HII Ingalls Shipbuilding Inc. Hourly Employees ... - Benefits Connect

HII Ingalls Shipbuilding Inc. Hourly Employees ... - Benefits Connect

HII Ingalls Shipbuilding Inc. Hourly Employees ... - Benefits Connect

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>HII</strong> <strong>Ingalls</strong> <strong>Shipbuilding</strong> <strong>Inc</strong>. <strong>Hourly</strong> <strong>Employees</strong>’ Retirement Plan<br />

Summary Plan Description<br />

March 2011<br />

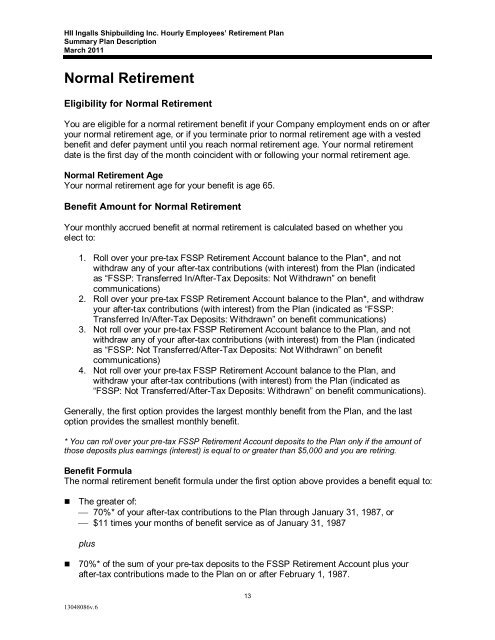

Normal Retirement<br />

Eligibility for Normal Retirement<br />

You are eligible for a normal retirement benefit if your Company employment ends on or after<br />

your normal retirement age, or if you terminate prior to normal retirement age with a vested<br />

benefit and defer payment until you reach normal retirement age. Your normal retirement<br />

date is the first day of the month coincident with or following your normal retirement age.<br />

Normal Retirement Age<br />

Your normal retirement age for your benefit is age 65.<br />

Benefit Amount for Normal Retirement<br />

Your monthly accrued benefit at normal retirement is calculated based on whether you<br />

elect to:<br />

1. Roll over your pre-tax FSSP Retirement Account balance to the Plan*, and not<br />

withdraw any of your after-tax contributions (with interest) from the Plan (indicated<br />

as “FSSP: Transferred In/After-Tax Deposits: Not Withdrawn” on benefit<br />

communications)<br />

2. Roll over your pre-tax FSSP Retirement Account balance to the Plan*, and withdraw<br />

your after-tax contributions (with interest) from the Plan (indicated as “FSSP:<br />

Transferred In/After-Tax Deposits: Withdrawn” on benefit communications)<br />

3. Not roll over your pre-tax FSSP Retirement Account balance to the Plan, and not<br />

withdraw any of your after-tax contributions (with interest) from the Plan (indicated<br />

as “FSSP: Not Transferred/After-Tax Deposits: Not Withdrawn” on benefit<br />

communications)<br />

4. Not roll over your pre-tax FSSP Retirement Account balance to the Plan, and<br />

withdraw your after-tax contributions (with interest) from the Plan (indicated as<br />

“FSSP: Not Transferred/After-Tax Deposits: Withdrawn” on benefit communications).<br />

Generally, the first option provides the largest monthly benefit from the Plan, and the last<br />

option provides the smallest monthly benefit.<br />

* You can roll over your pre-tax FSSP Retirement Account deposits to the Plan only if the amount of<br />

those deposits plus earnings (interest) is equal to or greater than $5,000 and you are retiring.<br />

Benefit Formula<br />

The normal retirement benefit formula under the first option above provides a benefit equal to:<br />

• The greater of:<br />

⎯ 70%* of your after-tax contributions to the Plan through January 31, 1987, or<br />

⎯ $11 times your months of benefit service as of January 31, 1987<br />

plus<br />

• 70%* of the sum of your pre-tax deposits to the FSSP Retirement Account plus your<br />

after-tax contributions made to the Plan on or after February 1, 1987.<br />

13048086v.6<br />

13