2011 Annual Report - the solid group inc website

2011 Annual Report - the solid group inc website

2011 Annual Report - the solid group inc website

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

- 38 -<br />

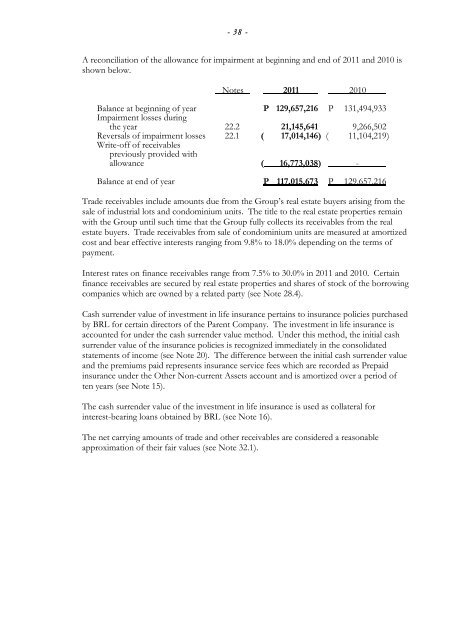

A reconciliation of <strong>the</strong> allowance for impairment at beginning and end of <strong>2011</strong> and 2010 is<br />

shown below.<br />

Notes <strong>2011</strong> 2010<br />

Balance at beginning of year P 129,657,216 P 131,494,933<br />

Impairment losses during<br />

<strong>the</strong> year 22.2 21,145,641 9,266,502<br />

Reversals of impairment losses 22.1 ( 17,014,146) ( 11,104,219 )<br />

Write-off of receivables<br />

previously provided with<br />

allowance ( 16,773,038) -<br />

Balance at end of year P 117,015,673 P 129,657,216<br />

Trade receivables <strong>inc</strong>lude amounts due from <strong>the</strong> Group’s real estate buyers arising from <strong>the</strong><br />

sale of industrial lots and condominium units. The title to <strong>the</strong> real estate properties remain<br />

with <strong>the</strong> Group until such time that <strong>the</strong> Group fully collects its receivables from <strong>the</strong> real<br />

estate buyers. Trade receivables from sale of condominium units are measured at amortized<br />

cost and bear effective interests ranging from 9.8% to 18.0% depending on <strong>the</strong> terms of<br />

payment.<br />

Interest rates on finance receivables range from 7.5% to 30.0% in <strong>2011</strong> and 2010. Certain<br />

finance receivables are secured by real estate properties and shares of stock of <strong>the</strong> borrowing<br />

companies which are owned by a related party (see Note 28.4).<br />

Cash surrender value of investment in life insurance pertains to insurance policies purchased<br />

by BRL for certain directors of <strong>the</strong> Parent Company. The investment in life insurance is<br />

accounted for under <strong>the</strong> cash surrender value method. Under this method, <strong>the</strong> initial cash<br />

surrender value of <strong>the</strong> insurance policies is recognized immediately in <strong>the</strong> con<strong>solid</strong>ated<br />

statements of <strong>inc</strong>ome (see Note 20). The difference between <strong>the</strong> initial cash surrender value<br />

and <strong>the</strong> premiums paid represents insurance service fees which are recorded as Prepaid<br />

insurance under <strong>the</strong> O<strong>the</strong>r Non-current Assets account and is amortized over a period of<br />

ten years (see Note 15).<br />

The cash surrender value of <strong>the</strong> investment in life insurance is used as collateral for<br />

interest-bearing loans obtained by BRL (see Note 16).<br />

The net carrying amounts of trade and o<strong>the</strong>r receivables are considered a reasonable<br />

approximation of <strong>the</strong>ir fair values (see Note 32.1).