2011 Annual Report - the solid group inc website

2011 Annual Report - the solid group inc website

2011 Annual Report - the solid group inc website

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

73<br />

Exposures to foreign exchange rates vary during <strong>the</strong> year depending on <strong>the</strong> volume of<br />

overseas transactions. None<strong>the</strong>less, <strong>the</strong> analysis above is considered to be representative of<br />

<strong>the</strong> Group’s foreign currency risk.<br />

31.2 Interest Rate Sensitivity<br />

At December 31, <strong>2011</strong>, 2010 and 2009, <strong>the</strong> Group is exposed to changes in market interest<br />

rates through its cash and cash equivalents, which are subject to variable interest rates<br />

(see Note 6).<br />

The following illustrates <strong>the</strong> sensitivity of profit before tax for <strong>the</strong> year to a reasonably<br />

possible change in interest rates of +/-1.17% in <strong>2011</strong>, +/-1.19% in 2010 and +/-7.21% in<br />

2009. These changes in rates have been determined based on <strong>the</strong> average market volatility<br />

in interest rates, using standard deviation, in <strong>the</strong> previous 12 months, estimated at 99%<br />

level of confidence. The sensitivity analysis is based on <strong>the</strong> Group’s financial instruments<br />

held at each reporting date, with effect estimated from <strong>the</strong> beginning of <strong>the</strong> year. All o<strong>the</strong>r<br />

variables held constant, if <strong>the</strong> interest rate <strong>inc</strong>reased by 1.17%, 1.19% and 7.21%, profit<br />

before tax in <strong>2011</strong>, 2010 and 2009 would have <strong>inc</strong>reased by P14.1 million, P13.2 million,<br />

and P68.1 million, respectively. Conversely, if <strong>the</strong> interest rate decreased by <strong>the</strong> same<br />

percentages, profit before tax would have been lower by <strong>the</strong> same amounts.<br />

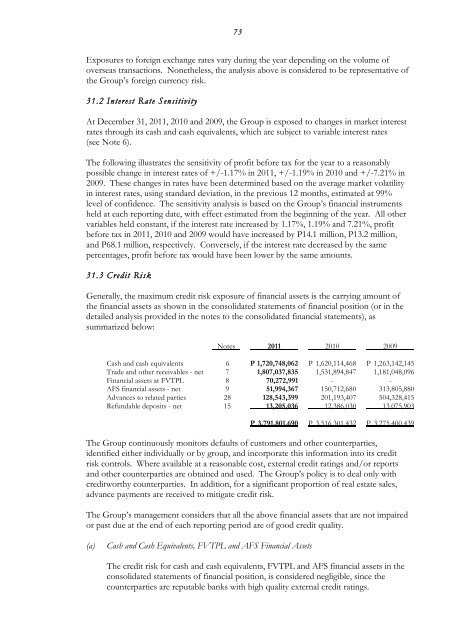

31.3 Credit Risk<br />

Generally, <strong>the</strong> maximum credit risk exposure of financial assets is <strong>the</strong> carrying amount of<br />

<strong>the</strong> financial assets as shown in <strong>the</strong> con<strong>solid</strong>ated statements of financial position (or in <strong>the</strong><br />

detailed analysis provided in <strong>the</strong> notes to <strong>the</strong> con<strong>solid</strong>ated financial statements), as<br />

summarized below:<br />

Notes <strong>2011</strong> 2010 2009<br />

Cash and cash equivalents 6 P 1,720,748,062 P 1,620,114,468 P 1,263,142,145<br />

Trade and o<strong>the</strong>r receivables - net 7 1,807,037,835 1,531,894,847 1,181,048,096<br />

Financial assets at FVTPL 8 70,272,991 - -<br />

AFS financial assets - net 9 51,994,367 150,712,680 313,805,880<br />

Advances to related parties 28 128,543,399 201,193,407 504,328,415<br />

Refundable deposits - net 15 13,205,036 12,386,030 13,075,903<br />

P 3,791,801,690 P 3,516,301,432 P 3,275,400,439<br />

The Group continuously monitors defaults of customers and o<strong>the</strong>r counterparties,<br />

identified ei<strong>the</strong>r individually or by <strong>group</strong>, and <strong>inc</strong>orporate this information into its credit<br />

risk controls. Where available at a reasonable cost, external credit ratings and/or reports<br />

and o<strong>the</strong>r counterparties are obtained and used. The Group’s policy is to deal only with<br />

creditworthy counterparties. In addition, for a significant proportion of real estate sales,<br />

advance payments are received to mitigate credit risk.<br />

The Group’s management considers that all <strong>the</strong> above financial assets that are not impaired<br />

or past due at <strong>the</strong> end of each reporting period are of good credit quality.<br />

(a)<br />

Cash and Cash Equivalents, FVTPL and AFS Financial Assets<br />

The credit risk for cash and cash equivalents, FVTPL and AFS financial assets in <strong>the</strong><br />

con<strong>solid</strong>ated statements of financial position, is considered negligible, s<strong>inc</strong>e <strong>the</strong><br />

counterparties are reputable banks with high quality external credit ratings.