ANNUAL REPORT

ANNUAL REPORT

ANNUAL REPORT

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

FINANCIAL STATEMENTS FOR THE FISCAL YEAR ENDED MARCH 31, 2009<br />

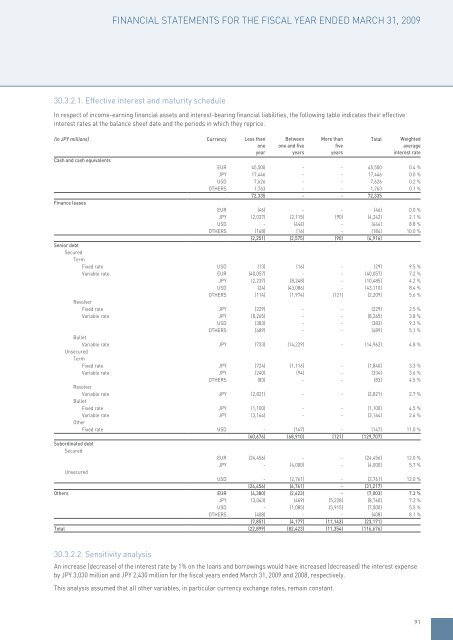

30.3.2.1. Effective interest and maturity schedule<br />

In respect of income-earning financial assets and interest-bearing financial liabilities, the following table indicates their effective<br />

interest rates at the balance sheet date and the periods in which they reprice.<br />

(in JPY millions) Currency Less than<br />

one<br />

year<br />

Cash and cash equivalents<br />

Between<br />

one and five<br />

years<br />

More than<br />

five<br />

years<br />

Total<br />

Weighted<br />

average<br />

interest rate<br />

EUR 45,500 - - 45,500 0.4 %<br />

JPY 17,446 - - 17,446 0.0 %<br />

USD 7,626 - - 7,626 0.2 %<br />

OTHERS 1,763 - - 1,763 0.1 %<br />

72,335 - - 72,335<br />

Finance leases<br />

EUR (46) - - (46) 0.0 %<br />

JPY (2,037) (2,115) (90) (4,242) 2.1 %<br />

USD - (444) - (444) 8.8 %<br />

OTHERS (168) (16) - (184) 10.0 %<br />

(2,251) (2,575) (90) (4,916)<br />

Senior debt<br />

Secured<br />

Term<br />

Fixed rate USD (13) (16) - (29) 9.5 %<br />

Variable rate EUR (40,057) - - (40,057) 7.2 %<br />

JPY (2,237) (8,248) - (10,485) 4.2 %<br />

USD (24) (43,086) - (43,110) 8.4 %<br />

OTHERS (114) (1,974) (121) (2,209) 5.6 %<br />

Revolver<br />

Fixed rate JPY (229) - - (229) 2.5 %<br />

Variable rate JPY (8,265) - - (8,265) 3.8 %<br />

USD (383) - - (383) 9.3 %<br />

OTHERS (489) - - (489) 5.1 %<br />

Bullet<br />

Variable rate JPY (733) (14,229) - (14,962) 4.8 %<br />

Unsecured<br />

Term<br />

Fixed rate JPY (724) (1,116) - (1,840) 3.3 %<br />

Variable rate JPY (240) (94) - (334) 3.6 %<br />

OTHERS (83) - - (83) 4.5 %<br />

Revolver<br />

Variable rate JPY (2,821) - - (2,821) 2.7 %<br />

Bullet<br />

Fixed rate JPY (1,100) - - (1,100) 4.5 %<br />

Variable rate JPY (3,164) - - (3,164) 2.6 %<br />

Other<br />

Fixed rate USD - (147) - (147) 11.0 %<br />

(60,676) (68,910) (121) (129,707)<br />

Subordinated debt<br />

Secured<br />

EUR (24,456) - - (24,456) 12.0 %<br />

JPY - (4,000) - (4,000) 5.7 %<br />

Unsecured<br />

USD - (2,761) - (2,761) 12.0 %<br />

(24,456) (6,761) - (31,217)<br />

Others EUR (4,380) (2,623) - (7,003) 7.3 %<br />

JPY (3,063) (469) (5,228) (8,760) 7.2 %<br />

USD - (1,085) (5,915) (7,000) 5.5 %<br />

OTHERS (408) - - (408) 8.1 %<br />

(7,851) (4,177) (11,143) (23,171)<br />

Total (22,899) (82,423) (11,354) (116,676)<br />

30.3.2.2. Sensitivity analysis<br />

An increase (decrease) of the interest rate by 1% on the loans and borrowings would have increased (decreased) the interest expense<br />

by JPY 3,030 million and JPY 2,430 million for the fiscal years ended March 31, 2009 and 2008, respectively.<br />

This analysis assumed that all other variables, in particular currency exchange rates, remain constant.<br />

91