Chevron 2006 Annual Report

Chevron 2006 Annual Report

Chevron 2006 Annual Report

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

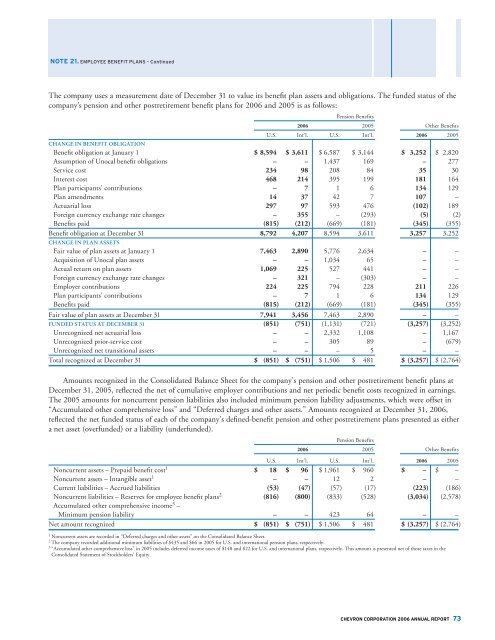

NOTE 21. EMPLOYEE BENEFIT PLANS – Continued<br />

The company uses a measurement date of December 31 to value its benefit plan assets and obligations. The funded status of the<br />

company’s pension and other postretirement benefit plans for <strong>2006</strong> and 2005 is as follows:<br />

Pension Benefits<br />

<strong>2006</strong> 2005 Other Benefits<br />

U.S. Int’l. U.S. Int’l. <strong>2006</strong> 2005<br />

CHANGE IN BENEFIT OBLIGATION<br />

Benefit obligation at January 1 $ 8,594 $ 3,611 $ 6,587 $ 3,144 $ 3,252 $ 2,820<br />

Assumption of Unocal benefit obligations – – 1,437 169 – 277<br />

Service cost 234 98 208 84 35 30<br />

Interest cost 468 214 395 199 181 164<br />

Plan participants’ contributions – 7 1 6 134 129<br />

Plan amendments 14 37 42 7 107 –<br />

Actuarial loss 297 97 593 476 (102) 189<br />

Foreign currency exchange rate changes – 355 – (293) (5) (2)<br />

Benefits paid (815) (212) (669) (181) (345) (355)<br />

Benefit obligation at December 31 8,792 4,207 8,594 3,611 3,257 3,252<br />

CHANGE IN PLAN ASSETS<br />

Fair value of plan assets at January 1 7,463 2,890 5,776 2,634 – –<br />

Acquisition of Unocal plan assets – – 1,034 65 – –<br />

Actual return on plan assets 1,069 225 527 441 – –<br />

Foreign currency exchange rate changes – 321 – (303) – –<br />

Employer contributions 224 225 794 228 211 226<br />

Plan participants’ contributions – 7 1 6 134 129<br />

Benefits paid (815) (212) (669) (181) (345) (355)<br />

Fair value of plan assets at December 31 7,941 3,456 7,463 2,890 – –<br />

FUNDED STATUS AT DECEMBER 31 (851) (751) (1,131) (721) (3,257) (3,252)<br />

Unrecognized net actuarial loss – – 2,332 1,108 – 1,167<br />

Unrecognized prior-service cost – – 305 89 – (679)<br />

Unrecognized net transitional assets – – – 5 – –<br />

Total recognized at December 31 $ (851) $ (751) $ 1,506 $ 481 $ (3,257) $ (2,764)<br />

Amounts recognized in the Consolidated Balance Sheet for the company’s pension and other postretirement benefit plans at<br />

December 31, 2005, reflected the net of cumulative employer contributions and net periodic benefit costs recognized in earnings.<br />

The 2005 amounts for noncurrent pension liabilities also included minimum pension liability adjustments, which were offset in<br />

“Accumulated other comprehensive loss” and “Deferred charges and other assets.” Amounts recognized at December 31, <strong>2006</strong>,<br />

reflected the net funded status of each of the company’s defined-benefit pension and other postretirement plans presented as either<br />

a net asset (overfunded) or a liability (underfunded).<br />

Pension Benefits<br />

<strong>2006</strong> 2005 Other Benefits<br />

U.S. Int’l. U.S. Int’l. <strong>2006</strong> 2005<br />

Noncurrent assets – Prepaid benefit cost 1 $ 18 $ 96 $ 1,961 $ 960 $ – $ –<br />

Noncurrent assets – Intangible asset 1 – – 12 2 – –<br />

Current liabilities – Accrued liabilities (53) (47) (57) (17) (223) (186)<br />

Noncurrent liabilities – Reserves for employee benefit plans 2 (816) (800) (833) (528) (3,034) (2,578)<br />

Accumulated other comprehensive income 3 –<br />

Minimum pension liability – – 423 64 – –<br />

Net amount recognized $ (851) $ (751) $ 1,506 $ 481 $ (3,257) $ (2,764)<br />

1 Noncurrent assets are recorded in “Deferred charges and other assets” on the Consolidated Balance Sheet.<br />

2 The company recorded additional minimum liabilities of $435 and $66 in 2005 for U.S. and international pension plans, respectively.<br />

3 “Accumulated other comprehensive loss” in 2005 includes deferred income taxes of $148 and $22 for U.S. and international plans, respectively. This amount is presented net of those taxes in the<br />

Consolidated Statement of Stockholders’ Equity.<br />

CHEVRON CORPORATION <strong>2006</strong> ANNUAL REPORT 73