% 5.5% 5.9% 5.8% 6.4% 5.8% 5.6% 5.8%<br />

Rate of compensation increase 4.5% 6.1% 4.0% 5.1% 4.0% 4.9% 4.5% 4.0% 4.1%<br />

Assumptions used to determine<br />

net periodic benefit cost<br />

Discount rate 1,2,3 5.8% 5.9% 5.5% 6.4% 5.9% 6.8% 5.9% 5.8% 6.1%<br />

Expected return on plan assets 1,2 7.8% 7.4% 7.8% 7.9% 7.8% 8.3% N/A N/A N/A<br />

Rate of compensation increase 2 4.2% 5.1% 4.0% 5.0% 4.0% 4.9% 4.2% 4.0% 4.1%<br />

1 Discount rate and expected rate of return on plan assets were reviewed and updated as needed on a quarterly basis for the main U.S. pension plan.<br />

2 The 2005 discount rate, expected return on plan assets and rate of compensation increase reflect the remeasurement of the Unocal benefit plans at July 31, 2005, due to the acquisition of Unocal.<br />

3 The <strong>2006</strong> U.S. discount rate reflects remeasurement on July 1, <strong>2006</strong>, due to plan combinations and changes, primarily merging benefits under several Unocal plans into related <strong>Chevron</strong> plans.<br />

Expected Return on Plan Assets The company’s estimates<br />

of the long-term rate of return on pension assets is driven<br />

primarily by actual historical asset-class returns, an assessment<br />

of expected future performance, advice from external<br />

actuarial firms and the incorporation of specific asset-class<br />

risk factors. Asset allocations are periodically updated using<br />

pension plan asset/liability studies, and the determination of<br />

the company’s estimates of long-term rates of return are consistent<br />

with these studies.<br />

There have been no changes in the expected long-term<br />

rate of return on plan assets since 2002 for U.S. plans, which<br />

account for 70 percent of the company’s pension plan assets.<br />

At December 31, <strong>2006</strong>, the estimated long-term rate of return<br />

on U.S. pension plan assets was 7.8 percent.<br />

The market-related value of assets of the major U.S. pension<br />

plan used in the determination of pension expense was<br />

based on the market values in the three months preceding<br />

the year-end measurement date, as opposed to the maximum<br />

allowable period of five years under U.S. accounting rules.<br />

Management considers the three-month time period long<br />

enough to minimize the effects of distortions from day-to-day<br />

market volatility and still be contemporaneous to the end<br />

of the year. For other plans, market value of assets as of the<br />

measurement date is used in calculating the pension expense.<br />

Discount Rate The discount rate assumptions used to determine<br />

U.S. and international pension and postretirement<br />

benefit plan obligations and expense reflect the prevailing<br />

rates available on high-quality, fi xed-income debt instruments.<br />

At December 31, <strong>2006</strong>, the company selected a<br />

5.8 percent discount rate based on Moody’s Aa Corporate<br />

Bond Index and a cash flow analysis that matched estimated<br />

future benefit payments to the Citigroup Pension Discount<br />

Yield Curve. The discount rates at the end of 2005 and 2004<br />

were 5.5 percent and 5.8 percent, respectively.<br />

Other Benefi t Assumptions For the measurement of accumulated<br />

postretirement benefit obligation at December 31,<br />

<strong>2006</strong>, for the main U.S. postretirement medical plan, the<br />

assumed health care cost-trend rates start with 9 percent<br />

in 2007 and gradually decline to 5 percent for 2011 and<br />

beyond. For this measurement at December 31, 2005, the<br />

assumed health care cost-trend rates started with 10 percent<br />

in <strong>2006</strong> and gradually decline to 5 percent for 2011<br />

and beyond. In both measurements, the annual increase to<br />

company contributions was capped at 4 percent.<br />

Assumed health care cost-trend rates can have a significant<br />

effect on the amounts reported for retiree health care<br />

costs. The impact is mitigated by the 4 percent cap on the<br />

company’s medical contributions for the primary U.S. plan.<br />

A one-percentage-point change in the assumed health care<br />

cost-trend rates would have the following effects:<br />

1 Percent 1 Percent<br />

Increase Decrease<br />

Effect on total service and interest cost components $ 8 $ (8)<br />

Effect on postretirement benefit obligation $ 89 $ (85)<br />

Plan Assets and Investment Strategy The company’s pension<br />

plan weighted-average asset allocations at December 31 by<br />

asset category are as follows:<br />

U.S.<br />

International<br />

Asset Category <strong>2006</strong> 2005 <strong>2006</strong> 2005<br />

Equities 68% 69% 62% 60%<br />

Fixed Income 21% 21% 37% 39%<br />

Real Estate 10% 9% 1% 1%<br />

Other 1% 1% – –<br />

Total 100% 100% 100% 100%<br />

The pension plans invest primarily in asset categories with<br />

sufficient size, liquidity and cost efficiency to permit investments<br />

of reasonable size. The pension plans invest in asset<br />

categories that provide diversification benefits and are easily<br />

CHEVRON CORPORATION <strong>2006</strong> ANNUAL REPORT 75