Chevron 2006 Annual Report

Chevron 2006 Annual Report

Chevron 2006 Annual Report

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

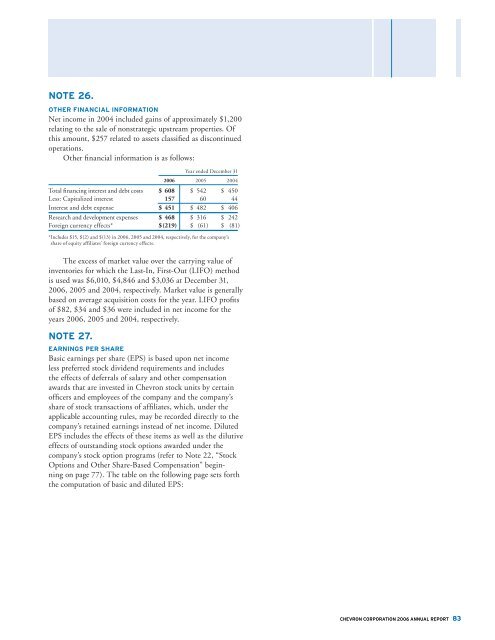

NOTE 26.<br />

OTHER FINANCIAL INFORMATION<br />

Net income in 2004 included gains of approximately $1,200<br />

relating to the sale of nonstrategic upstream properties. Of<br />

this amount, $257 related to assets classified as discontinued<br />

operations.<br />

Other financial information is as follows:<br />

Year ended December 31<br />

<strong>2006</strong> 2005 2004<br />

Total financing interest and debt costs $ 608 $ 542 $ 450<br />

Less: Capitalized interest 157 60 44<br />

Interest and debt expense $ 451 $ 482 $ 406<br />

Research and development expenses $ 468 $ 316 $ 242<br />

Foreign currency effects* $ (219) $ (61) $ (81)<br />

* Includes $15, $(2) and $(13) in <strong>2006</strong>, 2005 and 2004, respectively, for the company’s<br />

share of equity affi liates’ foreign currency effects.<br />

The excess of market value over the carrying value of<br />

inventories for which the Last-In, First-Out (LIFO) method<br />

is used was $6,010, $4,846 and $3,036 at December 31,<br />

<strong>2006</strong>, 2005 and 2004, respectively. Market value is generally<br />

based on average acquisition costs for the year. LIFO profits<br />

of $82, $34 and $36 were included in net income for the<br />

years <strong>2006</strong>, 2005 and 2004, respectively.<br />

NOTE 27.<br />

EARNINGS PER SHARE<br />

Basic earnings per share (EPS) is based upon net income<br />

less preferred stock dividend requirements and includes<br />

the effects of deferrals of salary and other compensation<br />

awards that are invested in <strong>Chevron</strong> stock units by certain<br />

officers and employees of the company and the company’s<br />

share of stock transactions of affi liates, which, under the<br />

applicable accounting rules, may be recorded directly to the<br />

company’s retained earnings instead of net income. Diluted<br />

EPS includes the effects of these items as well as the dilutive<br />

effects of outstanding stock options awarded under the<br />

company’s stock option programs (refer to Note 22, “Stock<br />

Options and Other Share-Based Compensation” beginning<br />

on page 77). The table on the following page sets forth<br />

the computation of basic and diluted EPS:<br />

CHEVRON CORPORATION <strong>2006</strong> ANNUAL REPORT 83