2011 Annual Report - the solid group inc website

2011 Annual Report - the solid group inc website

2011 Annual Report - the solid group inc website

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

- 37 -<br />

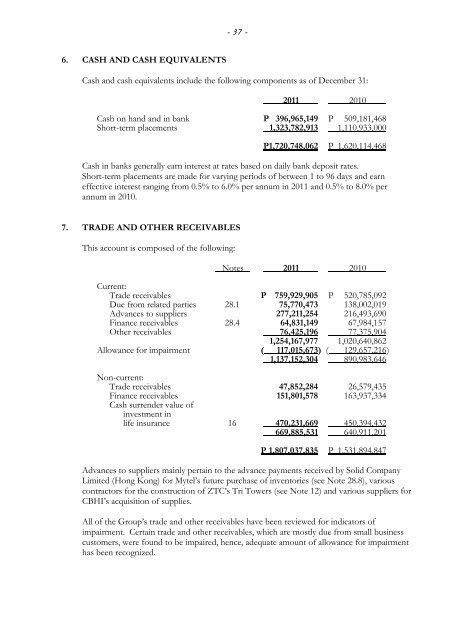

6. CASH AND CASH EQUIVALENTS<br />

Cash and cash equivalents <strong>inc</strong>lude <strong>the</strong> following components as of December 31:<br />

<strong>2011</strong> 2010<br />

Cash on hand and in bank P 396,965,149 P 509,181,468<br />

Short-term placements 1,323,782,913 1,110,933,000<br />

P1,720,748,062 P 1,620,114,468<br />

Cash in banks generally earn interest at rates based on daily bank deposit rates.<br />

Short-term placements are made for varying periods of between 1 to 96 days and earn<br />

effective interest ranging from 0.5% to 6.0% per annum in <strong>2011</strong> and 0.5% to 8.0% per<br />

annum in 2010.<br />

7. TRADE AND OTHER RECEIVABLES<br />

This account is composed of <strong>the</strong> following:<br />

Notes <strong>2011</strong> 2010<br />

Current:<br />

Trade receivables P 759,929,905 P 520,785,092<br />

Due from related parties 28.1 75,770,473 138,002,019<br />

Advances to suppliers 277,211,254 216,493,690<br />

Finance receivables 28.4 64,831,149 67,984,157<br />

O<strong>the</strong>r receivables 76,425,196 77,375,904<br />

1,254,167,977 1,020,640,862<br />

Allowance for impairment ( 117,015,673) ( 129,657,216 )<br />

1,137,152,304 890,983,646<br />

Non-current:<br />

Trade receivables 47,852,284 26,579,435<br />

Finance receivables 151,801,578 163,937,334<br />

Cash surrender value of<br />

investment in<br />

life insurance 16 470,231,669 450,394,432<br />

669,885,531 640,911,201<br />

P 1,807,037,835 P 1,531,894,847<br />

Advances to suppliers mainly pertain to <strong>the</strong> advance payments received by Solid Company<br />

Limited (Hong Kong) for Mytel’s future purchase of inventories (see Note 28.8), various<br />

contractors for <strong>the</strong> construction of ZTC’s Tri Towers (see Note 12) and various suppliers for<br />

CBHI’s acquisition of supplies.<br />

All of <strong>the</strong> Group’s trade and o<strong>the</strong>r receivables have been reviewed for indicators of<br />

impairment. Certain trade and o<strong>the</strong>r receivables, which are mostly due from small business<br />

customers, were found to be impaired, hence, adequate amount of allowance for impairment<br />

has been recognized.