View Full December PDF Issue - Utility Contractor Online

View Full December PDF Issue - Utility Contractor Online

View Full December PDF Issue - Utility Contractor Online

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

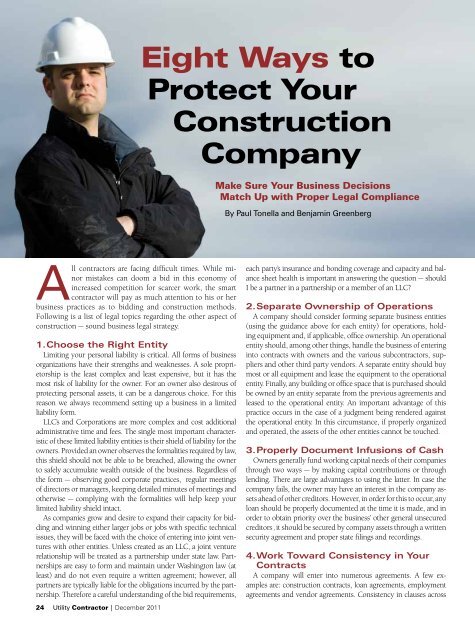

Eight Ways to<br />

Protect Your<br />

Construction<br />

Company<br />

Make Sure Your Business Decisions<br />

Match Up with Proper Legal Compliance<br />

By Paul Tonella and Benjamin Greenberg<br />

All contractors are facing difficult times. While minor<br />

mistakes can doom a bid in this economy of<br />

increased competition for scarcer work, the smart<br />

contractor will pay as much attention to his or her<br />

business practices as to bidding and construction methods.<br />

Following is a list of legal topics regarding the other aspect of<br />

construction — sound business legal strategy.<br />

1. Choose the Right Entity<br />

Limiting your personal liability is critical. All forms of business<br />

organizations have their strengths and weaknesses. A sole proprietorship<br />

is the least complex and least expensive, but it has the<br />

most risk of liability for the owner. For an owner also desirous of<br />

protecting personal assets, it can be a dangerous choice. For this<br />

reason we always recommend setting up a business in a limited<br />

liability form.<br />

LLC’s and Corporations are more complex and cost additional<br />

administrative time and fees. The single most important characteristic<br />

of these limited liability entities is their shield of liability for the<br />

owners. Provided an owner observes the formalities required by law,<br />

this shield should not be able to be breached, allowing the owner<br />

to safely accumulate wealth outside of the business. Regardless of<br />

the form — observing good corporate practices, regular meetings<br />

of directors or managers, keeping detailed minutes of meetings and<br />

otherwise — complying with the formalities will help keep your<br />

limited liability shield intact.<br />

As companies grow and desire to expand their capacity for bidding<br />

and winning either larger jobs or jobs with specific technical<br />

issues, they will be faced with the choice of entering into joint ventures<br />

with other entities. Unless created as an LLC, a joint venture<br />

relationship will be treated as a partnership under state law. Partnerships<br />

are easy to form and maintain under Washington law (at<br />

least) and do not even require a written agreement; however, all<br />

partners are typically liable for the obligations incurred by the partnership.<br />

Therefore a careful understanding of the bid requirements,<br />

24 <strong>Utility</strong> <strong>Contractor</strong> | <strong>December</strong> 2011<br />

each party’s insurance and bonding coverage and capacity and balance<br />

sheet health is important in answering the question — should<br />

I be a partner in a partnership or a member of an LLC?<br />

2. Separate Ownership of Operations<br />

A company should consider forming separate business entities<br />

(using the guidance above for each entity) for operations, holding<br />

equipment and, if applicable, office ownership. An operational<br />

entity should, among other things, handle the business of entering<br />

into contracts with owners and the various subcontractors, suppliers<br />

and other third party vendors. A separate entity should buy<br />

most or all equipment and lease the equipment to the operational<br />

entity. Finally, any building or office space that is purchased should<br />

be owned by an entity separate from the previous agreements and<br />

leased to the operational entity. An important advantage of this<br />

practice occurs in the case of a judgment being rendered against<br />

the operational entity. In this circumstance, if properly organized<br />

and operated, the assets of the other entities cannot be touched.<br />

3. Properly Document Infusions of Cash<br />

Owners generally fund working capital needs of their companies<br />

through two ways — by making capital contributions or through<br />

lending. There are large advantages to using the latter. In case the<br />

company fails, the owner may have an interest in the company assets<br />

ahead of other creditors. However, in order for this to occur, any<br />

loan should be properly documented at the time it is made, and in<br />

order to obtain priority over the business’ other general unsecured<br />

creditors , it should be secured by company assets through a written<br />

security agreement and proper state filings and recordings.<br />

4. Work Toward Consistency in Your<br />

Contracts<br />

A company will enter into numerous agreements. A few examples<br />

are: construction contracts, loan agreements, employment<br />

agreements and vendor agreements. Consistency in clauses across