2011 Annual Report - the solid group inc website

2011 Annual Report - the solid group inc website

2011 Annual Report - the solid group inc website

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

- 39 -<br />

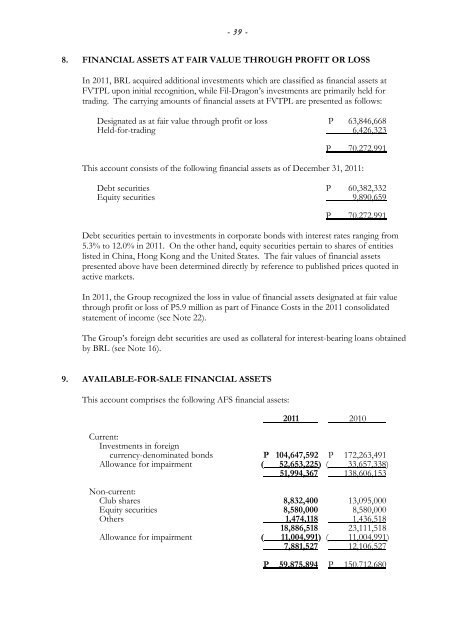

8. FINANCIAL ASSETS AT FAIR VALUE THROUGH PROFIT OR LOSS<br />

In <strong>2011</strong>, BRL acquired additional investments which are classified as financial assets at<br />

FVTPL upon initial recognition, while Fil-Dragon’s investments are primarily held for<br />

trading. The carrying amounts of financial assets at FVTPL are presented as follows:<br />

Designated as at fair value through profit or loss P 63,846,668<br />

Held-for-trading 6,426,323<br />

P 70,272,991<br />

This account consists of <strong>the</strong> following financial assets as of December 31, <strong>2011</strong>:<br />

Debt securities P 60,382,332<br />

Equity securities 9,890,659<br />

P 70,272,991<br />

Debt securities pertain to investments in corporate bonds with interest rates ranging from<br />

5.3% to 12.0% in <strong>2011</strong>. On <strong>the</strong> o<strong>the</strong>r hand, equity securities pertain to shares of entities<br />

listed in China, Hong Kong and <strong>the</strong> United States. The fair values of financial assets<br />

presented above have been determined directly by reference to published prices quoted in<br />

active markets.<br />

In <strong>2011</strong>, <strong>the</strong> Group recognized <strong>the</strong> loss in value of financial assets designated at fair value<br />

through profit or loss of P5.9 million as part of Finance Costs in <strong>the</strong> <strong>2011</strong> con<strong>solid</strong>ated<br />

statement of <strong>inc</strong>ome (see Note 22).<br />

The Group’s foreign debt securities are used as collateral for interest-bearing loans obtained<br />

by BRL (see Note 16).<br />

9. AVAILABLE-FOR-SALE FINANCIAL ASSETS<br />

This account comprises <strong>the</strong> following AFS financial assets:<br />

<strong>2011</strong> 2010<br />

Current:<br />

Investments in foreign<br />

currency-denominated bonds P 104,647,592 P 172,263,491<br />

Allowance for impairment ( 52,653,225) ( 33,657,338)<br />

51,994,367 138,606,153<br />

Non-current:<br />

Club shares 8,832,400 13,095,000<br />

Equity securities 8,580,000 8,580,000<br />

O<strong>the</strong>rs 1,474,118 1,436,518<br />

18,886,518 23,111,518<br />

Allowance for impairment ( 11,004,991) ( 11,004,991 )<br />

7,881,527 12,106,527<br />

P 59,875,894 P 150,712,680