ProPosed FY 2010/11 Work Plan And Budget - City of Miami Beach

ProPosed FY 2010/11 Work Plan And Budget - City of Miami Beach

ProPosed FY 2010/11 Work Plan And Budget - City of Miami Beach

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>FY</strong> <strong>2010</strong>/<strong>11</strong> Proposed <strong>Work</strong> <strong>Plan</strong> and <strong>Budget</strong> Message<br />

September 10, <strong>2010</strong><br />

Page 24<br />

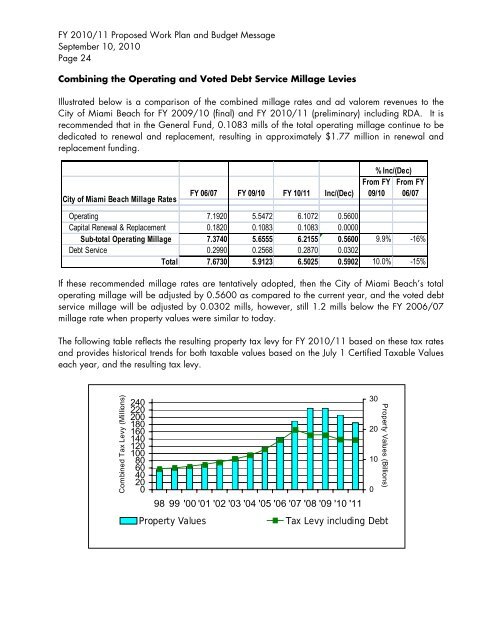

Combining the Operating and Voted Debt Service Millage Levies<br />

Illustrated below is a comparison <strong>of</strong> the combined millage rates and ad valorem revenues to the<br />

<strong>City</strong> <strong>of</strong> <strong>Miami</strong> <strong>Beach</strong> for <strong>FY</strong> 2009/10 (final) and <strong>FY</strong> <strong>2010</strong>/<strong>11</strong> (preliminary) including RDA. It is<br />

recommended that in the General Fund, 0.1083 mills <strong>of</strong> the total operating millage continue to be<br />

dedicated to renewal and replacement, resulting in approximately $1.77 million in renewal and<br />

replacement funding.<br />

<strong>City</strong> <strong>of</strong> <strong>Miami</strong> <strong>Beach</strong> Millage Rates<br />

<strong>FY</strong> 06/07 <strong>FY</strong> 09/10 <strong>FY</strong> 10/<strong>11</strong> Inc/(Dec)<br />

% Inc/(Dec)<br />

From <strong>FY</strong><br />

09/10<br />

From <strong>FY</strong><br />

06/07<br />

Operating 7.1920 5.5472 6.1072 0.5600<br />

Capital Renewal & Replacement 0.1820 0.1083 0.1083 0.0000<br />

Sub-total Operating Millage 7.3740 5.6555 6.2155 0.5600 9.9% -16%<br />

Debt Service 0.2990 0.2568 0.2870 0.0302<br />

Total 7.6730 5.9123 6.5025 0.5902 10.0% -15%<br />

If these recommended millage rates are tentatively adopted, then the <strong>City</strong> <strong>of</strong> <strong>Miami</strong> <strong>Beach</strong>’s total<br />

operating millage will be adjusted by 0.5600 as compared to the current year, and the voted debt<br />

service millage will be adjusted by 0.0302 mills, however, still 1.2 mills below the <strong>FY</strong> 2006/07<br />

millage rate when property values were similar to today.<br />

The following table reflects the resulting property tax levy for <strong>FY</strong> <strong>2010</strong>/<strong>11</strong> based on these tax rates<br />

and provides historical trends for both taxable values based on the July 1 Certified Taxable Values<br />

each year, and the resulting tax levy.<br />

Combined Tax Levy (Millions)<br />

240<br />

220<br />

200<br />

180<br />

160<br />

140<br />

120<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0<br />

98 99 '00'01'02'03'04'05'06'07'08'09'10'<strong>11</strong><br />

Property Values<br />

30<br />

20<br />

10<br />

0<br />

Property Values (Billions)<br />

Tax Levy including Debt