ANNUAL REPORT

ANNUAL REPORT

ANNUAL REPORT

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Gross profit for the fiscal year ended March 31, 2009 amounted<br />

to JPY 34,820 million, representing 8.8% of revenue, compared<br />

to 11.1% for the fiscal year ended March 31, 2008. The decrease<br />

in gross profit margin is driven by the significant decline in<br />

production volumes of the car manufacturers and the inability to<br />

reduce variable costs accordingly.<br />

Selling, general and administrative expenses amounted to JPY<br />

47,961 million for the fiscal year ended March 31, 2009,<br />

compared to JPY 52,878 million during the previous fiscal year.<br />

The selling, general and administrative expenses partly<br />

reflected the impact from ongoing restructuring efforts that<br />

were deployed towards the end of the fiscal year ended March<br />

31, 2009, including at the level of the Company’s operating cost<br />

structure, which is being gradually reduced to approximately<br />

JPY 3,500 million, compared to JPY 4,935 million for the fiscal<br />

year ended March 31, 2009.<br />

Other income and expenses amounted to JPY 11,041 million for<br />

the fiscal year ended March 31, 2009, compared to JPY 4,594<br />

million during the previous fiscal year. The increase mainly<br />

resulted from non-recurring restructuring expenses of JPY<br />

5,118 million at HIT and Metaldyne and JPY 1,403 million losses<br />

on disposal of certain of Metaldyne’s assets.<br />

Loss from operations for the fiscal year ending March 31, 2009<br />

of JPY 154,159 million, included amortization and impairment<br />

charges of JPY 123,259 million of which JPY 38,096 million were<br />

recognized in the consolidated financial statements only and<br />

which are not reflected in the individual consolidated<br />

subsidiaries’ income statements presented in Part I of this<br />

Annual Report. Excluding those non-cash charges for both<br />

periods, the operating loss of JPY 30,900 million for the fiscal<br />

year ended March 31, 2009, compared to an operating loss of<br />

JPY 4,662 million for the fiscal year ended March 31, 2008, again<br />

clearly reflecting the magnitude of the impact the economic<br />

recession had on the operating performance across all<br />

consolidated subsidiaries.<br />

As a result of the capital restructuring of Honsel, completed in<br />

July, 2009, and Metaldyne's filing for Chapter 11 bankruptcy<br />

protection, the Company will record significant gains associated<br />

with the waiver of Honsel’s debt and the deconsolidation of<br />

Metaldyne. These gains will be recorded in the fiscal year<br />

ending March 31, 2010, and are currently estimated at<br />

approximately JPY 57 billion or EUR 434.5 million.<br />

Net financial income of JPY 15,269 million for the fiscal year<br />

ended March 31, 2009, included (a) a gain of JPY 30,552 million<br />

following Metaldyne’s bond tender, (b) a gain of JPY 3,134<br />

million resulting from the agreement between Chrysler and<br />

Metaldyne to cancel USD 31.0 million of Metaldyne’s secured<br />

subordinated notes, (c) the gain of JPY 6,082 million from the<br />

cancelation of some of the preferred C shares at Asahi Tec and<br />

(d) a gain of JPY 3,370 million on the sale of a non-controlling<br />

minority investment. These gains were offset by financial costs<br />

including (a) net interest expense of JPY 19,154 million from<br />

consolidated subsidiaries, (b) net foreign exchange losses of JPY<br />

7,345 million, and (c) JPY 1,045 million of fair value adjustments<br />

on certain financial assets. Last year, financial costs amounted<br />

to JPY 32,881 million, and included (a) interest expense of JPY<br />

22,301 million, (b) foreign currency exchange losses of JPY 7,438<br />

million and (c) the write-off of previously deferred financing fees<br />

of JPY 2,526 million.<br />

Income tax benefit for the fiscal year ended March 31, 2009<br />

amounted to JPY 6,232 million, compared to JPY 186 million for<br />

the previous fiscal year, and mainly resulted from the reversal of<br />

deferred tax liabilities of JPY 7,761 million following the<br />

impairment of certain tangible and intangible assets.<br />

Discontinued operations reflect D&M and HIT’s Canadian<br />

operations. The result from D&M includes the net loss of JPY<br />

999 million from operations for the six months ended September<br />

30, 2008 and the gain on disposal of JPY 11,073 million. The gain<br />

on disposal as reflected in the Company’s consolidated income<br />

statement consists of the gain of JPY 12,600 million over the<br />

acquisition cost less JPY 1,527 million of income contributed by<br />

D&M to consolidated reserves from April 1, 2005 through the<br />

date of effective disposal. The gain from the liquidation of HIT’s<br />

Canadian subsidiary, Amcan, amounted to JPY 1,918 million. The<br />

breakdown of discontinued operations for the fiscal years ended<br />

March 31, 2009 and 2008 is as follows:<br />

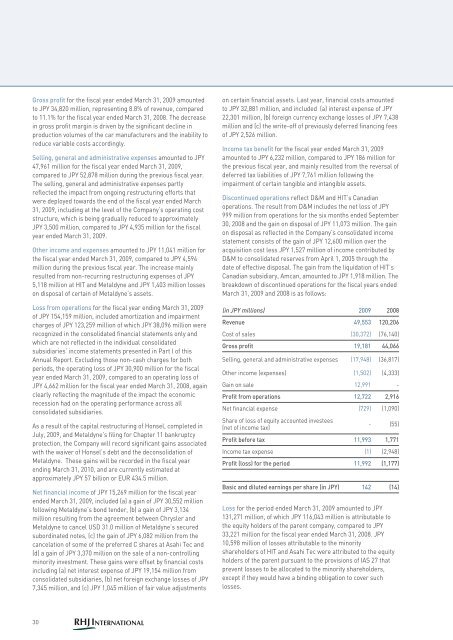

(in JPY millions) 2009 2008<br />

Revenue 49,553 120,206<br />

Cost of sales (30,372) (76,140)<br />

Gross profit 19,181 44,066<br />

Selling, general and administrative expenses (17,948) (36,817)<br />

Other income (expenses) (1,502) (4,333)<br />

Gain on sale 12,991 -<br />

Profit from operations 12,722 2,916<br />

Net financial expense (729) (1,090)<br />

Share of loss of equity accounted investees<br />

(net of income tax)<br />

- (55)<br />

Profit before tax 11,993 1,771<br />

Income tax expense (1) (2,948)<br />

Profit (loss) for the period 11,992 (1,177)<br />

Basic and diluted earnings per share (in JPY) 142 (14)<br />

Loss for the period ended March 31, 2009 amounted to JPY<br />

131,271 million, of which JPY 116,043 million is attributable to<br />

the equity holders of the parent company, compared to JPY<br />

33,221 million for the fiscal year ended March 31, 2008. JPY<br />

10,598 million of losses attributable to the minority<br />

shareholders of HIT and Asahi Tec were attributed to the equity<br />

holders of the parent pursuant to the provisions of IAS 27 that<br />

prevent losses to be allocated to the minority shareholders,<br />

except if they would have a binding obligation to cover such<br />

losses.<br />

30