HII Ingalls Shipbuilding Inc. Hourly Employees ... - Benefits Connect

HII Ingalls Shipbuilding Inc. Hourly Employees ... - Benefits Connect

HII Ingalls Shipbuilding Inc. Hourly Employees ... - Benefits Connect

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

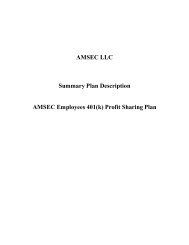

<strong>HII</strong> <strong>Ingalls</strong> <strong>Shipbuilding</strong> <strong>Inc</strong>. <strong>Hourly</strong> <strong>Employees</strong>’ Retirement Plan<br />

Summary Plan Description<br />

March 2011<br />

This option assumes you do not roll over your pre-tax FSSP Retirement Account balance to<br />

the Plan and do not withdraw your after-tax contributions (with interest) from the Plan. Your<br />

“FSSP: Not Transferred/After-Tax Deposits: Not Withdrawn” Plan early retirement benefit<br />

would be determined as follows.<br />

1. First, determine your normal retirement benefit<br />

You would receive the greater of:<br />

• 70% x ($0) = $0 annually<br />

plus<br />

OR<br />

$11 x 0 months = $0 annually<br />

• 70% x ($67,000 + $5,000) = $50,400.00 annually<br />

equals<br />

• Total benefit = $50,400.00<br />

Then, we determine the annuity equivalent of your pre-tax FSSP Retirement Account<br />

balance ($125,000 from the “Assumptions”) and subtract this from your total maximum<br />

benefit:<br />

• Annuity equivalent of pre-tax<br />

Retirement Account balance<br />

$125,000 x factor of 0.1392 = $17,400.00<br />

• Total maximum benefit of $50,400<br />

minus<br />

Annuity equivalent of pre-tax<br />

Retirement Account balance<br />

of $17,400 = $33,000.00<br />

2. Then, calculate your early retirement benefit<br />

At age 60, you receive 88% of your normal retirement benefit:<br />

• 88% x $33,000 = $29,040 annually<br />

To determine your monthly benefit, divide your annual benefit by 12.<br />

In this example, your pre-tax Retirement Account balance of $125,000 will be paid according<br />

to the FSSP plan rules and your instructions. In addition, you will receive the annuity benefit<br />

shown above.<br />

Example 4 ⎯ FSSP: Not Transferred/After-Tax Deposits: Withdrawn<br />

This option assumes you do not roll over your pre-tax FSSP Retirement Account balance to<br />

the Plan and you withdraw your after-tax contributions (with interest) from the Plan. Your<br />

13048086v.6<br />

22