2007-2008 - Cgglobal.com

2007-2008 - Cgglobal.com

2007-2008 - Cgglobal.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

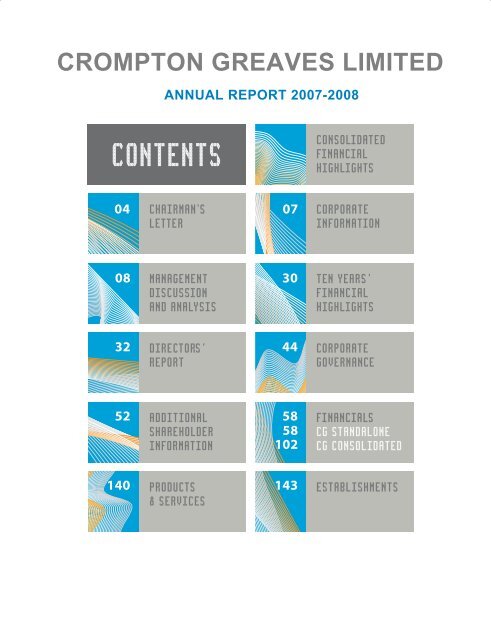

CROMPTON GREAVES LIMITED<br />

ANNUAL REPORT <strong>2007</strong>-<strong>2008</strong><br />

CONTENTS<br />

CONSOLIDATED<br />

FINANCIAL<br />

HIGHLIGHTS<br />

04 CHAIRMAN’S<br />

07<br />

LETTER<br />

CORPORATE<br />

INFORMATION<br />

08 MANAGEMENT<br />

30<br />

DISCUSSION<br />

AND ANALYSIS<br />

TEN YEARS’<br />

FINANCIAL<br />

HIGHLIGHTS<br />

32 DIRECTORS’<br />

44<br />

REPORT<br />

CORPORATE<br />

GOVERNANCE<br />

52 ADDITIONAL<br />

58<br />

SHAREHOLDER<br />

58<br />

INFORMATION<br />

102<br />

FINANCIALS<br />

CG STANDALONE<br />

CG CONSOLIDATED<br />

140 PRODUCTS<br />

143<br />

& SERVICES<br />

ESTABLISHMENTS

REVENUE<br />

RS. BILLION<br />

EARNINGS<br />

RS. BILLION<br />

OPERATING<br />

EBIDTA<br />

21<br />

38<br />

EARNINGS BEFORE INTEREST,<br />

REVENUE<br />

43<br />

PERCENT PERCENT DEPRECIATION, TAX AND<br />

PERCENT<br />

AMORTIZATION<br />

PAT<br />

PROFIT AFTER TAX<br />

59.34<br />

71.81<br />

8.12<br />

4.10<br />

5.88<br />

2.87<br />

FY<strong>2007</strong> FY<strong>2008</strong> FY<strong>2007</strong> FY<strong>2008</strong> FY<strong>2007</strong> FY<strong>2008</strong><br />

NET SALES<br />

PBT<br />

21<br />

PROFIT BEFORE TAX<br />

& SERVICES 41 44<br />

PERCENT PERCENT<br />

PERCENT<br />

PAT*<br />

*PROFIT AFTER TAX,<br />

MINORITY INTEREST & SHARE<br />

OF ASSOCIATE COMPANIES<br />

56.40<br />

68.32<br />

6.15<br />

4.07<br />

4.36<br />

2.82<br />

FY<strong>2007</strong> FY<strong>2008</strong> FY<strong>2007</strong> FY<strong>2008</strong> FY<strong>2007</strong> FY<strong>2008</strong><br />

2 ANNUAL REPORT <strong>2007</strong>–<strong>2008</strong> CROMPTON GREAVES LIMITED

RETURNS<br />

PERCENT<br />

23<br />

PERCENT<br />

25.90<br />

ROCE<br />

RETURN ON CAPITAL<br />

EMPLOYED<br />

31.79<br />

<strong>2007</strong>–<strong>2008</strong><br />

CONSOLIDATED<br />

FINANCIAL<br />

HIGHLIGHTS<br />

Relentless quest for greater global opportunities, business growth,<br />

operational efficiency and input costs management has been the<br />

hallmark for the Company during <strong>2007</strong>-08.<br />

07<br />

PERCENT<br />

FY<strong>2007</strong><br />

FY<strong>2008</strong><br />

RONW<br />

RETURN ON NET WORTH<br />

With the acquisition of the Ireland based Microsol Group, having its<br />

facilities in UK and USA, and engaged in the business of providing<br />

substation automation and retrofitting solutions, the Company is<br />

rapidly moving towards its objective of be<strong>com</strong>ing a “full solutions<br />

provider”.<br />

Acquisition of our JV Partner’s voting stake in the Indonesia based PT<br />

Pauwels Trafo Asia has further enhanced the Company’s capabilities of<br />

catering to the fast growing Asian markets.<br />

30.91<br />

32.97<br />

CG Power Systems’ business scaled new heights in new product<br />

development, enhanced its capacities and entered unchartered new<br />

markets and territories.<br />

Innovative product development, focus on quality, forging key<br />

alliances and enhanced marketing efforts has resulted in the Industrial<br />

Systems and Consumer Products businesses delivering admirable<br />

performances during the year.<br />

FY<strong>2007</strong><br />

FY<strong>2008</strong><br />

CONSOLIDATED FINANCIAL HIGHLIGHTS 3

CHAIRMAN’S<br />

LETTER<br />

Over the past few years, Crompton Greaves has been executing various initiatives and<br />

leveraging its acquisitions to consistently deliver superior corporate performance. These<br />

have all <strong>com</strong>e into play in <strong>2007</strong>-08 with your Company achieving its best ever results in<br />

71 years of its existence.<br />

Let me share with you some of the key<br />

consolidated financial numbers.<br />

$ Net sales and in<strong>com</strong>e from services<br />

increased by over 21% to reach Rs.68.3 billion.<br />

This translates to a top-line of US$ 1.7 billion.<br />

$ Each of the businesses has done very well.<br />

Power Systems saw gross sales increasing by<br />

21% to Rs.48.2 billion in <strong>2007</strong>-08, or US$ 1.2<br />

billion. Industrial Systems grew by 23% to<br />

Rs.11 billion, or US$ 275 million; and Consumer<br />

Products increased revenues by 17% to Rs.11.7<br />

billion, or US$ 291 million.<br />

The Management of your Company and<br />

I, believe that top-line growth must be<br />

ac<strong>com</strong>panied by significant increase in profits. I<br />

am happy to inform you that Crompton Greaves’<br />

profits have grown considerably in <strong>2007</strong>-08,<br />

with a sizeable increase in profitability. Here are<br />

some consolidated numbers for <strong>2007</strong>-08:<br />

$ Operating EBIDTA grew by 54% to Rs.7.4<br />

billion or US$ 185 million. Consequently, the<br />

ratio of operating EBIDTA to net sales increased<br />

by 230 basis points — from 8.6% in 2006-07 to<br />

10.9% in <strong>2007</strong>-08.<br />

$ Profits after tax (PAT), net of minority interests<br />

and share of associate <strong>com</strong>panies grew by 44%<br />

to Rs.4.1 billion, or US$ 101 million.<br />

$ Earnings per share (EPS) on a fully diluted<br />

basis increased from Rs.7.69 in 2006-07 to<br />

Rs.11.10 in <strong>2007</strong>-08. Cash EPS stood at Rs.14.60.<br />

4 ANNUAL REPORT <strong>2007</strong>–<strong>2008</strong> CROMPTON GREAVES LIMITED

$ Return on net worth (RONW) rose by 210<br />

basis points to 33%.<br />

$ Return on capital employed (ROCE) increased<br />

by 590 basis points to 31.8% in <strong>2007</strong>-08.<br />

These are excellent results and exemplify<br />

how Crompton Greaves has been consistently<br />

growing shareholder value over the last eight<br />

years. Given the execution excellence of your<br />

Company’s Management, I am sure that we will<br />

see more such results in the years ahead.<br />

Up to <strong>2007</strong>-08, Crompton Greaves’ focus<br />

was to substantially increase operational<br />

efficiencies and reduce unit costs across all<br />

the businesses — especially its two major<br />

overseas acquisitions, Pauwels and Ganz.<br />

While Management will never take its eyes off<br />

achieving greater productivity growth and<br />

higher ROCE, you will now see a subtle change<br />

in strategic emphasis. With capital efficiency,<br />

inventory turns and cost minimisation firmly<br />

embedded in the DNA of Crompton Greaves,<br />

your Company will focus more on achieving<br />

even higher growth. We expect this to occur<br />

both inorganically as well as through strategic<br />

acquisitions.<br />

Microsol has been one such acquisition,<br />

which your Company purchased in May <strong>2007</strong>.<br />

With a substantial presence in Europe, Microsol<br />

provides automated solutions for medium and<br />

high voltage substations. With Microsol, we can<br />

now be<strong>com</strong>e a full solutions provider.<br />

Going forward, I expect to see more such<br />

strategic, technology based acquisitions — of<br />

small, medium and large enterprises in the rest<br />

of the world as well as India.<br />

As we acquire more global entities, we will<br />

have to master the art of managing these<br />

across diverse geographies, markets and work<br />

cultures. Part of this involves putting in place<br />

uniform processes and reporting systems —<br />

and doing so by adopting best practices across<br />

all entities. This is being done.<br />

The task of managing a truly global MNC,<br />

however, is more than having <strong>com</strong>mon<br />

processes and reporting systems. It involves<br />

creating global managers — who can be as<br />

efficient and <strong>com</strong>fortable in running a business<br />

out of Mandideep, near Bhopal, as in Winnipeg<br />

in Canada, Bogor in Indonesia, Mechelen in<br />

Belgium or Tapioszele in Hungary.<br />

As a part of the Avantha Group, your Company<br />

has begun taking significant steps in creating<br />

such a best-in-class global managerial cadre.<br />

At the group level, we will be choosing 50 such<br />

people across different businesses, training<br />

them for global leadership and posting them<br />

to international assignments, to expedite<br />

managerial cross-fertilisation. Our aim is to have<br />

a team of 200 cross-functional global managers<br />

across the Avantha Group to lead key tasks in<br />

India and elsewhere.<br />

A year and a half ago, few would have<br />

believed that the global economy would be<br />

where it is today. As I write this letter, the US may<br />

well get into a recession. In any event, US GDP<br />

growth for <strong>2008</strong> is not expected to be greater<br />

than 1.2%. The UK too is slowing down, with a<br />

growth forecast of 1.5% to 1.8% for <strong>2008</strong>. So too<br />

is the Euro zone, which is expected to<br />

With capital efficiency, inventory turns and<br />

cost minimisation firmly embedded in the<br />

DNA of Crompton Greaves, your Company<br />

will focus more on achieving even higher<br />

growth. We expect this to occur both<br />

inorganically as well as through strategic<br />

acquisitions<br />

CHAIRMAN’S LETTER 5

Your Company has begun taking significant<br />

steps in creating a best-in-class global<br />

managerial cadre. Our aim is to have a team<br />

of 200 cross-functional global managers<br />

across the Avantha Group<br />

grow by no more than 1.7% in <strong>2008</strong>. The only<br />

beacons of growth are some key emerging<br />

economies led by China and India, and the oil<br />

and <strong>com</strong>modity producing nations. China is<br />

expected to grow by over 10% in <strong>2008</strong>; India<br />

by somewhere between 7.5% and 8%; Russia<br />

by over 7%; and the major Latin American<br />

economies by over 5%.<br />

Your Company, therefore, will need to achieve<br />

higher growth and profitability at a time<br />

when the overall global economic scenario<br />

has be<strong>com</strong>e bearish and more volatile. This<br />

is a challenge. It involves careful selection of<br />

markets, portfolio rebalancing and increasing<br />

the share of business in those emerging<br />

economies which have large capital outlays<br />

for infrastructure spends. It also involves<br />

reorienting Consumer Products — a successful<br />

cash generating business — into be<strong>com</strong>ing<br />

a truly consumer-brand-marketing driven<br />

enterprise. Your Company’s Management is<br />

seized of this strategic emphasis.<br />

Given your Company’s inherent managerial<br />

strengths, I am sure these initiatives will be<br />

successfully executed.<br />

As a responsible global organisation,<br />

Crompton Greaves has the obligation to<br />

lessen its carbon footprint throughout the<br />

world. This is important in itself; it also makes<br />

good business sense. We are in the process of<br />

studying how this can be done for the Group as<br />

a whole. Once, we are certain of our approach,<br />

you will see us rolling out several key initiatives<br />

in this area.<br />

I thank all employees of your Company —<br />

Crompton Greaves, Pauwels, Ganz and Microsol<br />

— for the excellent work that they have done in<br />

delivering such superior results. Knowing their<br />

capabilities, and the drive of your Company’s<br />

Senior Management, I am confident that they<br />

will do even better next year.<br />

Let me also thank you for supporting your<br />

Company. You will agree, I am sure, that<br />

Crompton Greaves has rewarded your support<br />

by delivering superior long term shareholder<br />

value.<br />

With kind regards<br />

Yours sincerely<br />

GAUTAM THAPAR<br />

Chairman<br />

6 ANNUAL REPORT <strong>2007</strong>–<strong>2008</strong> CROMPTON GREAVES LIMITED

CORPORATE<br />

INFORMATION<br />

Board of Directors<br />

CHAIRMAN<br />

G Thapar<br />

CHIEF FINANCIAL OFFICER<br />

BR Jaju<br />

MANAGING DIRECTOR<br />

SM Trehan<br />

COMPANY SECRETARY<br />

W Henriques<br />

NON-EXECUTIVE, INDEPENDENTS<br />

S Bayman<br />

O Goswami<br />

S Labroo<br />

M Pudumjee<br />

SP Talwar<br />

V von Massow<br />

AUDITORS<br />

SOLICITORS<br />

BANKERS<br />

Union Bank of India<br />

State Bank of India<br />

Sharp & Tannan<br />

Crawford Bayley & Co.<br />

IDBI Bank Ltd<br />

ICICI Bank Ltd<br />

Corporation Bank<br />

ABN Amro Bank NV<br />

Bank of Maharashtra<br />

Standard Chartered Bank<br />

Canara Bank<br />

Calyon Bank<br />

Senior Management Team<br />

REGISTERED OFFICE<br />

6th Floor, CG House, Dr. Annie<br />

Besant Road , Worli, Mumbai 400 030<br />

FIRST ROW, LEFT TO RIGHT JG KULKARNI, VP-CG Power (Asia); SM TREHAN, Managing Director and W HENRIQUES, Company Secretary, Legal Counsel & Global Head-Human Resources<br />

SECOND ROW, LEFT TO RIGHT M VERMA, VP-Lighting & International; BR JAJU, CFO and DS PATIL, CEO-CG Power<br />

STANDING, LEFT TO RIGHT AN RAVICHANDRAN, VP-Fans, Appliances & Pumps; F ROBBERECHTS, VP-CG Power (Europe, Middle East & Africa); M SCHILLEBEECKX, VP-CG Power (Americas);<br />

AK RAINA, VP-Large & Traction Machines & Stampings and M KELLY, CFO-CG Power<br />

CORPORATE INFORMATION 7

MANAGEMENT<br />

DISCUSSION<br />

& ANALYSIS<br />

Seeking greater global opportunities,<br />

growing its various businesses, increasing<br />

capacities, improving operational<br />

efficiencies and controlling input costs at<br />

a time of high <strong>com</strong>modity prices — these<br />

have been some of the focus areas for<br />

Crompton Greaves during <strong>2007</strong>-08<br />

Overview<br />

Over the last five years, Crompton Greaves<br />

Ltd (‘Crompton Greaves’ or ‘the Company’)<br />

has successfully executed several initiatives:<br />

creating synergies, integration, growth and a<br />

transformation from being a first-rate Indian<br />

<strong>com</strong>pany to a world leader in its business lines.<br />

Thus, despite operating in an increasingly<br />

<strong>com</strong>petitive global environment, the Company<br />

has been consistently reaping benefits from<br />

these efforts and achieving higher growth and<br />

profitability.<br />

As stated in last year’s Annual Report,<br />

Crompton Greaves, through its 100%<br />

subsidiary CG International BV (Netherlands),<br />

had executed an agreement in May <strong>2007</strong> to<br />

purchase the shares of Microsol Holdings<br />

Limited (‘Microsol’) for an enterprise value of €<br />

10.50 million. The purchase was <strong>com</strong>pleted on<br />

28 May <strong>2007</strong>. Thus, the consolidated financials<br />

of Crompton Greaves reflect Microsol’s<br />

performance from that date. Headquartered<br />

in Ireland and with a substantial presence in<br />

Europe, Microsol provides automated solutions<br />

for medium and high voltage substations — for<br />

new units as well as for retrofitting. Automated<br />

solutions was one of the missing pieces in the<br />

Crompton Greaves’ portfolio. With Microsol,<br />

the Company can now be<strong>com</strong>e a full solutions<br />

provider. Moreover, since Microsol’s solutions<br />

are based on open architecture software,<br />

these can be aligned to any product, including<br />

those of <strong>com</strong>petitors — thus making it an ideal<br />

platform for retrofitting of substations.<br />

To enhance its strengths even further, in<br />

February <strong>2008</strong>, the Company, through CG<br />

International BV, acquired the balance 40%<br />

voting share capital in PT Pauwels Trafo Asia,<br />

Indonesia, for US$ 10.70 million. Therefore, with<br />

effect from 13 February <strong>2008</strong>, the Company,<br />

through its subsidiaries now owns 100% of the<br />

voting share capital of PT Pauwels Trafo Asia.<br />

Seeking greater global opportunities,<br />

growing its various businesses, increasing<br />

capacities, improving operational efficiencies<br />

and controlling input costs at a time of high<br />

<strong>com</strong>modity prices — these have been some of<br />

the focus areas for Crompton Greaves during<br />

<strong>2007</strong>-08. The consolidated financial results on<br />

the next page reflect the Company’s successes<br />

in these endeavours.<br />

Strategic Business Units<br />

Crompton Greaves has three Strategic Business<br />

Units (SBUs) : Power Systems, Industrial Systems<br />

and Consumer Products. Chart A gives the<br />

<strong>com</strong>parative shares of business of the three<br />

SBUs on a consolidated global basis for <strong>2007</strong>-08<br />

<strong>com</strong>pared with 2006-07.<br />

8 ANNUAL REPORT <strong>2007</strong>–<strong>2008</strong> CROMPTON GREAVES LIMITED

Power Systems<br />

CONSOLIDATED PERFORMANCE<br />

Power Systems (or CG Power) includes the<br />

<strong>com</strong>bined global transmission and distribution<br />

businesses, and is the largest revenue generator<br />

for Crompton Greaves. This SBU manufactures<br />

power transformers, distribution transformers,<br />

extra high voltage (EHV) and medium voltage<br />

(MV) circuit breakers, gas insulated switchgear<br />

(GIS), EHV and MV instrument transformers,<br />

lightning arrestors, isolators, vacuum<br />

interrupters and electronic energy meters. In<br />

addition to designing and manufacturing these<br />

substation equipment, CG Power provides<br />

end-to-end turnkey solutions for transmission<br />

and distribution (T&D) through customised<br />

substation projects.<br />

To capitalise on global growth opportunities<br />

and to enable seamless integration of the best<br />

design and manufacturing practices across the<br />

world, Power Systems has built and acquired<br />

multiple manufacturing facilities in India and<br />

overseas. These are at:<br />

IN INDIA<br />

$ KANJUR MARG (MUMBAI), MALANPUR<br />

AND MANDIDEEP (MADHYA PRADESH) Power<br />

and Distribution transformers.<br />

$ NASHIK AND AURANGABAD<br />

(MAHARASHTRA), BANGALORE (KARNATAKA)<br />

EHV and MV circuit breakers, EHV and MV<br />

instrument transformers, vacuum interrupters,<br />

isolators, lightning arrestors, power quality<br />

products and solutions and electronic energy<br />

meters.<br />

CHART<br />

A<br />

Share of Revenue, by Business<br />

SHARE OF TOTAL, % | RS. MILLION<br />

<br />

Rs 39,896 mn<br />

POWER<br />

<br />

Rs 9,940 mn<br />

CONSUMER<br />

<br />

Rs 8,971 mn<br />

INDUSTRIAL<br />

<br />

$ GURGAON (HARYANA) Engineering Projects<br />

Division (EPD).<br />

OVERSEAS<br />

$ MECHELEN (BELGIUM) The biggest plant<br />

of Pauwels. It manufactures large distribution<br />

transformers, custom-made medium and large<br />

power transformers, mobile substations and is<br />

engaged in contracting.<br />

$ CAVAN (IRELAND) Smaller single-phase<br />

and three-phase distribution transformers and<br />

micro-substations.<br />

$ CHARLEROI (BELGIUM) The services<br />

division of Pauwels.<br />

$ WASHINGTON (MISSOURI, USA) Threephase<br />

& pad-mounted transformers, unitized<br />

substations and small power transformers.<br />

$ WINNIPEG (CANADA) Medium and large<br />

power transformers up to 575 MVA, mobile<br />

substations and high voltage direct current<br />

(HVDC) converter transformers.<br />

$ BOGOR (INDONESIA) Power transformers<br />

from 10 MVA to 260 MVA.<br />

$ TAPIOSZELE (HUNGARY) The Ganz plant<br />

manufactures transformers, GIS and engages in<br />

contracting and services. It also manufactures<br />

traction motors (see section on Industrial<br />

Systems).<br />

$ DUBLIN (IRELAND), JARROW (UK),<br />

SEYMOUR (CONNECTICUT, USA) AND EAGLE<br />

(IDAHO, USA) These Microsol facilities focus on<br />

the manufacture of substation and distribution<br />

automation products and systems; and project<br />

delivery and sales management for Europe, the<br />

Middle East and the US markets.<br />

Rs 797 mn<br />

2006–07 OTHERS<br />

<strong>2007</strong>–08<br />

<br />

Rs 48,243 mn<br />

POWER<br />

<br />

Rs 11,668 mn<br />

CONSUMER<br />

<br />

Rs 11,044 mn<br />

INDUSTRIAL<br />

<br />

Rs 1,119 mn<br />

OTHERS<br />

Consolidated Financial Highlights<br />

for <strong>2007</strong>-08<br />

GROSS SALES AND INCOME from services<br />

grew by 21% to Rs.71,814 million in <strong>2007</strong>-08<br />

(US$ 1.79 billion). This translates to a threeyear<br />

<strong>com</strong>pounded annual growth rate<br />

(CAGR) of 29%.<br />

CG POWER (i.e. the transformer, switchgear<br />

and engineering projects business of<br />

Crompton Greaves) grew by 21% to<br />

Rs.48,243 million (US$ 1.20 billion) in <strong>2007</strong>-08.<br />

INDUSTRIAL SYSTEMS increased its<br />

revenues by 23% to Rs.11,044 million (US$<br />

275 million).<br />

CONSUMER PRODUCTS grew by 17% to<br />

Rs.11,668 million (US$ 291 million).<br />

OPERATING EBIDTA (operating earnings<br />

before interest, depreciation, taxation and<br />

amortisation) for the Company increased by<br />

54% to Rs.7,439 million (US$ 185 million) in<br />

<strong>2007</strong>-08. Including non-operating in<strong>com</strong>e,<br />

the EBIDTA was Rs.8,116 million (US$ 202<br />

million).<br />

PBT (Profit before tax) increased by 41% to<br />

Rs.6,152 million (US$ 153 million) in <strong>2007</strong>-08.<br />

PAT (Profit after tax) net of minority interests<br />

and share of associate <strong>com</strong>panies, grew by<br />

over 44% from Rs. 2,817 million in 2006-07 to<br />

Rs. 4,067 million (US$ 101 million) in <strong>2007</strong>-08.<br />

CONSOLIDATED ROCE (Return on capital<br />

employed) based on year-end capital rose<br />

from 26% in 2006-07 to 32% in <strong>2007</strong>-08.<br />

CONSOLIDATED RONW (return on net<br />

worth) increased from 31% in 2006-07 to<br />

33% in <strong>2007</strong>-08.<br />

CONSOLIDATED EPS (earnings per share)<br />

on fully diluted basis rose from Rs.7.69 in<br />

2006-07 to Rs.11.10 in <strong>2007</strong>-08. Cash EPS<br />

increased from Rs.11.20 to Rs.14.60 over the<br />

same period.<br />

NOTES For <strong>2007</strong>-08, US$1 = Rs.40.12; for 2006-07,<br />

US$1 = Rs.43.47. Figures for 2006-07 have been regrouped<br />

wherever necessary in order to make them <strong>com</strong>parable with<br />

those of <strong>2007</strong>-08.<br />

MANAGEMENT DISCUSSION AND ANALYSIS 9

Key Performance Indicators of<br />

CG Power<br />

GROSS SALES of CG Power increased to<br />

Rs.48,243 million in <strong>2007</strong>-08 — a growth<br />

of over 21% during the year, on the back<br />

of a 43% growth during the previous<br />

year. This translates to US$ 1.20 billion of<br />

revenue.<br />

PBIT (profit before interest and taxation)<br />

of CG Power increased by 34% to Rs.4,372<br />

million in <strong>2007</strong>-08.<br />

ROCE Despite a 13% growth in capital<br />

employed, CG Power’s ROCE (return on<br />

capital employed) grew from 27% in<br />

2006-07 to 31% in <strong>2007</strong>-08.<br />

UEOB (unexecuted order book) increased<br />

by over 14% to Rs.46,535 million as on 31<br />

March <strong>2008</strong> (US$ 1.16 billion).<br />

CHART<br />

B<br />

Consolidated Sales of<br />

CG Power<br />

RS. MILLION<br />

21%<br />

48,243<br />

TABLE<br />

01<br />

WE VALUE CUSTOMER COMMITMENTS THE PICTURE DEPICTS<br />

COMBINED FINANCIAL PERFORMANCE OF CG POWER<br />

YEAR ENDED 31 MARCH, IN RS. MILLION FY <strong>2007</strong> FY <strong>2008</strong> GROWTH<br />

GROSS SALES 39,896 48,243 21%<br />

PBIT 3,272 4,372 34%<br />

CAPITAL EMPLOYED 12,305 13,959 13%<br />

UNEXECUTED ORDER BOOK 40,694 46,535 14%<br />

NOTES Microsol was acquired on 28 May <strong>2007</strong>. Therefore, the consolidated figures for <strong>2007</strong>-08 is including 10 months for Microsol.<br />

Figures for 2006-07 have been regrouped wherever necessary in order to make them <strong>com</strong>parable with those of <strong>2007</strong>-08.<br />

39,896<br />

FY<strong>2007</strong><br />

FY<strong>2008</strong><br />

The key performance indicators of CG Power<br />

are detailed in Table 1 above. This includes the<br />

performance of CG Power’s Indian operations,<br />

as well as that of the international divisions:<br />

Pauwels, Ganz (excluding motors) and Microsol.<br />

Global statistics suggest an enormous growth<br />

potential for the CG Power business. Here is<br />

some data:<br />

$ The International Energy Agency estimates<br />

that between now and 2030, world demand<br />

for primary energy will rise from 11.4 billion to<br />

about 17.7 billion tonnes of oil equivalent, and<br />

74% of this increase would be accounted for by<br />

India and China.<br />

$ The current per capita electricity<br />

consumption in India is at 625 kWh, versus<br />

12,200 kWh in the US and 2,150 kWh in China.<br />

Moreover, peak shortage of power in India<br />

has increased from 12% in 2003 to over 16% in<br />

<strong>2007</strong>-08. Thus there is considerable head room<br />

for growth in the power sector — and with it,<br />

the demand for transmission and distribution<br />

equipment and solutions.<br />

Given the synergies of size, global reach,<br />

operational excellence and technical expertise<br />

within CG Power, this SBU of Crompton Greaves<br />

is well poised to exploit these opportunities and<br />

continue with its double-digit growth in the<br />

<strong>com</strong>ing years.<br />

FINANCIAL PERFORMANCE: THE<br />

INDIAN POWER SYSTEMS BUSINESS<br />

The performance of the standalone Indian<br />

Power Systems operations for 2006-07 and<br />

<strong>2007</strong>-08 is given in Table 2.<br />

CG Power’s Indian operations showed a<br />

topline growth of 13% over last year to reach<br />

Rs.19,633 million. This translates to a 3-year<br />

CAGR of 27%. Year-on-year PBIT grew by 40% to<br />

Rs.2,577 million.<br />

10 ANNUAL REPORT <strong>2007</strong>–<strong>2008</strong> CROMPTON GREAVES LIMITED

CG Power’s Indian operations showed a<br />

topline growth of 13% over last year to<br />

reach Rs.19,633 million. This translates<br />

to a 3-year CAGR of 27%<br />

Return on year-end capital employed<br />

(ROCE) was at 63% — a quantum jump<br />

over last year’s figure of 43%<br />

PAUWELS CANADA DISPATCHING A TRANSFORMER TO PACIFICORP IN TOUGH WINTER CONDITIONS<br />

TABLE<br />

02<br />

PERFORMANCE OF THE INDIAN POWER SYSTEMS BUSINESS<br />

YEAR ENDED 31 MARCH, IN RS. MILLION FY <strong>2007</strong> FY <strong>2008</strong> GROWTH<br />

GROSS SALES 17,412 19,633 13%<br />

PBIT 1,835 2,577 40%<br />

CAPITAL EMPLOYED 4,266 4,099 -4%<br />

UNEXECUTED ORDER BOOK 17,044 17,086 -<br />

CHART<br />

C<br />

Gross Sales of Indian<br />

Power Systems Business<br />

RS. MILLION<br />

13%<br />

19,633<br />

Return on year-end capital employed (ROCE)<br />

was at 63% — a quantum jump over last year’s<br />

figure of 43%. This improvement in ROCE bears<br />

testimony to the efforts that CG Power has put<br />

in place during <strong>2007</strong>-08 in reducing its working<br />

capital needs and creating better operational<br />

efficiencies across all its product lines. It needs<br />

to be noted that a 40% growth in PBIT has<br />

been achieved with a 4% reduction in capital<br />

employed.<br />

The unexecuted order book (UEOB) is at<br />

Rs.17,086 million, which translates to over 10<br />

months’ of current sales.<br />

FINANCIAL PERFORMANCE:<br />

OVERSEAS POWER SYSTEMS<br />

BUSINESS<br />

Established over 60 years ago in Belgium,<br />

the Pauwels Group (‘Pauwels’) is a leader in<br />

the design and manufacture of three-phase<br />

distribution and power transformers, in the<br />

production and retrofitting of substations and<br />

in providing integrated solutions and services<br />

for the international transmission & distribution<br />

market.<br />

Ganz has a history of 125 years of being<br />

a quality supplier to the Hungarian heavy<br />

electrical industry. It is in the business of<br />

contracting and sub-contracting turnkey<br />

solutions in power transmission and<br />

distribution (including servicing and retrofitting<br />

power plants), substations and industrial<br />

electrical systems. It also manufactures power<br />

transformers, GIS upto 245 KV, high-voltage<br />

asynchronous and traction motors at its plant<br />

in Tapioszele, Hungary. Ganz is also engaged in<br />

substation contracting services.<br />

Microsol was established in 1986 and<br />

has a technological edge in the substation<br />

automation business. Over the years, it has<br />

expanded into a full line developer and supplier<br />

of automation equipment and solutions, as well<br />

17,412<br />

FY<strong>2007</strong><br />

FY<strong>2008</strong><br />

MANAGEMENT DISCUSSION AND ANALYSIS 11

CHART<br />

D<br />

Gross Sales of Overseas<br />

Power Systems Business<br />

RS. MILLION<br />

28%<br />

29,597<br />

TABLE<br />

03<br />

PERFORMANCE OF THE OVERSEAS POWER SYSTEMS BUSINESS<br />

YEAR ENDED 31 MARCH, IN RS. MILLION FY <strong>2007</strong> FY <strong>2008</strong> GROWTH<br />

GROSS SALES 23,199 29,597 28%<br />

PBIT 1,437 1,795 25%<br />

CAPITAL EMPLOYED 8,039 10,135 26%<br />

UNEXECUTED ORDER BOOK 23,650 29,449 25%<br />

NOTE Year-on-year figures are not strictly <strong>com</strong>parable, since 2006-07 did not have Microsol performance figures<br />

23,199<br />

FY<strong>2007</strong><br />

FY<strong>2008</strong><br />

The Overseas Power Systems business has<br />

shown 28% topline growth over 2006-07<br />

to reach Rs. 29,597 million in <strong>2007</strong>-08<br />

(US$ 738 Million)<br />

as network enabled products. Microsol’s<br />

customers are a mixture of major utilities,<br />

government and military agencies as well as<br />

global OEMs. It also has <strong>com</strong>plete hardware<br />

development capabilities to produce<br />

customised interface boards. As mentioned<br />

earlier, Crompton Greaves acquired Microsol on<br />

28 May <strong>2007</strong>.<br />

The overall performance of the overseas<br />

Power Systems business is detailed in Table 3.<br />

The overseas Power Systems business has<br />

shown 28% topline growth over 2006-07 to<br />

reach Rs.29,597 million in <strong>2007</strong>-08 (US$ 738<br />

million). Better realisation, greater capacity<br />

utilisation and rationalisation of material costs<br />

have resulted in a 25% year-on-year growth<br />

of PBIT to Rs.1,795 million in <strong>2007</strong>-08 (US$ 45<br />

million). Simultaneously, orders have increased:<br />

the UEOB has increased by nearly 25% to<br />

Rs.29,449 million (US$ 734 million), representing<br />

nearly 12 months of current sales.<br />

KEY DEVELOPMENTS IN CG POWER<br />

<strong>2007</strong>-08 saw several significant developments<br />

in CG Power. Given below are a few:<br />

$ PRODUCT DEVELOPMENT: CG POWER<br />

IN INDIA CG Power’s Kanjur Marg plant built<br />

and supplied 220 / 220 KV, 200 MVA unit ratio<br />

transformers for National Aluminium Company<br />

Limited (NALCO) and 230 / 220 KV, 250 MVA<br />

for TNB, the state electricity board of Malaysia.<br />

International acceptance of this new product<br />

bodes well for its future prospects. Additionally,<br />

the plant manufactured and supplied to Bokaro<br />

Steel Plant its largest furnace transformer at 33<br />

KV / 46 MVA. CG Power’s Mandideep plant built<br />

for the first time in India a 765 KV / 260 MVA<br />

single phase generating transformer — which<br />

was supplied to the National Thermal Power<br />

Corporation (NTPC) for its plant at Sipat, in<br />

Chhattisgarh.<br />

The distribution transformer division at<br />

Malanpur and Mandideep, developed foil<br />

wound transformers based on Pauwels<br />

technology, which reduce material quantity<br />

and costs while enhancing efficiency levels.<br />

It is an example of cross-border absorption<br />

of best-in-class manufacturing practices and<br />

technologies. For the first time, the division<br />

developed a 132 KV / 23 MVA class low power<br />

transformer, as well as a 5 MVA single phase<br />

lo<strong>com</strong>otive transformer.<br />

CG Power’s Nashik and Aurangabad plants<br />

have developed a 67 KV and a 138 KV ANSI<br />

bushing, which are both being tested for the<br />

US markets. These products have high global<br />

acceptability and strong export prospects.<br />

The switchgear division has been developing<br />

several products for export markets: a 170 KV,<br />

40 KA SF6 circuit breaker for South East Asia<br />

and a 245 KV, 40 KA, 60HZ SF6 circuit breaker<br />

for Brazil. It also produced a 36-245 KV<br />

disconnecter, which was supplied to Australia,<br />

Peru and Ecuador.<br />

$ PRODUCT DEVELOPMENT: PAUWELS, GANZ<br />

AND MICROSOL CG Power, through Pauwels,<br />

is involved in the development of Unipower<br />

— a <strong>com</strong>mon software enabled <strong>com</strong>panywide<br />

global platform for the design of power<br />

transformers. The idea behind this project is to<br />

facilitate quicker and more optimal designs;<br />

spread these lessons across various facilities;<br />

and substantially reduce response time to<br />

customers. There has been good progress in the<br />

Unipower project throughout <strong>2007</strong>-08. There<br />

is also a <strong>com</strong>mon global design platform for<br />

distribution transformers called DesDT.<br />

There were several new products / services<br />

offered by Pauwels during the year, such as<br />

transformers filled with FR3 cooling liquid<br />

(natural ester); the prototype of a 5.5 MVA<br />

converter transformer for RATP, the French<br />

metro; and the prototype of a 6.2 MVA bioSLIM®<br />

transformer for an offshore wind park.<br />

Pauwels <strong>com</strong>fortably retains its No.1 position<br />

as the manufacturer of SLIM® transformers for<br />

wind power and wind park installations. It is also<br />

considered a global market leader in the design<br />

and sales of mobile substations up to 220 kV.<br />

Ganz’s tank shop in Szolnok (Hungary) is<br />

being developed as a resource centre for the<br />

production of tanks used for transformers<br />

for Europe, Middle East and Africa (the EMEA<br />

region). Plans are being executed so that the<br />

12 ANNUAL REPORT <strong>2007</strong>–<strong>2008</strong> CROMPTON GREAVES LIMITED

Szolnok facility be<strong>com</strong>es a strategic enabler for<br />

the EMEA business.<br />

During <strong>2007</strong>-08, Microsol has had several<br />

wins, two of which are highlighted here.<br />

First, it introduced a submersible control<br />

box (RCAM–E) for underground distribution<br />

switches. This not only helped it to secure orders<br />

from NSTAR, the Boston based utility, but has<br />

also made it the automation solution of choice<br />

for all NSTAR underground switch applications.<br />

Second, Microsol has successfully be<strong>com</strong>e the<br />

remote telemetry unit (RTU) automation of<br />

choice for the entire Amtrak electrified corridor<br />

from Washington DC to Boston.<br />

Microsol has also developed an IEC 61850<br />

interface for its XCell product range. This opens<br />

the new IEC 61850 based substation market to<br />

the Company and provides an upgrade path<br />

for existing customers to the new IEC 61850<br />

standard. Consequently, Microsol has started<br />

participating in some pilot projects based on<br />

IEC 61850 and are in some substantial tenders<br />

based on that standard.<br />

capacity by 38%, including adding three vertical<br />

winding machines and a foil winding machine.<br />

It has also developed two strategic vendors: one<br />

for high quality corrugated fin-wall tanks (the<br />

first time such a vendor has been developed<br />

in India) and another for the built-core of the<br />

transformer.<br />

The switchgear division reaped benefits from<br />

capacity enhancements made in 2006-07, and<br />

has developed strategic vendors for its 300<br />

KV CT/IVT products. Product outsourcing and<br />

alternate vendor development have helped the<br />

division enhance productivity and reduce costs.<br />

Production of circuit breakers was enhanced<br />

by over 40%, in large part due to the addition of<br />

nine assembly and test pads in the plant.<br />

Mandideep plant built for the first time<br />

in India a 765 KV / 260 MVA single phase<br />

generating transformer — which was<br />

supplied to the National Thermal Power<br />

Corporation (NTPC) for its plant at Sipat,<br />

in Chhattisgarh<br />

$ CAPACITY ENHANCEMENT AND VENDOR<br />

DEVELOPMENT: INDIA AND ABROAD For<br />

CG Power, <strong>2007</strong>-08 saw major developments<br />

in two areas: increase in capacity of its Indian<br />

operations and strategic vendor development.<br />

The SBU has taken a conscious decision<br />

to identify areas that can be outsourced<br />

to strategic vendors, who will work in<br />

manufacturing important <strong>com</strong>ponents<br />

according to Crompton Greaves’ performance<br />

and quality standards and controls.<br />

Simultaneously, ‘brownfield’ expansions at<br />

existing units have helped the SBU to grow<br />

capacity in order to address the growing<br />

demands of the global market.<br />

The Kanjur Marg plant <strong>com</strong>missioned a<br />

new Vapour Phase Drying Oven. Two new<br />

vendors were identified for transformer tank<br />

construction and development according<br />

to international standards. Thanks to these<br />

measures, manufacturing capacity went up by<br />

almost 15%, and resulted in a 20% growth in<br />

production volumes.<br />

The Mandideep plant has also developed<br />

a strategic vendor for the manufacture of the<br />

winding and core coil assembly. This is expected<br />

to increase manufacturing capacity and reduce<br />

costs.<br />

Significant expansions have taken place at the<br />

Malanpur plant. This division, which has shown<br />

the highest sales growth among the CG Power<br />

plants in India, has increased manufacturing<br />

ASSEMBLY OF A 420 KV SF6 CIRCUIT BREAKER AT THE NASHIK SWITCHGEAR DIVISION<br />

MANAGEMENT DISCUSSION AND ANALYSIS 13

There was a breakthrough in selling of<br />

wind power transformers in the Americas,<br />

when the first 38 units of 2300 kVA SLIM®<br />

transformers were sold to Enercon for the<br />

Ripley Wind Farm in Canada<br />

In Pauwels, too, there have been several<br />

capacity increasing initiatives in <strong>2007</strong>-08.<br />

Investments were made in the Indonesian plant<br />

to raise capacities. This involved setting up a<br />

floating core coil assembly platform; installing a<br />

second drying oven; and a heavy duty vacuum<br />

pump. The distribution transformer facility at<br />

Cavan (Ireland) increased efficiency by 5% at<br />

little or no cost, and also added additional shifts<br />

in the bottleneck areas to increase output. The<br />

distribution transformer facility in the US is in<br />

the midst of an expansion programme which<br />

will facilitate manufacture of 10MVA through 60<br />

MVA medium power transformers up to 138 KV,<br />

650 KV BIL.<br />

$ DEVELOPING NEW MARKETS AND<br />

CUSTOMERS The SBU’s power transformer<br />

division achieved 32% growth over last year<br />

in its international orders. Export orders were<br />

obtained from eight new countries, including<br />

Greece, Trinidad, Qatar, Jordan and Ecuador. The<br />

division also supplied a new product: 2 X<br />

250 MVA 230/220 KV transformers for the<br />

Singapore and Malaysian power grids. Oman<br />

and Guatemala were countries where the<br />

division supplied equipment for the first time.<br />

Pauwels continued enjoying successes in the<br />

wind power industry, especially in Southern<br />

Europe, mainly Spain, where several new<br />

customers signed on to the SLIM® or bioSLIM®<br />

solution throughout <strong>2007</strong>-08. In addition, there<br />

was a breakthrough in selling of wind power<br />

transformers in the Americas, when the first 38<br />

units of 2300 kVA SLIM® transformers were sold<br />

to Enercon for the Ripley Wind Farm in Canada.<br />

Ganz’s transformers have also been getting<br />

new orders in Europe — in Spain, Belgium,<br />

Ireland and the UK.<br />

Ganz is executing one of its largest single GIS<br />

orders for the Steel Authority of India Limited’s<br />

Bhilai steel plant for 10 bays of 220 KV GIS and<br />

16 bays of 132 KV GIS. It also obtained an order<br />

for Power Grid Corporation of India Ltd for the<br />

supply of three bays of 132 KV GIS. In addition,<br />

the division became an approved vendor for<br />

customers such as Delhi Metro Rail Corporation,<br />

Reliance Energy, Torrent Power and the Nuclear<br />

Power Corporation of India. International<br />

marketing of switchgear also received a boost<br />

with new orders from Italy, Malaysia, Chile,<br />

Spain, Canada, Myanmar and Vietnam.<br />

A SLIM® TRANSFORMER BEING INSTALLED INSIDE THE WORLD’S HIGHEST TURBINE IN THE NORTHERN<br />

PART OF GERMANY<br />

Ganz is executing one of its largest single<br />

GIS orders for the Steel Authority of India<br />

Limited’s Bhillai steel plant for 10 bays of<br />

220 KV GIS and 16 bays of 132 KV GIS<br />

14 ANNUAL REPORT <strong>2007</strong>–<strong>2008</strong> CROMPTON GREAVES LIMITED

Industrial Systems<br />

The Company’s Industrial Systems SBU<br />

manufactures the following categories of<br />

products:<br />

$ High tension (HT) motors<br />

$ Railway transportation equipment<br />

$ Low tension (LT) motors<br />

$ Direct current (DC) motors<br />

$ Railway signalling equipment<br />

$ Fractional horse power (FHP) motors<br />

$ Alternators<br />

$ Stampings<br />

Its facilities are located at following locations:<br />

$ MADHYA PRADESH Mandideep (HT motors<br />

and rail transportation equipment) and<br />

Pithampur (railway signalling equipment).<br />

$ MAHARASHTRA Kanjur Marg (stampings)<br />

and Ahmednagar (LT motors, alternators and<br />

stampings).<br />

TABLE<br />

04<br />

PERFORMANCE OF THE INDUSTRIAL SYSTEMS BUSINESS<br />

$ GOA Bardez (LT motors) and Kundaim (FHP<br />

motors).<br />

$ HUNGARY Tapioszele (rotating machines).<br />

Table 4 gives the financial performance of the<br />

Industrial Systems Group.<br />

In spite of growing the operations by over<br />

23%, the division’s year-end capital employed<br />

decreased by 17% to Rs.1,618 million. This has<br />

resulted in a significant growth in ROCE: 121%<br />

in <strong>2007</strong>-08, versus 67% in the previous year. The<br />

division’s UEOB increased by 26% to Rs.4,247<br />

million, which translates to over 4 months’<br />

current sales.<br />

During the year, the HT and LT motors divisions<br />

created additional capacity which helped in<br />

growing production. The cement sector has<br />

been the prime customer for the Company’s slip<br />

ring induction motors, with Crompton Greaves’<br />

products having very high acceptance among<br />

the end users. The division is now concentrating<br />

YEAR ENDED 31 MARCH, IN RS. MILLION FY <strong>2007</strong> FY <strong>2008</strong> GROWTH<br />

GROSS SALES 8,971 11,044 23%<br />

PBIT 1,302 1,956 50%<br />

CAPITAL EMPLOYED 1,954 1,618 -17%<br />

UNEXECUTED ORDER BOOK 3,367 4,247 26%<br />

CHART<br />

Key Performance Indicators of<br />

the Industrial Systems Business<br />

PBIT grew by over 50% to Rs.1,956 million<br />

— in the process growing faster than last<br />

year’s rate of 40% growth.<br />

GROSS SALES increased by 23% over the<br />

previous year to reach Rs.11,044 million;<br />

a three-year CAGR of 27%.<br />

E<br />

Gross Sales of Industrial<br />

Systems Business<br />

RS MILLION<br />

23%<br />

11,044<br />

8,971<br />

STATOR WINDINGS OF AC INDUCTION MOTORS AT LT MOTORS DIVISION, AHMEDNAGAR<br />

FY<strong>2007</strong><br />

FY<strong>2008</strong><br />

MANAGEMENT DISCUSSION AND ANALYSIS 15

The fans manufacturing plant at Baddi<br />

produced 80,000 units in March <strong>2008</strong>, with<br />

a target to produce 1 million units during<br />

<strong>2008</strong>-09<br />

TABLE FAN ASSEMBLY LINE AT THE FANS DIVISION, GOA<br />

on high value added large rating motors. It<br />

has also undertaken a number of measures to<br />

reduce material cost.<br />

<strong>2007</strong>-08 saw a number of new products<br />

introduced by the SBU, as well as some<br />

significant developments. Some of these were:<br />

$ Development of traction motor type<br />

C1001TM for diesel electric lo<strong>com</strong>otives<br />

approved by the Railway Designs and Standards<br />

Organisation. This has opened up a new market<br />

for the SBU.<br />

$ Development of largest rating horizontal<br />

motors (3,700 KW) and vertical motors (2,675<br />

KW) and extending the 11KV HT machines<br />

range upto 2500 KW.<br />

During <strong>2007</strong>-08, the SBU also executed a<br />

number of prestigious orders for Indian as well<br />

as overseas customers. The HT Motors division<br />

supplied equipment to Indian Oil Corporation<br />

at Panipat, as well as for a Kenyan cement plant<br />

and DC Motors for Turkey and North America.<br />

The stampings division showed 17% volume<br />

growth in <strong>2007</strong>-08, which came about mainly<br />

due to the installation of four high speed<br />

notching machines at Ahmednagar. The<br />

Ahmednagar plant, which started in 2006-07<br />

with a capacity of 7,500 tonnes per year, is now<br />

capable of producing 10,000 tonnes. During the<br />

year, it developed the tooling to deliver export<br />

orders as well as to prestigious Indian customers<br />

such as Cummins Generators and Larsen &<br />

Toubro. The division has over 20% market-share<br />

in the stampings business.<br />

Consumer Products<br />

Crompton Greaves’ Consumer Products<br />

business supplies fans, pumps, lighting<br />

equipment (light sources and luminaires) and<br />

a range of electrical household appliances. The<br />

SBU has the following facilities:<br />

$ Bethora and Kundaim (Goa): Fans.<br />

$ Baddi (Himachal Pradesh): Fans.<br />

$ Kanjur Marg (Maharashtra): Luminaires.<br />

$ Ahmednagar (Maharashtra): Pumps.<br />

$ Vadodara (Gujarat): Light sources.<br />

The financial performance of the SBU is given<br />

in Table 5.<br />

In <strong>2007</strong>-08, the SBU achieved gross sales<br />

of Rs.11,668 million, which was 17% over the<br />

previous year’s figures. PBIT grew at an even<br />

higher rate of 27% — to reach Rs.1,208 million.<br />

<strong>2007</strong>-08 is the first year in which Consumer<br />

Products has crossed Rs.10 billion in gross sales<br />

and Rs.1 billion in PBIT. This SBU contributes to<br />

16% of the Company’s topline as well as PBIT.<br />

Consumer Products also generated the highest<br />

return on capital employed for the Company —<br />

138% in <strong>2007</strong>-08.<br />

Revenue from fans and appliances has grown<br />

by 24%, <strong>com</strong>pared to the overall industry<br />

growth of 16% — a testimony to the robustness<br />

of the Company’s fans business. This <strong>com</strong>es<br />

on the back of similar growth in the last five<br />

years which has made this business’ 5-year<br />

CAGR greater than the industry average. It is<br />

now the second largest exporter of fans from<br />

India — up from third position last year. The fans<br />

manufacturing plant at Baddi produced 80,000<br />

units in March <strong>2008</strong>, with a target to produce 1<br />

million units during <strong>2008</strong>-09.<br />

The appliances division (sells products such as<br />

geysers, mixers, grinders, electric irons, toasters<br />

and emergency lanterns) has also shown<br />

appreciable growth. Its products are visible<br />

in retail chains in India as well as in Dubai and<br />

Muscat. As a part of its product development<br />

exercise, the division has launched 600 VA, 800<br />

VA and 1,400 VA ‘pure sine wave’ Home UPS.<br />

After winning the Gold Award for 2006, both<br />

the Goa units won the Frost & Sullivan (India)<br />

Manufacturing Excellence Platinum Awards<br />

in <strong>2007</strong>, which is the highest level of awards in<br />

its category. The division has started a Product<br />

Development Centre at Goa, which focusses<br />

on bringing new products to the market,<br />

increasing product efficiencies and reducing<br />

material costs.<br />

16 ANNUAL REPORT <strong>2007</strong>–<strong>2008</strong> CROMPTON GREAVES LIMITED

CHART<br />

F<br />

Gross Sales of Consumer<br />

Products Business<br />

RS. MILLION<br />

17%<br />

11,668<br />

9,940<br />

HI-TECHNOLOGY HYDRAULIC BALANCING FACILITY USED IN PUMP MANUFACTURING ENSURING LONG<br />

SERVICE LIFE OF PUMPS<br />

TABLE<br />

05<br />

PERFORMANCE OF THE CONSUMER PRODUCTS BUSINESS<br />

YEAR ENDED 31 MARCH, IN RS. MILLION FY <strong>2007</strong> FY <strong>2008</strong> GROWTH<br />

GROSS SALES 9,940 11,668 17%<br />

PBIT 955 1,208 27%<br />

CAPITAL EMPLOYED 776 877 13%<br />

FY<strong>2007</strong><br />

FY<strong>2008</strong><br />

In a year where the domestic pump industry<br />

(excluding industrial pumps) grew at 6%,<br />

Crompton Greaves’ pumps outperformed the<br />

market. The Company dominates the pump<br />

market with over 20% share in the domestic<br />

segment. During <strong>2007</strong>-08, the division<br />

continued its focus on gaining volume in the<br />

agricultural pumps segment and launched<br />

a new series of pumps: OS series open-well<br />

submersible pumps, improved 6” submersible<br />

pumps, light-weight diesel engine coupled<br />

pumps and monobloc pumps exceeding<br />

20HP. The focus on agricultural pumps has<br />

helped the division double its market share<br />

in this segment within two years. In <strong>2007</strong>-08,<br />

the pumps division identified a new facility at<br />

Ahmednagar (Maharashtra), which will allow for<br />

substantial capacity increases to cater to rising<br />

future demand.<br />

The lighting division, which manufactures<br />

light sources and supplies luminaires, grew by<br />

18% over last year — outperforming market<br />

growth of 14%. The Company’s products<br />

<strong>com</strong>mand about 12% market-share, up a<br />

percentage point from last year. The maximum<br />

growth potential for this business is in <strong>com</strong>pact<br />

fluorescent lamps (CFL), which is growing at<br />

over 25% annually in quantitative terms; and in<br />

high-end Light Emitting Diode (LED) lighting<br />

systems.<br />

The division’s export efforts during the<br />

previous two years has been showing signs of<br />

success, with exports reaching Rs.61 million.<br />

A significant achievement was to bag a<br />

prestigious Rs.45 million order from Reliance<br />

Energy for the supply of 37,000 street lighting<br />

luminaires for Mumbai, which was successfully<br />

executed within three months. The division also<br />

won a contract of Rs.35 million for supplying<br />

light sources and luminaires for the Delhi Metro.<br />

It has also entered into the area of CCTV and<br />

surveillance equipment.<br />

<strong>2007</strong>-08 is the first year in which Consumer<br />

Products has crossed Rs.10 billion in gross<br />

sales and Rs.1 billion in PBIT.<br />

Consumer Products also generated the<br />

highest return on capital employed for the<br />

Company — 138% in <strong>2007</strong>-08<br />

MANAGEMENT DISCUSSION AND ANALYSIS 17

Human Resources (HR)<br />

Crompton Greaves has always fostered an<br />

integrated approach towards HR — that of<br />

aligning its human capital in all its facets with<br />

business and organisational transformation.<br />

Hence, the HR imperatives at Crompton Greaves<br />

en<strong>com</strong>pass a wider canvas. It consists of HR<br />

management; productive and harmonious<br />

industrial relations; raising productivity through<br />

the Crompton Greaves Production System<br />

(CGPS); business excellence initiatives; and<br />

influencing the Company’s thrust on Corporate<br />

Social Responsibility.<br />

During the year, in a first-of-its-kind<br />

endeavour, the Company successfully<br />

implemented a variable pay scheme for its<br />

leadership level management based on<br />

CROMPTON GREAVES MANAGEMENT DEVELOPMENT CENTRE, MULSHI FOCUSES ON DEVELOPING AND<br />

NURTURING THE SKILLS AND TALENTS OF ITS EMPLOYEES<br />

Crompton Greaves’ future efforts will be<br />

focused on a unified global philosophy and<br />

approach to human capital management<br />

During the year, the Company successfully<br />

implemented a variable pay scheme for its<br />

leadership level management based on<br />

Economic Value Added (EVA)<br />

Economic Value Added (EVA). The scheme is<br />

unique in that the EVA parameters are linked<br />

with performance thresholds of a chosen group<br />

of <strong>com</strong>petitors rather than the Company’s own<br />

internal targets. The result has been a greater<br />

linkage of performance and variable rewards<br />

with how the Company performs vis-à-vis its<br />

<strong>com</strong>petitors.<br />

Integration of the business leadership in<br />

HR processes, receives continuous attention<br />

of Corporate HR and senior management.<br />

Quarterly “HR Summits” were initiated during<br />

the year to create greater ownership and<br />

accountability for human capital and to<br />

stimulate major changes in HR policies. The<br />

purpose of these Summits is to achieve greater<br />

business leadership involvement and, thus,<br />

yield better transformational and peoplecentric<br />

results.<br />

As with all <strong>com</strong>panies worldwide, talent<br />

retention at Crompton Greaves continues<br />

to be a challenge. While attrition levels are<br />

no worse than <strong>com</strong>parable <strong>com</strong>panies in<br />

the manufacturing industry, the <strong>com</strong>pany is<br />

giving even greater emphasis on building a<br />

talent pipeline, enriching job roles, providing<br />

challenging career paths and a satisfying work<br />

environment which promotes professionalism,<br />

openness and freedom to innovate, with<br />

minimum hierarchical intervention. It is<br />

expected that these initiatives will keep attrition<br />

to minimal levels.<br />

To address changes in the market<br />

environment and create a better link between<br />

job roles and remuneration structures, the<br />

Company retained the services of a major HR<br />

consulting firm. Based on its re<strong>com</strong>mendations,<br />

Crompton Greaves has considerably realigned<br />

remuneration structures for its executives at<br />

various levels. Meritocracy and differentiation<br />

— based on consistency of performance and<br />

potential, continue to be the guiding force for<br />

deciding remuneration levels.<br />

Employee engagement and feedback are<br />

key metrics for the Company’s HR initiatives.<br />

These are implemented through a variety<br />

of mechanisms, such as ‘open houses’ with<br />

the senior management, the Performance<br />

Management System, and involvement of<br />

a large number of employees in Companywide<br />

initiatives. To demonstrate its sincerity<br />

in receiving feedback, in <strong>2007</strong>-08 the senior<br />

leadership team volunteered and participated<br />

in a 360-degree feedback programme.<br />

CGHR4U, the Company’s HR Portal, continues<br />

to grow in strength and has be<strong>com</strong>e a truly<br />

HR Life Cycle Management System. Existing<br />

modules are being further strengthened for<br />

content and user-friendliness. During the<br />

year, new modules were added in the area of<br />

<strong>com</strong>plete automation of appraisal process,<br />

i.e. from goal setting to pay-outs; movement<br />

of employees — transfers, deputation and<br />

unauthorized cessation; and the entire<br />

recruitment cycle.<br />

The integration of CGHR4U with the<br />

Company’s remuneration systems has enabled<br />

Crompton Greaves to issue its executives<br />

their annual salary certificates in e-form. The<br />

Company will also be providing its executives<br />

the facility to e-file their In<strong>com</strong>e Tax Returns as<br />

yet another employee-friendly measure.<br />

Training and development continues to<br />

receive serious attention. A well designed<br />

and full corporate training calendar ensures<br />

18 ANNUAL REPORT <strong>2007</strong>–<strong>2008</strong> CROMPTON GREAVES LIMITED

egular programmes at the units as well as at<br />

the Company’s state-of-the-art Management<br />

Development Centre at Mulshi, near Pune.<br />

The training calendar is prepared based on the<br />

feedback from the units as well as a training<br />

needs analysis derived from its Performance<br />

Management System. These actions are<br />

further supplemented by sponsoring high<br />

performing–high potential executives for<br />

training at reputed management institutes,<br />

both in India and abroad.<br />

Having achieved 133% of work content/CGPS<br />

norms at all its manufacturing units, across<br />

India, the Company’s focus has been to start<br />

productivity enhancing CGPS actions at the<br />

foreign locations. These have been activated at<br />

Indonesia, Hungary and Belgium.<br />

To strengthen the performance from its<br />

technician workforce in India, Crompton Greaves<br />

has launched a creative incentive scheme at most<br />

of its units. This scheme has built-in productivity,<br />

quality, attendance and grade factors, with<br />

appropriate multipliers, to enable technicians<br />

to earn rewards in addition to their fixed wages,<br />

while delivering enhanced productivity.<br />

With the operations of the units outside<br />

India having stabilised and well on the path<br />

of growth, Crompton Greaves’ future efforts<br />

will be focused on a unified global philosophy<br />

and approach to human capital management.<br />

The method will acknowledge the benefits of<br />

<strong>com</strong>mon frameworks while accepting that each<br />

location may have its special characteristics<br />

which need customised solutions.<br />

Corporate Social Responsibility (CSR)<br />

It is the Crompton Greaves’ expressed intention<br />

that it will conduct its business and achieve<br />

<strong>com</strong>mercial success, together with social<br />

responsibility to the <strong>com</strong>munities that surround<br />

its locations and society at large. The Company’s<br />

CSR efforts during <strong>2007</strong>-08 have continued<br />

to revolve around its CSR Statement of Intent,<br />

which focuses on three areas: the Workplace,<br />

the Communities and the Environment.<br />

AT THE WORKPLACE<br />

Crompton Greaves’ efforts have focused on<br />

health and safety. These involve periodic<br />

medical check-ups for all its employees, and an<br />

innovative hospitalisation insurance scheme<br />

together with a serious illness coverage. Its<br />

<strong>com</strong>mitment to spreading its message on HIV/<br />

AIDS has been widely demonstrated through<br />

an articulated HIV/AIDS Policy which was<br />

released on 1 August <strong>2007</strong>. During the year, the<br />

Company has installed 17 condom vending<br />

machines at its various plants.<br />

Crompton Greaves has also chosen three days<br />

every year, to be dedicated to CSR, with the<br />

intense involvement of all employees. These are:<br />

THE WORLD ENVIRONMENT DAY, 5 JUNE.<br />

In <strong>2007</strong>, activities included an intensified tree<br />

plantation drive in the immediate vicinities of<br />

the plants, talks on environment and videos<br />

on global warming, creation of <strong>com</strong>post<br />

vermiculture pits, as well as<br />

The Company’s CSR efforts during<br />

<strong>2007</strong>-08 have continued to revolve around<br />

its CSR Statement of Intent, which focuses<br />

on three areas: the Workplace,<br />

the Communities and the Environment<br />

BLOOD DONATION BY EMPLOYEES OF BANGALORE BRANCH AND ENERGY METERS UNIT, JIGANI<br />

SAPLINGS BEING PLANTED ON WORLD<br />

ENVIRONMENT DAY, IN THE ZP SCHOOL COMPOUND,<br />

OF RATANPUR VILLAGE, MANDIDEEP<br />

MANAGEMENT DISCUSSION AND ANALYSIS 19

During <strong>2007</strong>-08, Crompton Greaves received<br />

the prestigious Greentech Gold Award,<br />

<strong>2007</strong>– a recognition for the Company’s<br />

environmental management systems and<br />

development of green products and process<br />

technologies<br />

quiz and painting <strong>com</strong>petitions and street plays<br />

to spread the ‘Green’ message to the greatest<br />

extent possible.<br />

BLOOD DONATION DAY, 1 OCTOBER. Blood<br />

Donation Camps were organised at all the<br />

Company’s units and office locations through<br />

various reputed blood banks. Wide publicity<br />

to the event and strong management support<br />

resulted in approximately 1,100 bottles of blood<br />

being donated by the employees.<br />

WORLD AIDS DAY, 1 DECEMBER. The Company<br />

renewed its dedication to be considerate to<br />

employees afflicted with HIV/AIDS, and to<br />

continuously create increased awareness about<br />

the illness. The activities included organisation<br />

of a rally, distribution of literature and thematic<br />

cultural programmes for employees as well as<br />

casual labour, truckers and the surrounding<br />

<strong>com</strong>munities.<br />

IN THE COMMUNITIES<br />

The Company continues to make its presence<br />

felt in the <strong>com</strong>munities which surround its units<br />

through support for projects and sponsorship<br />

of identified causes based on a Needs Analysis.<br />

Given below are some the activities that took<br />

place during <strong>2007</strong>-08:<br />

AT THE S6 DIVISION (AURANGABAD) The first<br />

phase of Project Surya has been <strong>com</strong>pleted,<br />

which has illuminated the village of Shevta with<br />

10 solar street lights. These not only serve the<br />

village <strong>com</strong>munity, but have provided students<br />

of the village with lighting to study at night.<br />

AT THE M7 DIVISION (MANDIDEEP) This<br />

Division has adopted the village of Ratanpur.<br />

During the year, to improve the safety of<br />

students at the local school, a huge transformer<br />

was shifted from the centre of the school<br />

ground and re-installed at a safe distance<br />

outside. The bore-well pipeline has been<br />

<strong>com</strong>pletely re-laid and now encircles the entire<br />

village, resulting in fairer distribution of water<br />

to all. Four solar streetlights have been also<br />

installed on a pilot basis. The unit continues<br />

to help the local <strong>com</strong>munity in mobilising<br />

panchayat (local self-government) funds.<br />

AT THE T3 DIVISION (MANDIDEEP) This<br />

Division has adopted the village of Gurari<br />

Ghat which adjoins Ratanpur. It is working on<br />

finishing the construction of the middle school<br />

which was left in an in<strong>com</strong>plete state, and to<br />

create a drainage system.<br />

AT THE T2 DIVISION (MALANPUR) Traffic<br />

congestion in the main area of Malanpur has<br />

been a concern for many years. Responding to<br />

this need, the Division has renovated the traffic<br />

island and beautified it.<br />

FOCUS ON WOMEN EMPLOYMENT The<br />

Southern Regional Office at Chennai has<br />

collaborated with the Rotary Club to increase<br />

skills among the women of the village of<br />

Mathur. Three batches of sewing classes have<br />

already been <strong>com</strong>pleted and the women have<br />

been given sewing machines.<br />

Besides these initiatives, every manufacturing<br />

unit of Crompton Greaves is actively engaged<br />

in reaching out to the <strong>com</strong>munities around<br />

them by organising periodical health checkups,<br />

eye camps, provision of free medicines<br />

and upgrading the facilities of several schools<br />

and orphanages in their locations by providing<br />

the Company’s products, <strong>com</strong>puters and other<br />

benefits.<br />

PUMPS DIVISION, AHMEDNAGAR DONATING BLANKETS AND CLOTHES TO THE INMATES OF THE LEPROSY<br />

HOME, AHMEDNAGAR<br />

WITH THE ENVIRONMENT<br />

Energy savings, reduction of waste, re-use/<br />

recycling of materials are key pillars in this<br />

area. Every manufacturing unit of Crompton<br />

Greaves has the ISO 14001 and OHSAS 18001<br />

certification. With its focus on reduction of<br />

pollution, the Company has also self-initiated a<br />

PUC Certification check for all vehicles entering<br />

its plant <strong>com</strong>plexes. At some plants, windmills<br />

have been installed on a trial basis, which<br />

supply energy to the internal pathways within<br />

the <strong>com</strong>plex.<br />

20 ANNUAL REPORT <strong>2007</strong>–<strong>2008</strong> CROMPTON GREAVES LIMITED

During <strong>2007</strong>-08, Crompton Greaves received<br />

the prestigious Greentech Gold Award,<br />

<strong>2007</strong>, in the Engineering Sector. This is a<br />

recognition for the Company’s environmental<br />

management systems and development of<br />

green products and process technologies. The<br />

award acknowledged the Company’s efforts in<br />

developing eco-friendly products, packaging<br />

and processes, such as dry type transformers,<br />

BLDC motors and fans, CFL lamps and energy<br />

efficient luminaires, reduction of heating cycles<br />

by more than 50% through new brazing and<br />

sintering process technologies and premium<br />

efficiency motors as well as motors for ecofriendly<br />

vehicles.<br />

AFFIRMATIVE ACTION (AA)<br />

As a signatory to the Confederation of Indian<br />

Industry (CII) Code on Affirmative Action,<br />

the Company has made a conscious effort<br />

to promote the progress and betterment of<br />

AA candidates through several dedicated<br />

programmes which have the potential<br />

to increase skill sets and consequently<br />

employability. During the year, the Company’s<br />

actions have concentrated on the following:<br />

WORKING WITH UNIVERSITIES TO COACH<br />

STUDENTS Crompton Greaves continues its<br />

sponsorship of AA students from:<br />

$ Maulana Azad College of Technology,<br />

Bhopal.<br />

$ KK Wagh College of Engineering, Nasik.<br />

$ Goa College of Engineering, Goa.<br />

Through this initiative, the Company’s senior<br />

executives, supported by sponsored external<br />

faculty contribute to teaching these students<br />

about various core processes in Crompton<br />

Greaves’ various lines of business. These include<br />

factory visits as well as an exposure to modern<br />

concepts of Six Sigma, CGPS and SAP.<br />

STRENGTHENING COMPETENCE FOR<br />

ENTRANCE EXAMS This project was initiated<br />

last year by the LT Motors Division, Ahmednagar,<br />

and received an overwhelming response.<br />

Therefore, a second batch has been started, for<br />

25 AA students to better equip them for the CET<br />

Examination.<br />

ITI SPONSORSHIPS<br />

$ AT NASIK The first batch of 25 AA students<br />

<strong>com</strong>pleted their six-month electrician course<br />

in September <strong>2007</strong>. The entire batch has been<br />

either employed by industry or started their<br />

own businesses. The Company also supported<br />

A SESSION BEING CONDUCTED AT THE FINISHING SCHOOL CLASSES FOR AFFIRMATIVE ACTION STUDENTS<br />

the candidates by providing them with<br />

<strong>com</strong>prehensive tool kits. The Joint Certification<br />

by the Government of India and Germany<br />

under the Indo-German Bilateral Agreement<br />

has resulted in a high level of credibility to this<br />

programme. Given the strong response, the<br />

Company sponsored a second batch, which has<br />

already <strong>com</strong>menced training on 2 March <strong>2008</strong>.<br />

$ AT GWALIOR At T2 Division, the chosen path<br />

has been vigorous shop-floor training of 24 AA<br />

candidates in the manufacture of distribution<br />

transformers. This exposure was for six months,<br />

and has considerably enhanced employability<br />

levels.<br />

$ AT AHMEDNAGARThe Pumps Division has<br />

sponsored 23 students to attend six month<br />

courses at the local ITI, in the areas of lathe<br />

machines, electrical wiring, welding/fabrication,<br />

and mechanical/diesel operations.<br />

FINISHING SCHOOL CLASSES In collaboration<br />

with the CII, the Company has <strong>com</strong>mitted to<br />

sponsor a batch of 30 students to a three month<br />

finishing school programme to impart the<br />

soft-skills needed and help the students gain<br />

confidence to face life in industry.<br />

MANAGEMENT DISCUSSION AND ANALYSIS 21

In <strong>2007</strong>-08, Six Sigma was extended to<br />

suppliers to improve and sustain product<br />

quality from the supplier<br />

Six Sigma at Crompton Greaves<br />

Crompton Greaves has defined Six Sigma as, “A<br />

vigorous, scientific, data driven, breakthrough<br />

methodology focused on product quality<br />

improvement as perceived by customers.” The<br />

objective of the Six Sigma drive is to achieve<br />

major quality improvements and, in doing so,<br />

bring about a cultural change from judgmental<br />

to data-based decisions.<br />

The journey started in June 2002 by creating<br />

a core <strong>com</strong>mittee of all Vice Presidents of the<br />

Company, headed by the Managing Director.<br />

Business unit heads were nominated as<br />

Champions, with the role to drive Six Sigma in<br />

their Divisions. 22 best employees of different<br />

Divisions were designated as Black Belts and<br />

were trained for Six Sigma methodology by an<br />

international expert.<br />