2011 Annual Report - the solid group inc website

2011 Annual Report - the solid group inc website

2011 Annual Report - the solid group inc website

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

50<br />

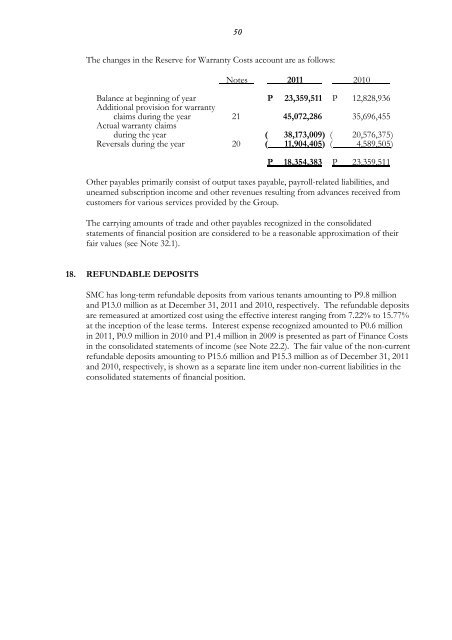

The changes in <strong>the</strong> Reserve for Warranty Costs account are as follows:<br />

Notes <strong>2011</strong> 2010<br />

Balance at beginning of year P 23,359,511 P 12,828,936<br />

Additional provision for warranty<br />

claims during <strong>the</strong> year 21 45,072,286 35,696,455<br />

Actual warranty claims<br />

during <strong>the</strong> year ( 38,173,009) ( 20,576,375 )<br />

Reversals during <strong>the</strong> year 20 ( 11,904,405) ( 4,589,505 )<br />

P 18,354,383 P 23,359,511<br />

O<strong>the</strong>r payables primarily consist of output taxes payable, payroll-related liabilities, and<br />

unearned subscription <strong>inc</strong>ome and o<strong>the</strong>r revenues resulting from advances received from<br />

customers for various services provided by <strong>the</strong> Group.<br />

The carrying amounts of trade and o<strong>the</strong>r payables recognized in <strong>the</strong> con<strong>solid</strong>ated<br />

statements of financial position are considered to be a reasonable approximation of <strong>the</strong>ir<br />

fair values (see Note 32.1).<br />

18. REFUNDABLE DEPOSITS<br />

SMC has long-term refundable deposits from various tenants amounting to P9.8 million<br />

and P13.0 million as at December 31, <strong>2011</strong> and 2010, respectively. The refundable deposits<br />

are remeasured at amortized cost using <strong>the</strong> effective interest ranging from 7.22% to 15.77%<br />

at <strong>the</strong> <strong>inc</strong>eption of <strong>the</strong> lease terms. Interest expense recognized amounted to P0.6 million<br />

in <strong>2011</strong>, P0.9 million in 2010 and P1.4 million in 2009 is presented as part of Finance Costs<br />

in <strong>the</strong> con<strong>solid</strong>ated statements of <strong>inc</strong>ome (see Note 22.2). The fair value of <strong>the</strong> non-current<br />

refundable deposits amounting to P15.6 million and P15.3 million as of December 31, <strong>2011</strong><br />

and 2010, respectively, is shown as a separate line item under non-current liabilities in <strong>the</strong><br />

con<strong>solid</strong>ated statements of financial position.