BMO Financial Group - Outlook 2005(1.1Mb pdf File) - Boardwalk REIT

BMO Financial Group - Outlook 2005(1.1Mb pdf File) - Boardwalk REIT

BMO Financial Group - Outlook 2005(1.1Mb pdf File) - Boardwalk REIT

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

11<br />

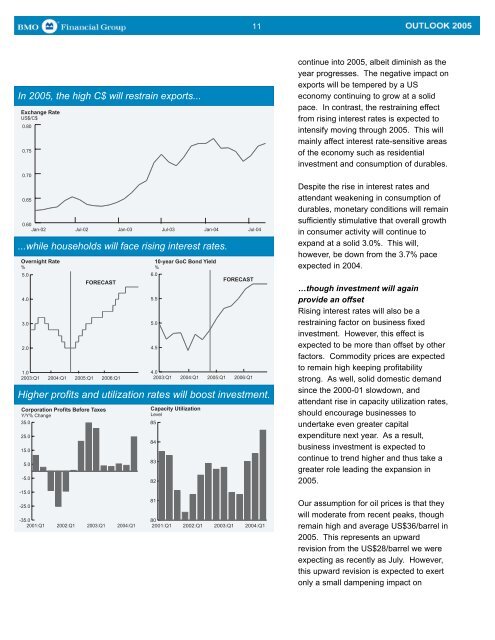

In <strong>2005</strong>, the high C$ will restrain exports...<br />

Exchange Rate<br />

US$/C$<br />

0.80<br />

0.75<br />

continue into <strong>2005</strong>, albeit diminish as the<br />

year progresses. The negative impact on<br />

exports will be tempered by a US<br />

economy continuing to grow at a solid<br />

pace. In contrast, the restraining effect<br />

from rising interest rates is expected to<br />

intensify moving through <strong>2005</strong>. This will<br />

mainly affect interest rate-sensitive areas<br />

of the economy such as residential<br />

investment and consumption of durables.<br />

0.70<br />

0.65<br />

0.60<br />

Jan-02<br />

...while households will face rising interest rates.<br />

Overnight Rate<br />

%<br />

5.0<br />

4.0<br />

3.0<br />

2.0<br />

1.0<br />

2003:Q1<br />

2004:Q1<br />

Jul-02<br />

<strong>2005</strong>:Q1<br />

FORECAST<br />

2006:Q1<br />

Jan-03<br />

Jul-03<br />

4.0<br />

2003:Q1<br />

Jan-04<br />

10-year GoC Bond Yield<br />

%<br />

6.0<br />

Jul-04<br />

Higher profits and utilization rates will boost investment.<br />

Corporation Profits Before Taxes<br />

Y/Y% Change<br />

35.0<br />

25.0<br />

15.0<br />

5.0<br />

-5.0<br />

-15.0<br />

-25.0<br />

-35.0<br />

2001:Q1<br />

2002:Q1<br />

2003:Q1<br />

2004:Q1<br />

5.5<br />

5.0<br />

4.5<br />

85<br />

84<br />

83<br />

82<br />

81<br />

80<br />

2001:Q1<br />

2004:Q1<br />

Capacity Utilization<br />

Level<br />

2002:Q1<br />

<strong>2005</strong>:Q1<br />

FORECAST<br />

2003:Q1<br />

2006:Q1<br />

2004:Q1<br />

Despite the rise in interest rates and<br />

attendant weakening in consumption of<br />

durables, monetary conditions will remain<br />

sufficiently stimulative that overall growth<br />

in consumer activity will continue to<br />

expand at a solid 3.0%. This will,<br />

however, be down from the 3.7% pace<br />

expected in 2004.<br />

…though investment will again<br />

provide an offset<br />

Rising interest rates will also be a<br />

restraining factor on business fixed<br />

investment. However, this effect is<br />

expected to be more than offset by other<br />

factors. Commodity prices are expected<br />

to remain high keeping profitability<br />

strong. As well, solid domestic demand<br />

since the 2000-01 slowdown, and<br />

attendant rise in capacity utilization rates,<br />

should encourage businesses to<br />

undertake even greater capital<br />

expenditure next year. As a result,<br />

business investment is expected to<br />

continue to trend higher and thus take a<br />

greater role leading the expansion in<br />

<strong>2005</strong>.<br />

Our assumption for oil prices is that they<br />

will moderate from recent peaks, though<br />

remain high and average US$36/barrel in<br />

<strong>2005</strong>. This represents an upward<br />

revision from the US$28/barrel we were<br />

expecting as recently as July. However,<br />

this upward revision is expected to exert<br />

only a small dampening impact on